ASX Growth Companies With High Insider Ownership And At Least 25% Earnings Growth

The Australian market has shown robust performance, increasing by 1.5% over the last week and achieving a 7.3% rise over the past 12 months, with earnings expected to grow by 13% annually. In this context, stocks of growth companies with high insider ownership may offer appealing opportunities, particularly when they also demonstrate significant earnings growth.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Alpha HPA (ASX:A4N) | 28.3% | 95.9% |

Liontown Resources (ASX:LTR) | 16.4% | 64.3% |

DUG Technology (ASX:DUG) | 28.3% | 43.5% |

SiteMinder (ASX:SDR) | 11.4% | 69.4% |

Let's uncover some gems from our specialized screener.

Kogan.com

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kogan.com Ltd is an online retailer based in Australia with a market capitalization of approximately A$471.22 million.

Operations: The company generates revenue through its operations in both Australia and New Zealand, with segments including Mighty Ape and Kogan Parent, earning A$274.85 million and A$33.40 million in Australia, and A$142.52 million and A$11.39 million in New Zealand respectively.

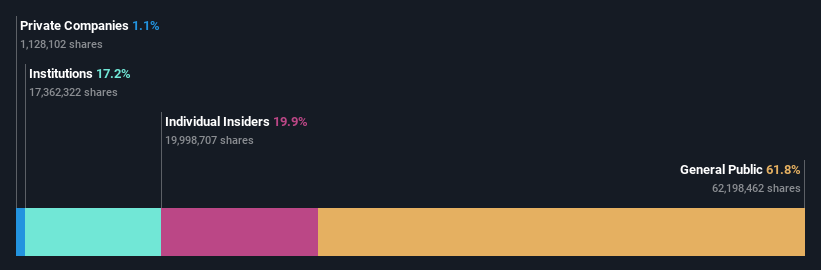

Insider Ownership: 19.9%

Earnings Growth Forecast: 35.4% p.a.

Kogan.com has recently transitioned from a loss to a profit, reporting net income of A$8.7 million for the half-year, a significant recovery from a net loss of A$23.8 million in the previous period. Despite this turnaround, insider activity shows more selling than buying over the past three months, which might raise concerns about confidence levels internally. However, Kogan's earnings are expected to grow significantly at 35.44% annually over the next three years, outpacing both its own revenue growth projections and broader market averages. The stock is also considered to be trading well below its estimated fair value by 54.4%.

Click here and access our complete growth analysis report to understand the dynamics of Kogan.com.

Our valuation report here indicates Kogan.com may be overvalued.

Ora Banda Mining

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ora Banda Mining Limited is a company based in Australia that focuses on the exploration, operation, and development of mineral properties, with a market capitalization of approximately A$575.52 million.

Operations: The company generates revenue primarily from its gold mining segment, totaling A$166.66 million.

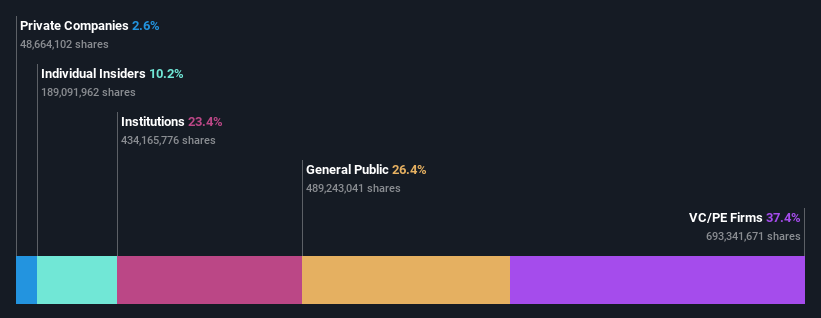

Insider Ownership: 10.2%

Earnings Growth Forecast: 85% p.a.

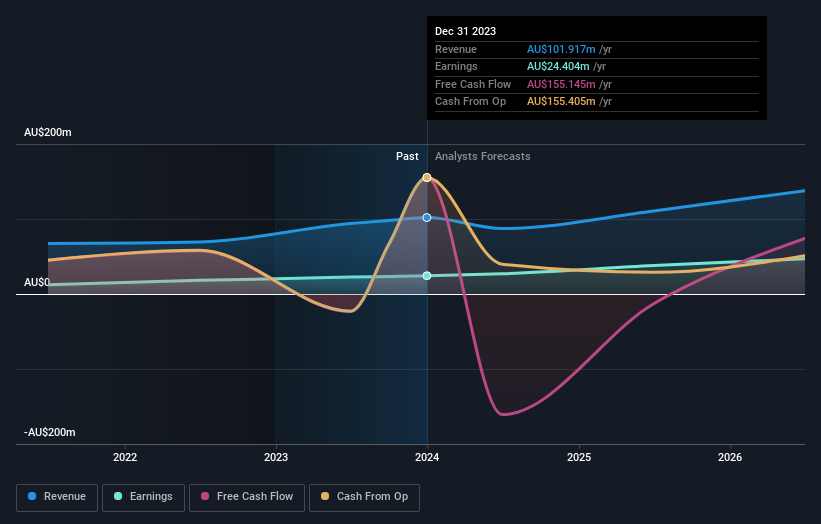

Ora Banda Mining, recently added to the S&P/ASX All Ordinaries Index, has shown a strong financial turnaround with its latest earnings report indicating a shift from a net loss to a profit of A$10.79 million. This performance is underpinned by significant revenue growth of 39.1% per year, forecasted to surpass market averages substantially. Despite recent equity offerings potentially diluting shareholder value, the company's projected earnings growth rate is an impressive 85.03% annually over the next three years, positioning it as an emerging growth entity in Australia's mining sector.

Qualitas

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qualitas operates as a real estate investment firm specializing in direct investments across various real estate classes and geographies, distressed debt acquisitions and restructuring, third-party capital raising, and consulting services, with a market capitalization of approximately A$687.98 million.

Operations: The company generates revenue primarily through direct lending and funds management, amounting to A$27.58 million and A$19.32 million respectively.

Insider Ownership: 27.1%

Earnings Growth Forecast: 25.1% p.a.

Qualitas has demonstrated robust financial growth, with recent earnings showing a revenue increase to A$42.52 million and net income rising to A$12.56 million. This performance is supported by an earnings growth of 19.8% over the past year, outpacing the Australian market's average. Analysts predict both revenue and earnings will continue to grow significantly above market rates at 15.4% and 25.1% per year, respectively, although its dividend coverage remains low at 3.3%. Insider activity has been balanced with more buying than selling, but not in large volumes.

Where To Now?

Delve into our full catalog of 89 Fast Growing ASX Companies With High Insider Ownership here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:KGN ASX:OBMASX:QAL and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance