Altair (ALTR) Buys Cambridge Semantics, Enhances AI Technology

In a bid to enhance its strong analytics and data science team with deep data warehousing expertise, Altair Engineering Inc. ALTR has acquired Cambridge Semantics.

Cambridge Semantics is a modern data fabric provider and creator of one of the industry's leading analytical graph databases. Its graph-powered data fabric technology simplifies the creation of comprehensive enterprise knowledge graphs by integrating the complex web of structured and unstructured enterprise data into one place.

Cambridge Semantics' transformational knowledge graph technology will be integrated into Altair’s RapidMiner platform. This will add knowledge graph, data governance, data virtualization and data discovery technology to ALTR’s existing data preparation, ETL, data science, business intelligence, MLOps, workload management and orchestration tools.

The deal will help organizations build a solid foundation for advanced analytics ecosystems that will incorporate artificial intelligence (AI) into day-to-day business operations.

Accretive Acquisitions: A Boon

Altair’s products, services and business models have been driving market share growth. ALTR continues to evolve its product portfolio with a combination of sustainable and disruptive innovations. Also, strategic investments in engineering AI, accretive acquisitions and robust product demand are encouraging.

Acquisitions are an important part of Altair’s strategy to supplement its organic growth and diversify extensively across its portfolio. Since 1996 through 2023, ALTR has acquired 51 companies or strategic technologies.

In 2023, the company acquired OmniQuest, a Michigan-based optimization software company, and OmniV technology from XLDyn, LLC. OmniQuest's flagship product, Genesis, will boost Altair's leadership in lightweight and structurally efficient designs across the globe. On the other hand, OmniV, which is a vendor-agnostic MBSE requirements management solution, will enhance Altair's ability to engage in projects involving digital twins, simulation data management and engineering data analytics.

This global leader in computational intelligence finished 2023 with record-high revenues and profits. Total revenues increased 7.1% in reported currency and 8.2% in constant currency. Adjusted EPS grew 27% from the 2022 level.

For 2024, it expects revenue growth within 8.2-9.8% year over year.

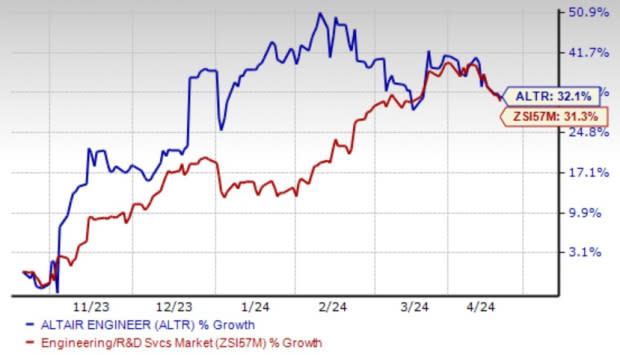

Image Source: Zacks Investment Research

Coming to share price performance, Altair has gained 32.1% year to date, compared with the Zacks Engineering - R and D Services industry’s 31.3% rise.

Earnings estimates for 2024 have moved up over the past 60 days to $1.28 per share from $1.11. This indicates a 13.3% year-over-year increase and analysts’ optimism regarding its growth potential.

Zacks Rank & Other Key Picks

Currently, ALTR carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the same space are:

Willdan Group, Inc. WLDN currently sports a Zacks Rank #1 (Strong Buy). WLDN delivered a trailing four-quarter average earnings surprise of a whopping 886.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for WLDN’s 2024 sales and earnings per share (EPS) indicates growth of 3.9% and 3.4%, respectively, from the year-ago levels.

Sterling Infrastructure, Inc. STRL presently sports a Zacks Rank #1. Sterling Infrastructure has a trailing four-quarter earnings surprise of 20.4%, on average.

The Zacks Consensus Estimate for STRL’s 2024 sales and EPS indicates a rise of 11.7% and 11.4%, respectively, from the prior-year levels.

M-tron Industries, Inc. MPTI currently sports a Zacks Rank #2. It has topped earnings estimates in two of the trailing four quarters, met on one occasion and missed once, with an average surprise of 24.7%.

The Zacks Consensus Estimate for MPTI’s 2024 EPS increased to $2.01 from $1.95 over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Altair Engineering Inc. (ALTR) : Free Stock Analysis Report

Willdan Group, Inc. (WLDN) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance