Arbor Realty Trust Inc (ABR) Reports Mixed Q1 2024 Results, Misses EPS Estimates but Declares ...

Net Income: Reported at $57.9 million, falling short of the estimated $91.84 million.

Earnings Per Share (EPS): Achieved $0.31 per diluted common share, below the estimate of $0.41.

Revenue: Agency business generated $66.6 million, not directly comparable to total estimated revenue of $89.95 million.

Distributable Earnings: Totalled $96.7 million or $0.47 per diluted common share, despite lower net income, reflecting strong operational performance.

Dividend: Declared a cash dividend of $0.43 per share, reflecting a payout ratio of 91%.

Liquidity and Capital Resources: Maintained a strong liquidity position with approximately $800 million in cash and liquidity.

Stock Repurchase: Repurchased $11.4 million of common stock, signaling confidence in the company's valuation.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

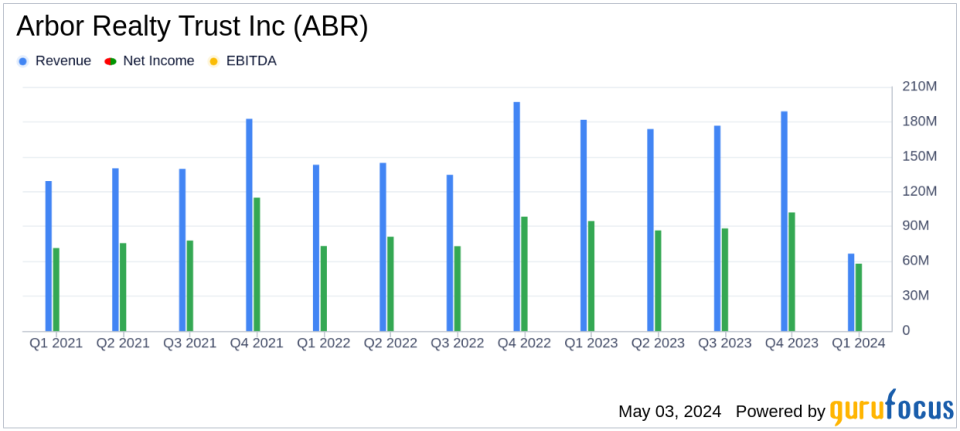

On May 3, 2024, Arbor Realty Trust Inc (NYSE:ABR) released its 8-K filing, revealing the financial outcomes for the first quarter ended March 31, 2024. The company reported a GAAP net income of $0.31 per diluted common share, falling short of the analyst estimated earnings per share of $0.41. However, distributable earnings stood at $0.47 per diluted common share, excluding a $1.6 million realized loss on a non-performing loan. Arbor also declared a quarterly cash dividend of $0.43 per share, maintaining a high payout ratio of 91%.

About Arbor Realty Trust Inc

Arbor Realty Trust Inc is a specialized real estate finance company investing in a diversified portfolio of structured finance assets in the multifamily and commercial real estate markets. The company operates through two segments: Structured Business and Agency Business, with the majority of its revenue generated from the Structured Business segment. Arbor is externally managed and advised by Arbor Commercial Mortgage, LLC.

Performance Highlights and Challenges

Arbor Realty Trust reported net income of $57.9 million for Q1 2024, a decrease from $84.3 million in the same quarter the previous year. This decline reflects challenges including higher provisions for loan losses and a decrease in income from mortgage servicing rights, which dropped to $10.2 million from $21.1 million in the previous quarter. The company's strong liquidity position, with approximately $800 million in cash and liquidity, remains a critical asset in navigating the fluctuating real estate finance market.

Financial Achievements and Strategic Moves

The company's agency loan originations amounted to $846.3 million during the quarter, with a servicing portfolio valued at approximately $31.38 billion, marking a 9% increase from Q1 2023. These figures underscore Arbor's robust position in the market. Additionally, Arbor's strategic stock repurchase in April 2024, where $11.4 million of common stock was bought back, reflects confidence in its financial health and commitment to delivering shareholder value.

Detailed Financial Analysis

Arbor's total revenue for the quarter was $66.6 million, primarily driven by its Agency Business, although this was a decrease from $96.3 million in the previous quarter. The structured loan portfolio showed a runoff of $640 million, but maintained a substantial portfolio valued at approximately $12.25 billion. The company's ability to manage a large and diverse portfolio highlights its expertise and strategic approach in the structured finance sector.

The balance of debt that finances the companys loan and investment portfolio as of March 31, 2024, was $11.11 billion, with a weighted average interest rate of 7.44%. This careful management of debt showcases Arbor's prudent financial practices in a challenging economic environment.

Conclusion and Outlook

Despite missing EPS estimates, Arbor Realty Trust's declaration of a consistent dividend and its strategic financial maneuvers reflect a stable outlook. The company's comprehensive approach to managing its extensive portfolio, combined with robust liquidity, positions it well for navigating future market dynamics. Investors and stakeholders will likely watch closely how Arbor adapts to ongoing economic fluctuations and capitalizes on market opportunities.

For more detailed financial analysis and future updates on Arbor Realty Trust Inc, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Arbor Realty Trust Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance