Ameriprise Financial Inc (AMP) Surpasses Q1 Earnings Estimates and Raises Dividend

Earnings Per Share (EPS): Reported GAAP EPS of $9.46, significantly surpassing the estimate of $8.20.

Adjusted Operating EPS: Achieved $8.39, slightly above the estimated $8.20.

Net Income: GAAP net income reached $990 million, far exceeding the estimated $852.09 million.

Revenue: Adjusted operating net revenues increased by 11% year-over-year, indicating robust organic growth and favorable market conditions.

Assets Under Management: Grew to $1.4 trillion, a 15% increase, driven by strong client net inflows and market appreciation.

Dividend: Raised quarterly dividend by 10%, reflecting strong free cash flow and a solid capital position.

Shareholder Returns: Returned $650 million to shareholders in the quarter, underscoring financial strength and commitment to shareholder value.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

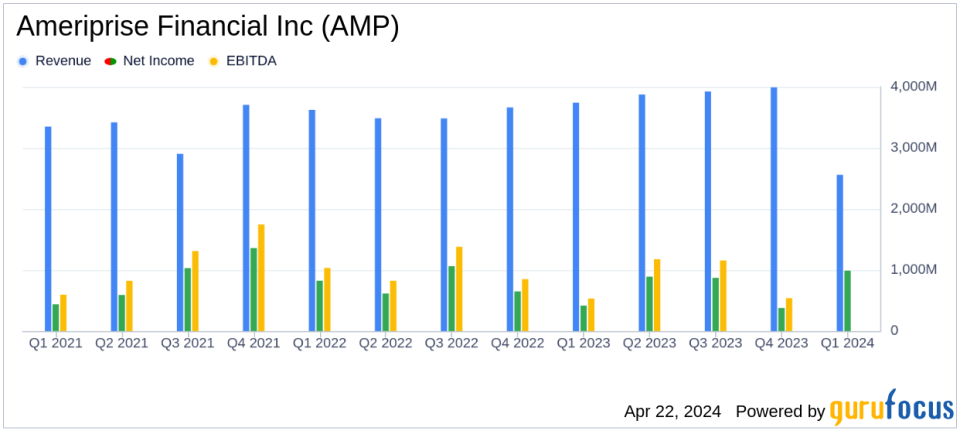

On April 22, 2024, Ameriprise Financial Inc (NYSE:AMP) released its 8-K filing, revealing a substantial outperformance in its first-quarter earnings. The company reported an adjusted operating earnings per share (EPS) of $8.39, significantly surpassing the analyst estimate of $8.20. This represents a 16% increase from the previous year, highlighting strong growth across the company's diversified business segments.

Ameriprise Financial, a leading entity in the US market for asset and wealth management, manages approximately $1.4 trillion in assets. The firm's revenue streams are predominantly derived from its asset and wealth management operations, which contribute about 80% to its total revenue. Following the divestiture of its auto and home insurance business in 2019 and the exit from proprietary fixed annuities in 2020, Ameriprise has strategically focused on its core financial advisory and asset management services.

Financial Highlights and Strategic Developments

The company's GAAP net income for Q1 2024 stood at $990 million, a dramatic increase from $417 million in the same period last year, primarily due to favorable market impacts on derivatives and market risk benefits. This resulted in a GAAP net income per diluted share of $9.46, compared to $3.79 a year ago. The adjusted operating net revenues saw an 11% increase, driven by organic growth, strong equity markets, and higher spread revenues.

Ameriprise's strategic focus on operational efficiency is evident from its well-managed general and administrative expenses and a robust pretax adjusted operating margin of 26.3%. The adjusted operating return on equity was impressive at 49.0%, reflecting the company's effective capital utilization.

Capital Management and Shareholder Returns

Highlighting its strong capital position, Ameriprise returned $650 million to shareholders in the quarter. Additionally, the company announced a 10% increase in its quarterly dividend, underscoring its commitment to delivering shareholder value. According to Jim Cracchiolo, Chairman and CEO, "Ameriprise delivered another good quarter with contributions across our diversified business. Our capital position is a consistent differentiator, generating significant free cash flow that we invest for growth and return to shareholders."

Operational and Segment Performance

Ameriprise's Wealth Management segment continued to be a primary growth driver, with assets under management and administration climbing to a new high of $1.4 trillion. This was supported by strong client net inflows and market appreciation. The Advice & Wealth Management segment reported a 13% increase in adjusted operating net revenues to $2.56 billion, with pretax adjusted operating earnings of $762 million, up 10% from the previous year.

The Asset Management segment also showed strong performance, with adjusted operating net revenues growing by 7% to $855 million. The segment's disciplined expense management and equity market appreciation helped achieve a 25% increase in pretax adjusted operating earnings.

Looking Forward

Ameriprise is positioned to continue its growth trajectory, supported by its robust financial health and strategic initiatives. The company's focus on enhancing advisor productivity and expanding its high-margin businesses, such as structured annuities and wealth management services, is expected to drive future profitability and shareholder returns.

For detailed financial figures and performance metrics, interested readers and investors are encouraged to refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Ameriprise Financial Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance