Agios (AGIO) Q1 Earnings Surpass, Sales Miss Estimates

Agios Pharmaceuticals AGIO reported a loss of $1.45 per share in first-quarter 2024, narrower than the Zacks Consensus Estimate of a loss of $1.64. In the year-ago quarter, the company reported a loss of $1.47.

AGIO reported revenues of $8.2 million, which slightly missed the Zacks Consensus Estimate of $8.4 million. In the year-ago quarter, the company recorded revenues of $5.6 million.

Quarter in Detail

In the reported quarter, revenues were generated entirely from product revenues of Agios’ only marketed drug, Pyrukynd (mitapivat), which is approved for treating hemolytic anemia in adults with pyruvate kinase (PK) deficiency.

Pyrukynd revenues in the United States were up 46% year over year and 15% sequentially. The reported figure marginally beat our model estimate of $8.1 million.

The sequential rise in Pyrukynd revenues was primarily driven by increased patient demand. Per management, a total of 120 patients are on Pyrukynd therapy, up 10% from fourth-quarter 2023 levels.

Research & development expenses rose 2% year over year to $68.6 million, driven by an increase in process development expenses.

Selling, general and administrative expenses increased 9% year over year to $31.0 million. The upside can be attributed to the company’s commercial preparations for a potential launch of Pyrukynd in thalassemia indication.

As of Mar 31, 2024, cash, cash equivalents and marketable securities totaled $714.3 million compared with $806.4 million as of Dec 31, 2023. Management expects this cash balance to fund its operations and meet capital expenditure requirements at least into 2026.

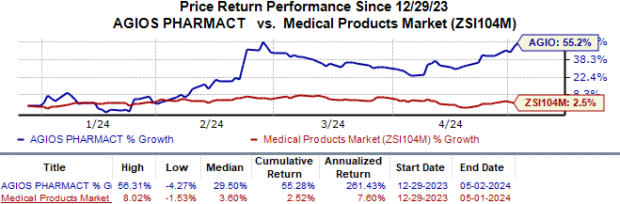

Agios’ shares have surged 55.3% year to date compared with the industry’s 2.5% growth.

Image Source: Zacks Investment Research

Pipeline & Other Updates

Agios is evaluating Pyrukynd in two phase III studies — ENERGIZE and ENERGIZE-T — for the treatment of thalassemia in adult patients who are non-transfusion-dependent and transfusion-dependent, respectively. In January, management reported that the ENERGIZE study achieved its primary endpoint of hemoglobin response, along with lower levels of fatigue.

A data readout from the ENERGIZE-T study is expected before June-end, a slightly refined time frame than the previously communicated timeline of mid-2024. If this data is positive, management expects a potential regulatory filing for Pyrukynd in thalassemia indication before this year’s end.

The company plans to complete enrollment in the phase III portion of the RISE UP study investigating Pyrukynd in sickle cell disease (SCD) by 2024-end. Data readout from this portion is expected next year.

Management intends to commercially launch Pyrukynd in thalassemia and SCD indications by 2025 and 2026, respectively.

Agios is evaluating its PKR activator candidate, AG-946, for lower-risk myelodysplastic syndrome (LR-MDS). Patient dosing in the phase IIb study on AG-946 is expected to begin in mid-2024.

In February, Servier announced that the FDA accepted the company’s regulatory filing seeking approval for vorasidenib to treat IDH-mutant diffuse glioma. A final decision is expected in August. Vorasidenib was part of Agios’ oncology business, which was sold to France-based Servier in 2021. Per the terms of sale, Agios retains the right to receive a milestone payment of $200 million if the FDA grants marketing approval to vorasidenib. The company is also eligible to receive 15% royalty payments from Servier on potential net sales of the drug in the United States.

Recently, Agios initiated an early-stage study on its investigational PAH stabilizer AG-181 for the treatment of phenylketonuria (PKU).

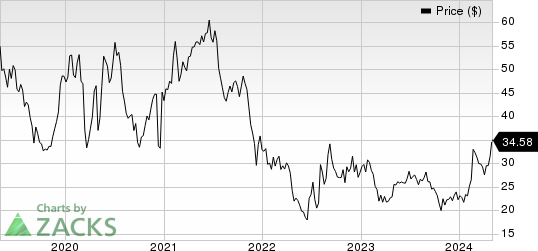

Agios Pharmaceuticals, Inc. Price

Agios Pharmaceuticals, Inc. price | Agios Pharmaceuticals, Inc. Quote

Zacks Rank & Key Picks

Agios currently carries a Zacks Rank #4 (Sell). Some better-ranked stocks in the overall healthcare sector include ANI Pharmaceuticals ANIP, Ligand Pharmaceuticals LGND and Voyager Therapeutics VYGR, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 earnings per share (EPS) have risen from $4.25 to $4.44. During the same period, EPS estimates for 2025 have improved from $4.83 to $5.04. Year to date, shares of ANIP have rallied 21.7%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters. ANI delivered a four-quarter average earnings surprise of 109.06%.

In the past 60 days, estimates for Ligand Pharmaceuticals’ 2024 EPS have risen from $4.42 to $4.56. During the same period, EPS estimates for 2025 have improved from $5.11 to $5.27. Year to date, LGND’s shares have risen 1.3%.

Earnings of Ligand Pharmaceuticals beat estimates in each of the last four quarters. Ligand delivered a four-quarter average earnings surprise of 84.81%.

In the past 60 days, estimates for Voyager Therapeutics’ 2024 loss per sharehave improved from $1.89 to $1.64. Year to date, shares of VYGR have inched up 1.1%.

Earnings of Voyager Therapeutics beat estimates in three of the last four quarters while missing the same on one occasion. VYGR delivered a four-quarter average earnings surprise of 545.93%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Agios Pharmaceuticals, Inc. (AGIO) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Voyager Therapeutics, Inc. (VYGR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance