Aehr Test Systems (AEHR) Reports Q3 Fiscal 2024 Results, Reiterates Full Year Guidance

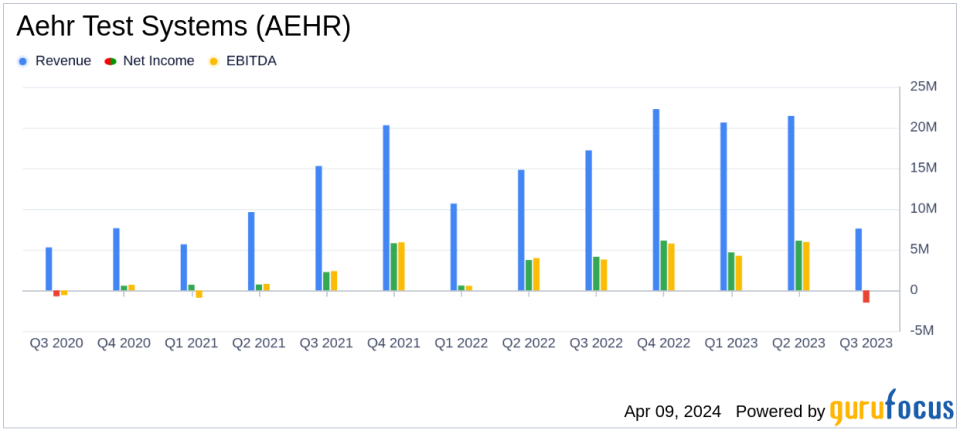

Quarterly Revenue: Reported $7.6 million, a significant decrease from $17.2 million in Q3 of fiscal 2023.

Quarterly Net Loss: GAAP net loss of $(1.5) million, a downturn from a net income of $4.1 million in the same quarter last year.

Annual Guidance Reiterated: Expects full year revenue to exceed $65 million with a GAAP net income of at least $11 million.

Bookings and Backlog: Bookings of $24.5 million for the quarter with a backlog of $20 million as of February 29, 2024.

Cash Position: Total cash and cash equivalents stood at $47.6 million, a slight decrease from $50.5 million in the previous quarter.

Aehr Test Systems (NASDAQ:AEHR), a global supplier of semiconductor test and burn-in equipment, announced its financial results for the third quarter of fiscal year 2024 on April 9, 2024. The company's 8-K filing revealed a net revenue of $7.6 million, which falls short of the quarterly estimated revenue of $15.437 million. Moreover, AEHR reported a GAAP net loss of $(1.5) million, or $(0.05) per diluted share, a stark contrast to the estimated earnings per share of $0.11. Despite this, AEHR maintains its full year financial guidance, projecting revenues greater than $65 million and a net income of approximately $11 million or more.

Company Overview

Aehr Test Systems specializes in test systems for burning-in and testing logic, optical, and memory integrated circuits. The company's products cater to the increased quality and reliability demands of the Automotive and Mobility integrated circuit markets, offering innovative solutions such as the ABTS and FOX-PTM families of test and burn-in systems, and FOX WaferPak Aligner, among others.

Financial Performance and Challenges

AEHR's third quarter performance was impacted by delays in wafer level burn-in system orders for silicon carbide semiconductor devices used in electric vehicles, leading to a considerable revenue decline compared to the same quarter last year. This setback highlights the volatility and challenges within the semiconductor industry, particularly concerning the adoption of new technologies in the automotive sector. Nevertheless, AEHR's reiteration of its full year financial guidance suggests confidence in its ability to recover from these short-term obstacles.

Significance of Financial Achievements

The company's bookings of $24.5 million and a backlog of $20 million are indicative of sustained demand for AEHR's products. The company's focus on expanding its customer base in the silicon carbide market, as well as its engagement with over a dozen silicon carbide suppliers, underscores the potential for growth in the semiconductor industry. AEHR's emphasis on wafer level test and burn-in solutions positions it to capitalize on the expected industry growth from $600 million in 2022 to over $1 trillion around 2030, driven by AI, green energy, and IoT-based digital transformation.

Key Financial Metrics

AEHR's financial strength is evident in its cash and cash equivalents of $47.6 million, despite a slight decrease from the previous quarter. The company's ability to maintain a strong cash position provides it with the flexibility to navigate market fluctuations and invest in growth opportunities. Additionally, the non-GAAP net income of $11.0 million for the first nine months of fiscal 2024, which excludes stock-based compensation, reflects a steady operational performance.

"Our discussions with customers indicate that the key markets Aehr is addressing for semiconductor wafer level test and burn-in have significant growth opportunities that will expand this year and throughout this decade," said Gayn Erickson, President and CEO of Aehr Test Systems.

AEHR's management remains optimistic about the company's long-term growth prospects, citing increased customer engagement and favorable macro trends driving the business. The introduction of the new 3.5 kW per wafer FOX-XP multi-wafer production system also demonstrates AEHR's commitment to innovation and addressing new market segments.

For investors and potential GuruFocus.com members, Aehr Test Systems' latest earnings report provides a mixed picture. While the quarterly performance has not met expectations, the company's steadfast outlook for the fiscal year and strategic positioning within the semiconductor industry offer a compelling narrative for value investors. As AEHR continues to navigate the dynamic semiconductor landscape, its ability to secure new customers and capitalize on industry growth trends will be critical to its success.

Explore the complete 8-K earnings release (here) from Aehr Test Systems for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance