Arcosa (ACA) to Boost Infrastructure Presence With Ameron Buyout

Arcosa, Inc. ACA inked a deal with NOV Inc. NOV to acquire Ameron Pole Products, LLC for $180 million. The purchase will be funded through cash and available revolver capacity.

The move will enhance Arcosa's presence in key infrastructure markets and is expected to boost overall company margins. It also represents ACA's entry into the complementary concrete and steel pole lighting market, further expanding its position in traffic and telecommunication structures.

The acquisition aligns with Arcosa’s strategy to expand into growth areas. Established in 1970, Ameron is a leading manufacturer of concrete and steel poles for various infrastructure applications. It operates four manufacturing facilities strategically located in Alabama, California and Oklahoma, serving customers nationwide.

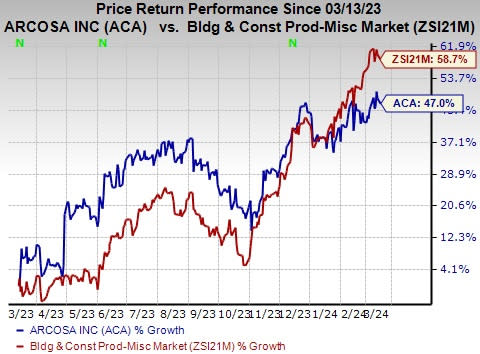

Price Performance

Shares of Arcosa have increased 47% in the past year compared with the Zacks Building Products – Miscellaneous industry's 58.7% rise. The company has been benefiting from solid contributions from its Construction Products and Transportation Products segments and a solid backlog level. A boost in infrastructural and public construction spending, along with a renewable energy drive, should improve Arcosa’s growth.

Image Source: Zacks Investment Research

During the fourth-quarter 2023, total revenues of $582.2 million increased 16.4% on a year-over-year basis. Revenues in the Construction Products segment increased 7% year over year to $238.3 million, driven by higher pricing across its aggregates and specialty materials businesses. Revenues in the Transportation Products segment amounted to $108 million, up 49% year over year, primarily driven by an 89% surge in barge revenues fueled by increased volumes and pricing.

At the end of the fourth quarter of 2023, the combined backlog for utility, wind and related structures was $1,367.5 million, up from $696.2 million at the end of the fourth quarter of 2022. The company expects to deliver approximately 43% of its current backlog in 2024.

The company remains focused on operational execution, portfolio optimization, and capital allocation. In 2023, Arcosa closed six bolt-on acquisitions, expanding its geographic presence in key natural and recycled aggregates markets. It expects healthy market fundamentals to drive solid results in its growth businesses. The company plans to advance its strategic objectives while investing to capture future growth opportunities across its portfolio.

Zacks Rank & Other Key Rank

Arcosa currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the Zacks Construction sector are:

NVR, Inc. NVR currently sports a Zacks Rank of #1 (Strong Buy). The stock has gained 24.4% in the past six months. You can see the complete list of today’s Zacks #1 Rank stocks here.

NVR delivered a trailing four-quarter earnings surprise of 8.1%, on average. The Zacks Consensus Estimate for NVR’s 2024 sales and earnings per share (EPS) indicates growth of 7.7% and 4.6%, respectively, from the prior-year levels.

Summit Materials, Inc. SUM currently sports a Zacks Rank of #1. SUM delivered a trailing four-quarter earnings surprise of 18.2%, on average. The stock has gained 28.2% in the past six months.

The Zacks Consensus Estimate for SUM’s 2024 sales and EPS indicates growth of 80.2% and 53.2%, respectively, from a year ago.

Century Communities, Inc. CCS presently sports a Zacks Rank of #1. It has a trailing four-quarter earnings surprise of 49.2%, on average. Shares of CCS have rallied 22.7% in the past six months.

The Zacks Consensus Estimate for CCS’ 2024 sales and EPS indicates a rise of 11.1% and 24.4%, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NOV Inc. (NOV) : Free Stock Analysis Report

Century Communities, Inc. (CCS) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

Summit Materials, Inc. (SUM) : Free Stock Analysis Report

Arcosa, Inc. (ACA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance