Amkor Technology Inc. (AMKR) Q1 2024 Earnings: Surpasses Revenue Forecasts with Strategic ...

Net Sales: Reported $1.37 billion, surpassing the estimated $1.356 billion.

Net Income: Achieved $59 million, significantly exceeding the estimate of $26.56 million.

Earnings Per Share (EPS): Recorded at $0.24, more than double the estimated $0.11.

Gross Margin: Reached 14.8%, showing improvement from 13.2% in the same quarter the previous year.

Operating Income: Posted $73 million with a margin of 5.4%, compared to $69 million and a 4.7% margin in Q1 2023.

Dividends: Paid a quarterly dividend of $0.07875 per share on April 1, 2024.

Future Outlook: Expects Q2 2024 net sales between $1.40 billion and $1.50 billion, with net income projected at $35 million to $75 million.

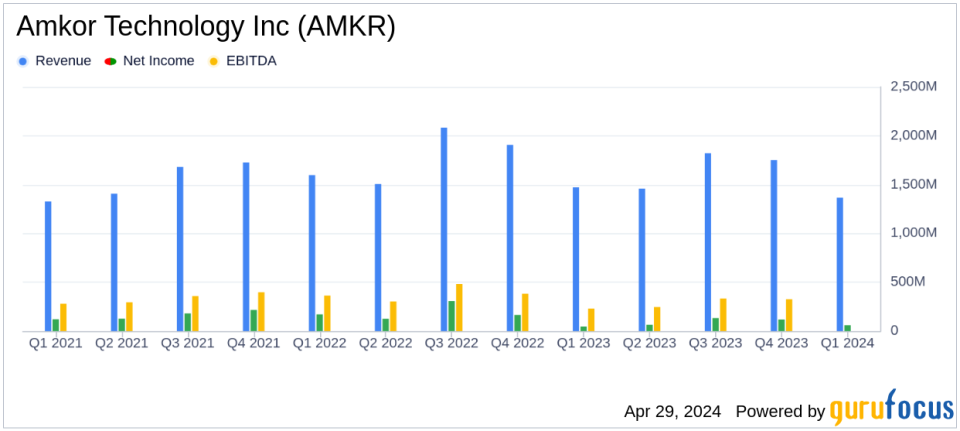

Amkor Technology Inc (NASDAQ:AMKR), a leader in semiconductor packaging and test services, announced its financial results for the first quarter ended March 31, 2024. The company reported a robust net sales of $1.37 billion, exceeding the analyst estimates of $1.356 billion. Amkor's earnings per share (EPS) of $0.24 also notably surpassed the expected $0.11, reflecting a strong performance against market expectations. This financial update was detailed in the company's recent 8-K filing released on April 29, 2024.

Amkor Technology operates as the world's largest US headquartered OSAT (outsourced semiconductor assembly and test) service provider, specializing in advanced and mainstream semiconductor packaging and test services. The company's strategic focus on advanced products, which include technologies like flip chip and wafer-level processing, continues to be the main revenue driver, contributing significantly to the quarterly sales.

Financial Performance Insights

During Q1 2024, Amkor reported a gross profit of $202 million and an operating income of $73 million. The company achieved a gross margin of 14.8% and an operating income margin of 5.4%. These figures represent an improvement in operational efficiency compared to the same quarter in the previous year. Net income attributable to Amkor stood at $59 million, with a diluted EPS of $0.24, reflecting an increase from $0.18 in Q1 2023.

Strategic Developments and Operational Highlights

Giel Rutten, President and CEO of Amkor, highlighted the company's ongoing initiatives, including the expansion of 2.5D capacity to boost AI device output and the strengthening of partnerships to enhance the European semiconductor supply chain. Notably, the company is progressing with its plans for an advanced packaging and test facility in Arizona and is focusing on ramping up production in its Vietnam factory in the latter half of the year.

Looking Ahead: Q2 2024 Guidance

For the second quarter of 2024, Amkor anticipates net sales to be between $1.40 billion and $1.50 billion, with a gross margin forecast of 13.0% to 15.0%. The projected net income ranges from $35 million to $75 million, translating to an EPS of $0.14 to $0.30. The company also plans to continue its investment in technology and capacity expansion, with capital expenditures expected to be around $750 million for the full year.

Financial Position and Liquidity

As of March 31, 2024, Amkor's total cash and short-term investments were reported at $1.6 billion, with total debt standing at $1.2 billion. The company maintains a strong liquidity position, supporting its ongoing and future operational needs.

Conclusion

Amkor Technology Inc's Q1 2024 results not only surpassed analyst expectations in terms of revenue and EPS but also demonstrated the company's resilience and strategic foresight in navigating the semiconductor industry's challenges. With significant investments in capacity and technology, alongside strategic global expansions, Amkor is well-positioned to sustain its growth trajectory and strengthen its market position in the upcoming quarters.

For detailed insights and further information, investors and stakeholders are encouraged to refer to the full earnings report and supplementary materials available on Amkor's investor relations website.

Explore the complete 8-K earnings release (here) from Amkor Technology Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance