Allogene (ALLO) Clinical Hold on CAR-T Studies Removed by FDA

Allogene Therapeutics ALLO announced that the FDA has removed the clinical hold on all five allogeneic CAR T (“AlloCAR T”) studies.

In October 2021, the FDA placed all its clinical studies evaluating AlloCAR T-based therapies on hold based on a report of a chromosomal abnormality with unclear clinical significance in a patient in the phase I/II study — ALPHA2 — evaluating its next-generation, AlloCAR T candidate, ALLO-501A.

The FDA’s decision to remove the clinical hold was based on investigations that concluded that chromosomal abnormality is not related to Allogene’s manufacturing process or the TALEN gene-editing technology and had no clinical significance. In fact, the investigations did not detect any abnormality in the manufactured AlloCAR T product or any patient treated with ALLO-501A.

Per Allogene, the abnormality arose in the patient after the therapy was administered.

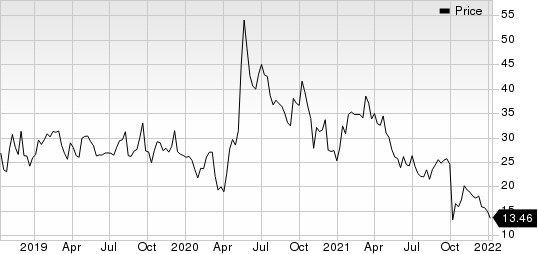

In the trailing 12 months, Allogene’s stock has plunged 55.8% in comparison with the industry’s decline of 31.3%.

Image Source: Zacks Investment Research

In the absence of a marketed product, Allogene is mainly dependent on its pipeline candidates for development. In fact, the company’s pipeline majorly constitutes AlloCAR T based-therapies that are currently in early-stage or mid-stage development. The removal of a clinical hold will allow Allogene to resume all clinical studies evaluating these AlloCART therapies. The company will be working with the investigators of these studies to resume study activities across all AlloCAR T programs.

Allogene is collaborating with Servier to develop and commercialize two anti-CD19 product therapies — ALLO-501 and ALLO-501A. While ALLO-501 is being evaluated in a phase I study in patients with relapsed or refractory (R/R) non-Hodgkin lymphoma, the company intends to start a phase II study on ALLO-501A for R/R large B cell lymphoma in mid-year 2022, following discussions with the FDA.

Allogene has an exclusive worldwide license from Cellectis CLLS for its TALEN gene-editing technology for the development of AlloCART product candidates directed against 15 different cancer antigens. Cellectis is eligible to receive potential development and sales milestone payments totaling up to $2.8 billion from Allogene.

As part of the agreement with Cellectis, Allogene is currently advancing ALLO-316 — a candidate targeting CD70 — in adult patients with advanced or metastatic clear cell renal cell carcinoma. Allogene is currently developing two therapies — ALLO-715 and ALL-605 — targeting BCMA for treating R/R multiple myeloma. Allogene holds the development and commercial rights for these allogeneic products.

Allogene Therapeutics, Inc. Price

Allogene Therapeutics, Inc. price | Allogene Therapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Allogene currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include Alkermes ALKS and Regeneron Pharmaceuticals REGN. While Alkermes sports a Zacks Rank #1 (Strong Buy) at present, Regeneron currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alkermes’ earnings per share estimates for 2022 have increased from $0.70 to $0.71 in the past 30 days. Shares of Alkermes have risen 13% in the past year.

Earnings of Alkermes beat estimates in all the last four quarters, delivering a surprise of 147%, on average.

Regeneron’s earnings per share estimates for 2022 have increased from $50.09 to $50.23 in the past 30 days. Shares of Regeneron Pharmaceuticals have risen 23.5% in the past year.

Earnings of Regeneron Pharmaceuticals beat estimates in all the last four quarters, delivering a surprise of 28.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Alkermes plc (ALKS) : Free Stock Analysis Report

Cellectis S.A. (CLLS) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance