Atlassian (TEAM) Q4 Earnings & Revenues Top Estimates, Up Y/Y

Atlassian TEAM reported stellar fourth-quarter fiscal 2020 results, wherein the top and bottom lines surpassed the Zacks Consensus Estimate as well as marked significant year-over-year improvements. The company’s non-IFRS earnings per share of 25 cents beat the consensus mark by 25% and jumped 25% year on year. Robust revenue growth and better cost management chiefly boosted Atlassian’s quarterly earnings.

Quarter in Detail

The company reported fiscal fourth-quarter revenues of $430.5 million, which surpassed the Zacks Consensus Estimate of $409 million. Moreover, quarterly revenues climbed 29% year on year, mainly on new client additions and increased pricing on certain products. During the reported quarter, Atlassian added 3,046 net new-clients, bringing the total customer count to 174,097.

Segment wise, Subscription revenues jumped 42% year over year to $257.5 million. Sales from the Maintenance business increased 16% to $122.8 million, while Perpetual License business revenues declined 11% to $20.4 million. Other revenues climbed 19% year over year to $29.8 million.

The company’s non-IFRS gross profit increased 29% year over year to $370.7 million. Non-IFRS gross margin expanded 20 basis points (bps) to 86.1% in the fiscal fourth quarter.

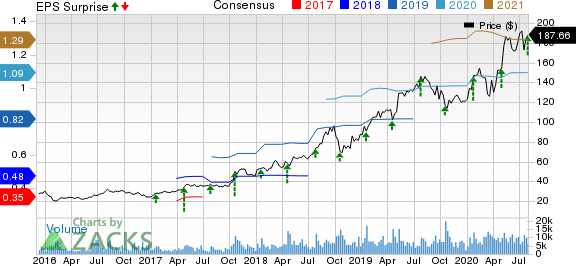

Atlassian Corporation PLC Price, Consensus and EPS Surprise

Atlassian Corporation PLC price-consensus-eps-surprise-chart | Atlassian Corporation PLC Quote

Atlassian’s non-IFRS operating income climbed 47.5% year over year to $82.5 million, while margin advanced 200 bps to 19%.

During the reported quarter, the company generated operating and free cash flow of $123.3 million and $95.7 million, respectively.

Fiscal 2020 Highlights

Atlassian’s fiscal 2020 total revenues increased 33% year over year to $1.61 billion and surpassed the Zacks Consensus Estimate of $1.59 billion. The company’s non-IFRS earnings per share of $1.15 beat the consensus mark by 5.5% and jumped 33.7% year over year.

The company ended the fiscal year with cash and cash equivalents, and short-term investments of $2.16 billion. During the fiscal, the company generated operating and free cash flow of $574.2 million and $500.4 million, respectively.

Outlook

For first-quarter fiscal 2021, the company anticipates revenues between $430 million $445 million (mid-point $437.5 million), suggesting year-over-year growth of 18-22%. Atlassian’s fiscal first-quarter revenue guidance at the mid-point is also ahead of the Zacks Consensus Estimate of $435.8 million.

Non-IFRS gross margin is anticipated to be approximately 86%. Non-IFRS operating margin is projected to be around 21%. The company expects to report non-IFRS earnings per share in the 26-27 cents band. The Zacks Consensus Estimate for fiscal first-quarter earnings is pegged at 27 cents.

Zacks Rank and Key Picks

Currently, Atlassian carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector include Dropbox DBX, Zoom Video Communications ZM and Analog Devices ADI. While Dropbox and Zoom sport a Zacks Rank #1 (Strong Buy), Analog Devices carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Dropbox, Zoom and Analog Devices is currently pegged at 32.5%, 25%, and 13.3%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Atlassian Corporation PLC (TEAM) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance