AstraZeneca's (AZN) Enhertu Gets FDA Nod for Solid Tumors

AstraZeneca AZN and partner Daiichi Sankyo announced that the FDA has granted accelerated approval to their drug Enhertu for treating unresectable or metastatic HER2-positive solid tumors in heavily pretreated patients.

The approval was based on data from the three phase II studies, including the DESTINY-PanTumor02 study on Enhertu, which showed clinically meaningful responses across a broad range of tumors. The accelerated approval was based on positive objective response rate (ORR) and duration of response (DoR) data seen in these studies. Continued approval for the indication will be based on the description of clinical benefit in a confirmatory study.

With the approval, Enhertu has become the first HER2-directed medicine to receive a tumor-agnostic indication.

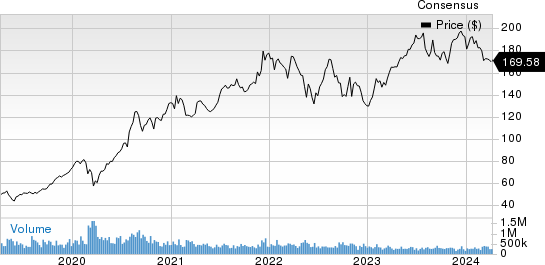

In the past year, the stock has declined 6.4% against the industry’s 20.2% rise.

Image Source: Zacks Investment Research

Enhertu, a specifically engineered HER2-directed antibody-drug conjugate (ADC), is jointly developed and commercialized by AstraZeneca and Daiichi Sankyo.

Daiichi Sankyo recognizes the U.S. sales of Enhertu while AstraZeneca records its share of gross profit margin from Enhertu sales under Alliance revenues. In 2023, Enhertu generated around $1 billion in alliance revenues for AstraZeneca.

Enhertu is presently approved for advanced or metastatic HER2-positive gastric cancer, previously treated HER2-mutant metastatic non-small cell lung cancer and metastatic HER2-positive and HER2-low breast cancer. The metastatic HER2-positive solid tumors indication is the fifth indication for Enhertu.

The U.S. regulatory application for the solid tumors indication was reviewed under the Real-Time Oncology Review program and Project Orbis, the FDA’s two new initiatives focused on bringing safe and effective cancer treatments to patients as early as possible.

Enhertu has also earlier received the FDA’s Breakthrough Therapy designation in the United States for the treatment of metastatic HER2-positive solid tumors.

Zacks Rank & Stocks to Consider

Currently, AstraZeneca has a Zacks Rank #3 (Hold).

AstraZeneca PLC Price and Consensus

AstraZeneca PLC price-consensus-chart | AstraZeneca PLC Quote

Some top-ranked stocks in the healthcare sector are Vanda Pharmaceuticals VNDA, ADMA Biologics ADMA and MorphoSys MOR, sporting a Zacks Rank #1 (Strong Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, 2024 estimates for Vanda Pharmaceuticals have narrowed from a loss of 46 cents to a loss of 6 cents. For 2025, loss estimates have narrowed from 94 cents to 33 cents per share in the past 60 days. In the past year, shares of VNDA have declined 28.5%.

Vanda Pharmaceuticals delivered a three-quarter average earnings surprise of 92.88%.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share have improved from 22 cents to 30 cents. Estimates for 2025 have increased from 32 cents to 50 cents. In the past year, shares of ADMA Biologics have risen 93.6%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same once. ADMA delivered a four-quarter average earnings surprise of 85.0%.

In the past 60 days, estimates for MorphoSys’ 2024 loss per share have narrowed from 96 cents per share to a loss of 73 cents per share. In the past year, shares of MOR have risen 288.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Vanda Pharmaceuticals Inc. (VNDA) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

MorphoSys AG Unsponsored ADR (MOR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance