Ascent Industries Co (ACNT) Faces Sharp Decline in 2023 Earnings Amid Industry Challenges

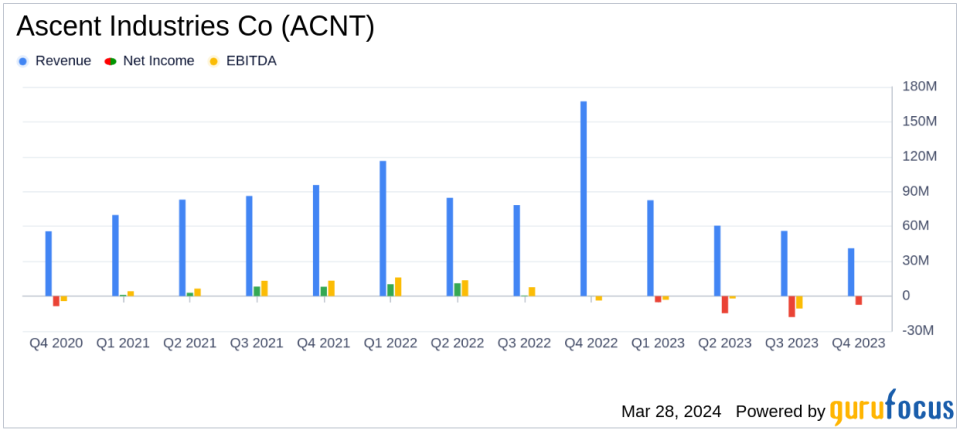

Net Sales: $193.2 million in 2023, a decrease of 26.3% from $262.0 million in 2022.

Gross Profit: Sharply down to $1.5 million in 2023 from $43.3 million in 2022.

Net Loss: Reported a net loss of $34.2 million in 2023, a significant downturn from a net income of $17.6 million in 2022.

Diluted Loss per Share: $(3.37) in 2023, compared to earnings of $1.69 per share in 2022.

Adjusted EBITDA: Fell to $(15.9) million in 2023 from $25.6 million in the previous year.

On March 28, 2024, Ascent Industries Co (NASDAQ:ACNT) released its 8-K filing, detailing a challenging fiscal year with significant declines in key financial metrics compared to the previous year and analyst estimates. Ascent Industries Co, a player in the chemical and metal industry, operates through its Ascent Tubular Products and Specialty Chemicals segments, serving a variety of markets with welded pipe and tube products, as well as specialty chemicals and dyes.

The company's fourth quarter and full-year results for 2023 reflect the impact of industry-wide destocking trends and decreased end-market demand. Net sales for the year dropped to $193.2 million, a significant decline from $262.0 million in 2022, and well below the estimated revenue of $74.1 million for the quarter. Gross profit margin plummeted to 0.8% from 16.5% a year earlier, culminating in a net loss of $34.2 million or $(3.37) diluted loss per share, starkly contrasting with the estimated earnings per share of $0.09.

Financial Performance and Strategic Shifts

Ascent's CEO, Bryan Kitchen, acknowledged the company's efforts to navigate long-term strategic goals amidst market headwinds. Despite onboarding new customers and unlocking operational efficiencies, the fourth quarter did not offset the adverse effects of the industry-wide trends.

"The Ascent team made notable progress towards our long-term strategic goals in 2023, despite continued market headwinds," said Ascent CEO Bryan Kitchen. "This progress was driven by meaningful initiatives to onboard new customers and unlock operational efficiencies that we expect to bear fruit next year. However, our momentum in the fourth quarter was not sufficient to fully mitigate the adverse effects of industry-wide destocking trends that impacted both business segments."

The company also reported the sale of Specialty Pipe & Tube assets for $55 million in cash, which was used to eliminate all outstanding debt. This strategic move has positioned Ascent favorably for 2024, with a healthy financial position and a commitment to sustainable earnings growth.

Segment and Liquidity Analysis

Segment-wise, both the Ascent Chemicals and Ascent Tubular segments witnessed declines in net sales and adjusted EBITDA. Ascent Chemicals' net sales dropped to $83.6 million from $107.5 million in 2022, while Ascent Tubular's sales decreased to $109.5 million from $154.0 million in the previous year.

The company's liquidity improved with the elimination of debt, ending the year with $61.8 million available under its revolving credit facility. Ascent also repurchased 143,108 shares at an average cost of $8.97 per share for approximately $1.3 million.

Outlook and Investor Relations

Ascent Industries Co is now focused on driving sustainable earnings growth across the enterprise, with a newly-assembled management team at the helm. The company will conduct a conference call to discuss its results and future outlook, providing an opportunity for investors to gain further insights.

For investors and value seekers, Ascent Industries Co's financial journey through 2023 serves as a testament to the volatile nature of the industry and the importance of strategic agility in the face of market fluctuations. The company's full financial statements and management's commentary provide a deeper look into its operational strategies and financial health.

For more detailed information, readers are encouraged to review the full 8-K filing and consider the implications of Ascent Industries Co's financial performance on their investment decisions.

Explore the complete 8-K earnings release (here) from Ascent Industries Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance