ASX Growth Companies With High Insider Ownership And Earnings Growth Up To 58%

The Australian stock market showcased resilience today, with the ASX200 climbing modestly by three quarters of a percent. Various sectors vied for dominance, ultimately seeing Financials lead with a 1.5% gain, closely followed by Utilities and Real Estate. In such a buoyant market environment, companies with high insider ownership can be particularly compelling. These firms often benefit from aligned interests between shareholders and management, potentially leading to robust earnings growth amidst current market conditions.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Alpha HPA (ASX:A4N) | 26.3% | 95.9% |

Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

Let's explore several standout options from the results in the screener.

Bell Financial Group

Simply Wall St Growth Rating: ★★★★☆☆

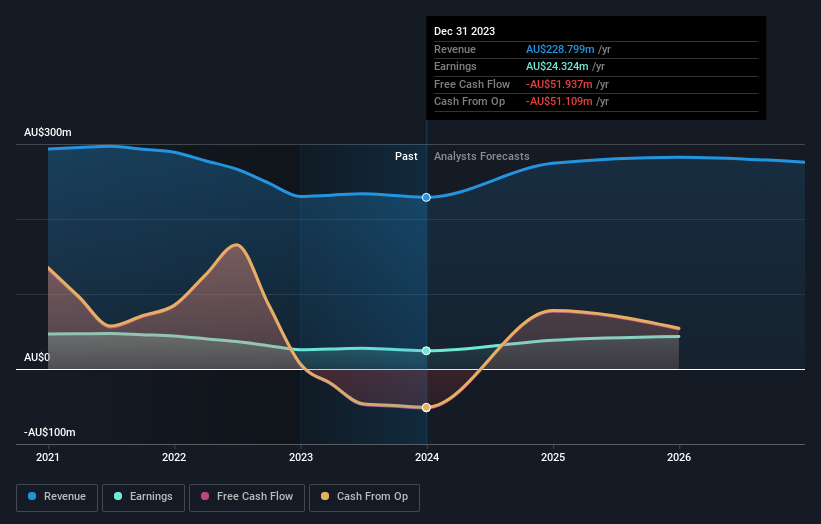

Overview: Bell Financial Group Limited, operating in Australia, offers a range of services including broking, online broking, corporate finance, and financial advisory to private, institutional, and corporate clients with a market cap of approximately A$426.59 million.

Operations: The company generates its revenue from four key areas: retail broking (A$103.58 million), institutional broking (A$50.36 million), financial products and services (A$48.10 million), and technology and platform services (A$26.20 million).

Insider Ownership: 10.7%

Earnings Growth Forecast: 26.9% p.a.

Bell Financial Group, despite trading 25.2% below its fair value, shows moderate revenue growth at 5.6% per year, slightly outpacing the Australian market's 5.3%. However, its standout feature is the significant earnings growth forecasted at 26.95% annually over the next three years, well above the market average of 14%. This performance is not matched by a sustainable dividend policy as current dividends are poorly covered by earnings and cash flow. Recent events include their presentation at the Bell Potter Emerging Leaders Conference and an AGM in March 2024.

Unlock comprehensive insights into our analysis of Bell Financial Group stock in this growth report.

Our valuation report here indicates Bell Financial Group may be undervalued.

IperionX

Simply Wall St Growth Rating: ★★★★★☆

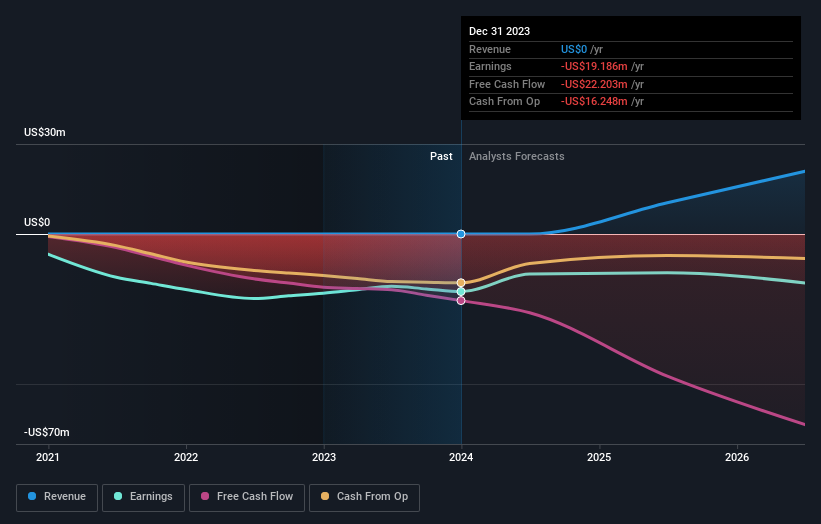

Overview: IperionX Limited is a company focused on the exploration and development of mineral properties in the United States, with a market capitalization of approximately A$694.38 million.

Operations: The firm is primarily involved in the exploration and development of mineral properties in the United States.

Insider Ownership: 14.0%

Earnings Growth Forecast: 47.4% p.a.

IperionX, while still in its early stages with less than US$1m in revenue, is poised for significant growth with revenues expected to increase at 76.4% annually. The company recently partnered with Vegas Fastener Manufacturing to supply the U.S. Army and other critical sectors, enhancing its commercial prospects. Despite a recent follow-on equity offering diluting shareholders, IperionX's strategic partnerships and innovative titanium technology position it well for future profitability and market expansion.

Take a closer look at IperionX's potential here in our earnings growth report.

The valuation report we've compiled suggests that IperionX's current price could be inflated.

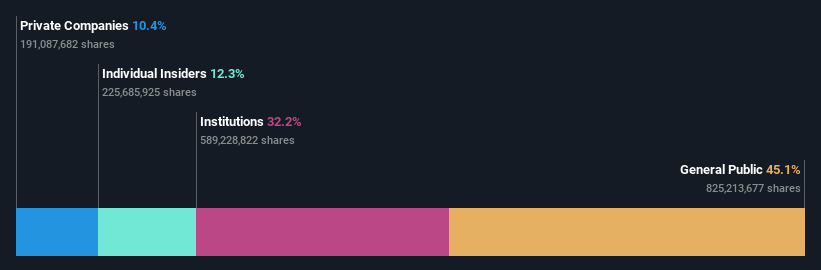

Lotus Resources

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotus Resources Limited focuses on the exploration, evaluation, and development of uranium properties in Australia and Africa, with a market capitalization of approximately A$869.83 million.

Operations: The firm primarily generates its revenue from the exploration, evaluation, and development of uranium properties across Australia and Africa.

Insider Ownership: 12.3%

Earnings Growth Forecast: 58.9% p.a.

Lotus Resources, with limited revenue of A$102K, is not currently profitable but is expected to shift positively within three years. Despite no immediate revenue growth forecasted, earnings could surge by 58.86% annually. The company's projected return on equity is very high at 69.3%. Recently added to the S&P/ASX 300 and Small Ordinaries Indexes, Lotus Resources shows potential for significant price appreciation, as analysts anticipate a substantial rise of 37.4% in its stock price.

Key Takeaways

Unlock our comprehensive list of 90 Fast Growing ASX Companies With High Insider Ownership by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:BFGASX:IPX ASX:LOT

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance