Agnico Eagle (AEM) Provides Update on Nunavut Operations

Agnico Eagle Mines Limited AEM recently announced an update linked to the hike in COVID-19 cases at its Nunavut operations. There have been a total of 13 tentative cases at its Meliadine, Meadowbank and Hope Bay operations since Dec 18, 2021. The company, along with Nunavut public health authorities, made a decision to immediately send home the Nunavut-based workforce (Nunavummiut) from the Meliadine, Meadowbank and Hope Bay operations as well as its Nunavut exploration projects.

Agnico Eagle gradually reduced the remaining workforce and activity levels at Nunavut. Due to the reduction, the company expects production to be minimal over this period. It is also reassessing current protocols in preparation for a resumption of activities expected in early 2022.

The health and safety measures set by the company since the start of the pandemic have remained in place at its Nunavut operations. It is undertaking precautionary steps to further protect the continued health of its Nunavut workforce and local residents in the communities in which it operates due to the increased spread and transmissibility of the Omicron variant of COVID-19.

All Nunavummiut workers, presently on site, will be sent home and those that are currently off-site will not return to work at this time for a period of at least three weeks. These employees will continue to receive their remuneration during this period.

The company will discuss the implementation of similar measures for its Nunavummiut workforce with its Nunavut contractors. It has also increased testing protocols at all its Nunavut operations for remaining workers.

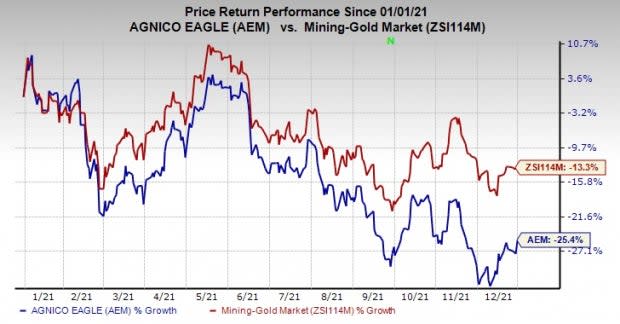

Shares of Agnico Eagle have declined 25.4% in the past year compared with a 13.3% fall of the industry.

Image Source: Zacks Investment Research

The company, in its last earnings call, stated that it expects gold production for 2021 to be 2,047,500 ounces. It also projects total cash costs per ounce of $700-$750 and AISC of $950-$1,000 per ounce for 2021.

The forecast for 2021 capital expenditures is roughly $803 million.

Zacks Rank & Key Picks

Agnico Eagle currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Nutrien Ltd. NTR, The Chemours Company CC and AdvanSix Inc. ASIX.

Nutrien has an expected earnings growth rate of 233.3% for the current year. The Zacks Consensus Estimate for NTR’s current-year earnings has been revised 16.3% upward in the past 60 days.

Nutrien beat the Zacks Consensus Estimate for earnings in three of the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 73.5%, on average. The stock has rallied 55% in a year. NTR currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected earnings growth rate of 104% for the current year. The Zacks Consensus Estimate for CC’s earnings for the current year has been revised 10% upward in the past 60 days.

Chemours beat the Zacks Consensus Estimate for earnings in the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 34.2%, on average. It has rallied 33.8% in a year. CC currently flaunts a Zacks Rank #1.

AdvanSix has a projected earnings growth rate of 194.5% for the current year. The Zacks Consensus Estimate for ASIX’s earnings for the current year has been revised 5.9% upward in the past 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 46.9%. ASIX has rallied 135.7% in a year. It currently sports a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

AdvanSix (ASIX) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance