Astec (ASTE) Q2 Earnings Lag Estimates, Revenues Up Y/Y

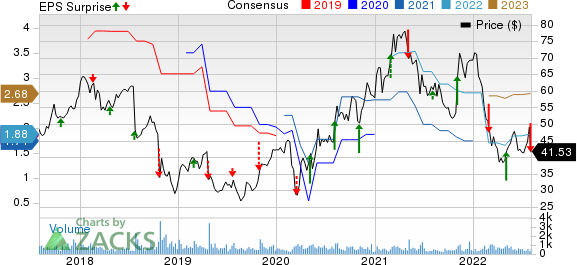

Astec Industries, Inc. ASTE reported second-quarter 2022 adjusted earnings per share of 19 cents, missing the Zacks Consensus Estimate of earnings of 50 cents. The bottom line compares to our estimate of 50 cents for the quarter. The figure plunged 59% year on year, as inflated costs outpaced sales volume, price and mix.

Including one-time items, the company reported a loss per share of 17 cents in the quarter under review against earnings of 36 cents per share in the year-ago quarter.

Revenues & Backlog

Astec’s revenues increased 14.6% year over year to $318 million in the quarter under review. The top line beat the Zacks Consensus Estimate of $309 million. Our estimate for the quarter was $310.3 million.

Domestic sales were up 23.3% year over year on increased equipment and parts sales in both segments. International sales declined 8.4% in the quarter owing to lower equipment sales, partly offset by increased parts and component sales.

Astec Industries, Inc. Price, Consensus and EPS Surprise

Astec Industries, Inc. price-consensus-eps-surprise-chart | Astec Industries, Inc. Quote

Astec reported a backlog of $436 million at the second quarter-end, suggesting a year-over-year surge of 92%. Domestic backlog soared 108% year over year to $705 million, while international backlog surged 36% to $132.3 million.

Operating Performance

Cost of sales climbed 22% year over year to $258 million in the second quarter. Adjusted gross profit was $60.6 million compared with the year-ago quarter’s $66.1 million. Adjusted gross margin contracted to 19% from the year-ago quarter’s 23.8%.

Adjusted selling, general, administrative and engineering (SG&A) increased 1% year over year to $46.5 million. The company reported an adjusted operating income of $6.6 million, reflecting a year-over-year slump of 50%.

The adjusted operating margin was 2.1% compared with 4.8% in the prior-year quarter. The 270-basis point contraction was caused by inflation, which outpaced sales volume, price and mix, combined with unfavorable foreign exchange.

Adjusted EBITDA was $13.2 million in the reported quarter, down 36.5% from the year-ago quarter. Adjusted EBITDA margin was 4.1%, reflecting a 340 basis points contraction from the prior-year quarter.

Segment Performance

Revenues in the Infrastructure Solutions segment were up 16.6% to $209.6 million from the year-ago quarter’s levels. The segment’s adjusted EBITDA was $15.9 million compared with the prior-year quarter’s $16.5 million.

Materials Solutions segment’s total revenues were $107.4 million in the quarter under review, reflecting an increase of 9.8% year over year. The segment’s adjusted gross profit was $9.5 million, down 40.3% year over year.

Financial Position

Astec ended the second quarter of 2022 with cash and cash equivalents of $50.6 million compared with $134.4 million at the 2021-end. At the end of 2021, the company’s long-term debt was $0.1 million compared with $0.2 million at the end of 2021.

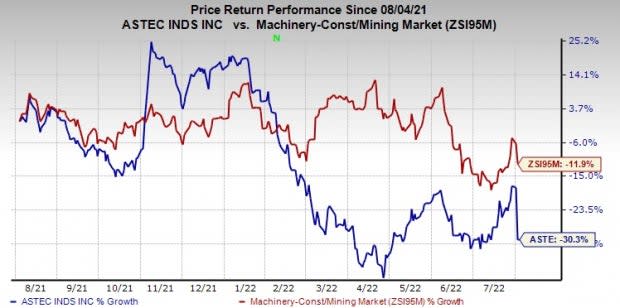

Price Performance

Image Source: Zacks Investment Research

Astec’s shares have slumped 30.3% in the past year compared with the industry's decline of 11.9%.

Zacks Rank & Stocks to Consider

Astec currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are Greif Inc. GEF, Titan International TWI and MRC Global MRC. All of these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Greif has an estimated earnings growth rate of 37% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 17%.

Greif pulled off a trailing four-quarter earnings surprise of 22.9%, on average. GEF’s shares have risen 15% in the past year.

Titan International has an estimated earnings growth rate of 165% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 43%.

Titan International pulled off a trailing four-quarter earnings surprise of 56.4%, on average. TWI’s shares have soared 83% in a year.

MRC Global has an expected earnings growth rate of 259% for 2022. The Zacks Consensus Estimate for the current year’s earnings has moved up 24% in the past 60 days.

MRC Global has a trailing four-quarter earnings surprise of 140.8%, on average. MRC’s shares have surged 41% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Astec Industries, Inc. (ASTE) : Free Stock Analysis Report

Titan International, Inc. (TWI) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

MRC Global Inc. (MRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance