Amerant Bancorp Inc. (AMTB) Q1 2024 Earnings Analysis: Misses EPS Estimates, Reports Net Income ...

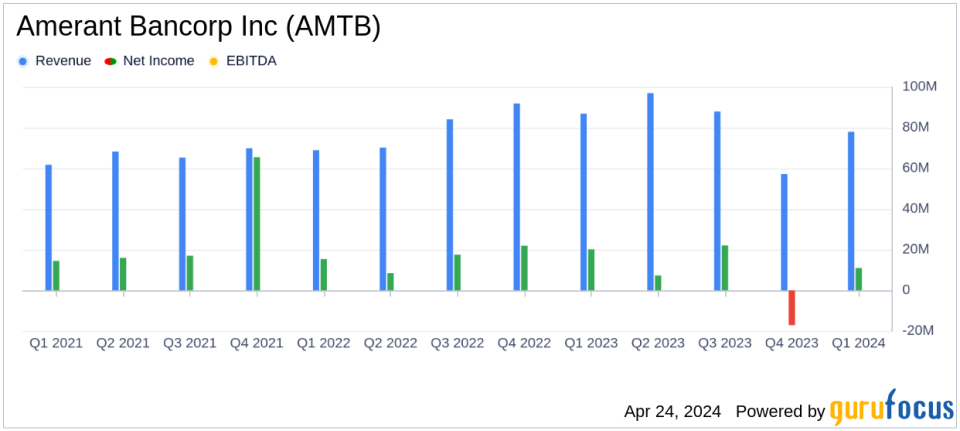

Net Income: Reported at $10.6 million for Q1 2024, below the estimated $12.07 million.

Earnings Per Share (EPS): Achieved $0.31 per diluted share, falling short of the estimated $0.36.

Revenue: Details on total revenue not provided, comparison to the estimated $91.37 million cannot be made.

Dividend: Declared a quarterly cash dividend of $0.09 per common share.

Asset Growth: Total assets increased to $9.8 billion, up by $101.4 million from the previous quarter.

Loan Portfolio: Total gross loans decreased to $7.01 billion, down by $258.5 million due to the sale of Houston-based multifamily loans.

Operational Efficiency: Efficiency ratio improved significantly to 72.0% in Q1 2024 from 108.3% in Q4 2023.

On April 24, 2024, Amerant Bancorp Inc (NYSE:AMTB) disclosed its financial results for the first quarter of 2024 through an 8-K filing. The company reported a net income of $10.6 million, or $0.31 per diluted share, a significant recovery from a net loss of $17.1 million in the previous quarter. Despite this improvement, the earnings per share fell short of the analyst estimate of $0.36.

Company Overview

Amerant Bancorp Inc., headquartered in Coral Gables, Florida, is a prominent bank holding company. Through its main subsidiary, Amerant Bank, it offers a comprehensive range of services including deposits, credit, investment, wealth management, and fiduciary services to both domestic and selected international clients. Established in 1979, Amerant operates 24 banking centers and emphasizes a combination of traditional and digital banking services.

Financial Highlights and Strategic Initiatives

The first quarter saw Amerant focusing on expansion and strategic restructuring, including the opening of new locations and the sale of its Houston franchise. This period marked a notable increase in total assets to $9.8 billion, reflecting a 1.0% growth from the fourth quarter of 2023. However, total gross loans decreased by 3.6% to $7.01 billion due to the sale of Houston-based multifamily loans, partially offset by organic loan production.

Deposit dynamics were mixed, with a slight decrease in total deposits to $7.88 billion. Nevertheless, organic deposit growth was robust, adding $331.8 million. The bank also reported an increase in cash and cash equivalents by 104.9%, amounting to $659.7 million.

Despite these positive developments, Amerant faced challenges including a decrease in net interest income to $78.0 million and a contraction in net interest margin to 3.51%. The efficiency ratio improved dramatically to 72.0% from 108.3% in the previous quarter, indicating better cost management.

Operational and Market Challenges

The reduction in net interest income and the contraction of the net interest margin underscore ongoing pressures in the banking sector, particularly in terms of interest rate volatility and competitive dynamics. Furthermore, the decrease in total gross loans highlights the impact of strategic asset sales on loan portfolio volume, which could affect future interest income.

Investor and Market Reactions

Despite missing EPS estimates, the recovery to profitability and the declaration of a quarterly cash dividend of $0.09 per common share reflect a positive turnaround in Amerant's operational performance. These factors, combined with strategic expansions and asset restructuring, provide a mixed yet cautiously optimistic outlook for investors.

For more detailed information, including future strategies and financial health, investors and stakeholders are encouraged to refer to the full earnings report and supplementary materials available on the Amerant investor relations website.

Conclusion

Amerant Bancorp Inc.'s first quarter of 2024 illustrates a period of recovery and strategic realignment. While challenges remain, particularly in loan portfolio management and interest income generation, the company's proactive strategies and improved efficiency ratios highlight its resilience and adaptability in a fluctuating banking environment.

Explore the complete 8-K earnings release (here) from Amerant Bancorp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance