Amdocs (DOX) to Support Colt in IT Modernization Journey

Amdocs Limited DOX recently announced that Colt Technology Services has selected it for strategic transformation of the latter’s core IT systems. Under the terms of the contract, Amdocs will deliver an inventory platform that will digitalize and automate Colt's global product and service inventory.

Colt’s global inventory platform will be integrated with Amdocs Resource Manager solution, which focuses on delivering digital infrastructure services. The new inventory platform will help Colt enhance its delivery and engineering services, and improve network operations.

The global inventory platform is expected to facilitate Colt teams' ability to deliver a wide range of provisioning changes, capacity planning and fault-resolution services across a single, connected platform in real-time and across borders. The new platform will also enhance customer experience by providing them with greater self-service options to manage their own infrastructure changes if they choose to.

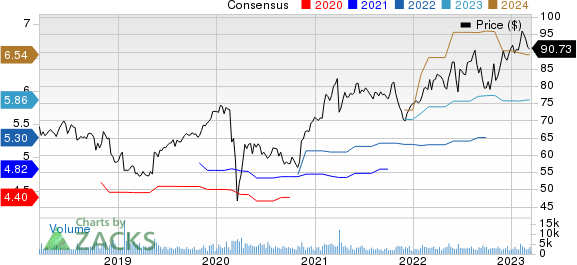

Amdocs Limited Price and Consensus

Amdocs Limited price-consensus-chart | Amdocs Limited Quote

Amdocs continues to expand its global client base by signing long-term contracts and collaborating with major companies across the world. The company ended the first quarter of fiscal 2023 with a 12-month backlog of $4.09 billion, up $120 million sequentially and $260 million year over year.

Currently, Amdocs' growth momentum is anticipated to continue, courtesy of its initiatives aimed at aiding digital, media, and network and cloud transformations of its clients. Our estimate for Amdocs’ top line suggests a CAGR of 7.5% over the next three fiscal years.

However, the company is highly susceptible to foreign currency exchange rate risk. It expects foreign-exchange fluctuations to continue affecting top-line performance in the near term. Economic and political uncertainty remains an overhang on Amdocs’ financials.

Zacks Rank & Stocks to Consider

DOX currently carries a Zacks Rank #3 (Hold). Shares of DOX have gained 13.4% over the past year.

Some better-ranked stocks from the broader technology sector are Wix.com WIX, Aspen Technology AZPN and ServiceNow NOW, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Wix.com’s first-quarter 2023 earnings has been revised upward to 23 cents per share from 16 cents seven days ago. For 2023, earnings estimates have been revised northward by 7 cents to $1.49 per share in the past seven days.

Wix.com's earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missing the same on one occasion, the average surprise being 225%. Shares of WIX have gained 4.7% in the trailing 12 months.

The Zacks Consensus Estimate for Aspen Technology's third-quarter fiscal 2023 earnings has been revised upward by 17 cents to $1.66 per share in the past 60 days. For fiscal 2023, earnings estimates have been revised northward by 25 cents to $7.10 per share in the past 60 days.

Aspen Technology’s earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missing the same on one occasion, the average surprise being 5.2%. Shares of AZPN have rallied 56.7% over the past year.

The Zacks Consensus Estimate for ServiceNow's first-quarter 2023 earnings has been revised southward by 2 cents to $2.02 per share over the past 60 days. For 2023, earnings estimates have moved downward by 3 cents to $9.15 per share in the past 30 days.

ServiceNow's earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 6.9%. Shares of NOW have plunged 22.5% in the trailing 12 months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amdocs Limited (DOX) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

Wix.com Ltd. (WIX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance