Amylyx Pharmaceuticals Reports Q1 2024 Financial Results

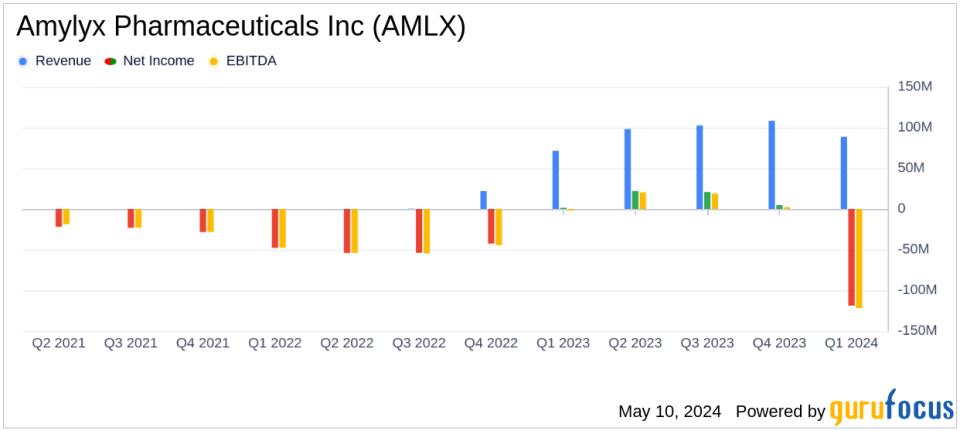

Revenue: Reported $88.6 million in net product revenue for Q1 2024, up from $71.4 million in Q1 2023, surpassing the estimated revenue of $82.63 million.

Net Loss: Incurred a net loss of $118.8 million in Q1 2024, significantly above the estimated net loss of $47.21 million.

Earnings Per Share: Reported a loss of $1.75 per share, falling short of the estimated loss per share of $0.70.

Cost of Sales: Cost of sales reached $116.4 million due to a substantial write-down of inventory, compared to $5.3 million in Q1 2023.

Research and Development Expenses: Increased to $36.6 million in Q1 2024 from $24.2 million in Q1 2023, reflecting higher investment in clinical studies and preclinical development.

Cash Position: Held $373.3 million in cash, cash equivalents, and short-term investments as of March 31, 2024, supporting operations into 2026.

Amylyx Pharmaceuticals Inc (NASDAQ:AMLX) released its 8-K filing on May 9, 2024, disclosing its financial outcomes for the first quarter ended March 31, 2024. The Cambridge, Massachusetts-based biopharmaceutical company, known for its focus on neurodegenerative diseases, reported a notable increase in revenue but also a significant net loss, influenced by strategic product discontinuations and increased operational expenses.

Company Overview

Amylyx Pharmaceuticals Inc is a clinical-stage pharmaceutical company dedicated to developing innovative therapeutics for amyotrophic lateral sclerosis (ALS) and other neurodegenerative diseases. It operates a single business segment focused on the research and development of novel treatments for these complex conditions.

Financial Performance Insights

The company's net product revenue rose to $88.6 million in Q1 2024, up from $71.4 million in the same period last year. This increase was largely due to the sales of RELYVRIO and ALBRIOZA in the U.S. and Canada. However, following the decision to discontinue these products based on the Phase 3 PHOENIX trial outcomes, Amylyx recorded substantial non-cash charges leading to a net loss of $118.8 million for the quarter, a stark contrast to the net income of $1.6 million reported in Q1 2023.

Research and development expenses were $36.6 million, reflecting a rise from the previous year's $24.2 million, driven by increased headcount and spending on clinical studies, particularly the Phase 3 ORION study of AMX0035 in progressive supranuclear palsy (PSP). Selling, general, and administrative expenses also grew to $57.8 million due to expanded operations as a public company.

Strategic Developments and Clinical Progress

Amylyx is navigating a period of transition, focusing its resources on promising clinical programs such as AMX0035 for Wolfram syndrome and PSP, and AMX0114 for ALS. The company has recently initiated plans to meet with the FDA following encouraging interim data from its Phase 2 HELIOS trial for Wolfram syndrome, with full data expected in fall 2024. Additionally, Amylyx anticipates interim results from the ORION study in mid-2025 and plans to commence a clinical trial for AMX0114 in ALS in the latter half of 2024.

Despite the discontinuation of RELYVRIO/ALBRIOZA, Amylyx has strategically restructured to extend its financial runway into 2026, ensuring continued support for its key clinical trials and research initiatives.

Financial Stability and Future Outlook

With $373.3 million in cash, cash equivalents, and short-term investments as of March 31, 2024, Amylyx is well-positioned to fund its operations and research commitments into 2026. This financial stability is crucial as the company focuses on advancing its clinical pipeline and potentially bringing new therapies to market.

As Amylyx continues to navigate its strategic pivots and advance its clinical programs, investors and stakeholders will be keenly watching the progression of its trials and the impacts of its recent product discontinuations on its financial health and operational focus.

For further details, Amylyx will be hosting a conference call and webcast today at 8:00 a.m. Eastern Time, accessible via their Investor Relations website.

Explore the complete 8-K earnings release (here) from Amylyx Pharmaceuticals Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance