Addus HomeCare Reports Q1 2024 Earnings: Revenue Surpasses Estimates, EPS Misses Expectations

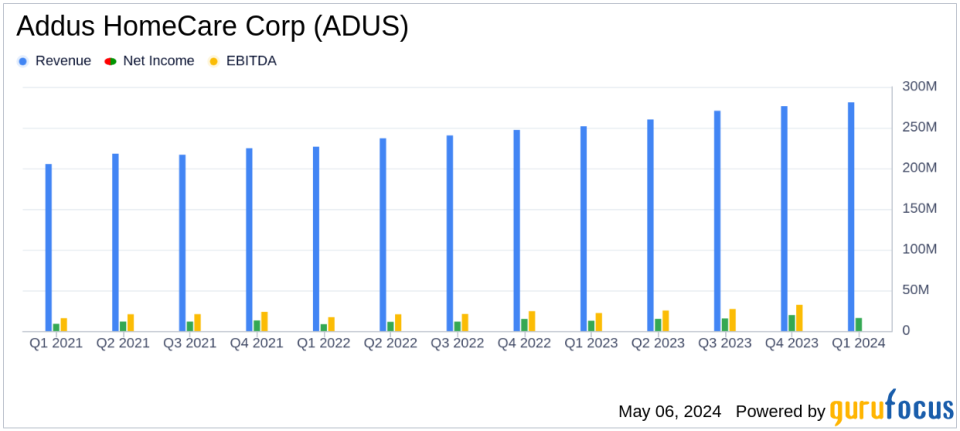

Revenue: $280.7M, up 11.6% year-over-year from $251.6M, exceeding estimates of $279.56M.

Net Income: $15.8M, up 24.6% from $12.7M last year, below estimates of $18.13M.

Earnings Per Share (EPS): Reported at $0.97, up from $0.78 year-over-year, below the estimated $1.09.

Adjusted EBITDA: Rose 24.6% to $32.4M from $26.0M in the previous year.

Cash Flow: Net cash provided by operating activities was $38.7M, significantly higher than the previous year's $18.8M.

Acquisitions: Included operations from Tennessee Quality Care acquired in August 2023, contributing to revenue growth in hospice care.

Market Expansion: Focused on identifying acquisition opportunities to enhance personal care services and leverage market presence.

On May 6, 2024, Addus HomeCare Corp (NASDAQ:ADUS) announced its financial results for the first quarter ended March 31, 2024, revealing a mixed performance against analyst expectations. The company reported a significant increase in net service revenues but fell short on earnings per share (EPS) compared to estimates. For detailed insights, refer to the company's 8-K filing.

Financial Highlights and Analyst Comparisons

Addus HomeCare, a key player in the provision of in-home personal care services, reported net service revenues of $280.7 million for Q1 2024, an 11.6% increase year-over-year and slightly above the estimated $279.56 million. However, the EPS was $0.97, missing the analyst projection of $1.09. Adjusted EPS, excluding certain expenses, was $1.21, reflecting a robust operational performance.

Operational and Segment Performance

The company's personal care segment, which constitutes 74.1% of its business, witnessed a 9.3% revenue increase on a same-store basis, driven by volume trends and rate increases in certain state markets. The hospice segment also showed strength with a 5.8% organic revenue growth, benefiting from rate increases and improved volume trends. Home health services, though smaller, contributed to the diversified service portfolio, enhancing overall company resilience against market fluctuations.

Cash Flow and Liquidity

Addus reported a strong liquidity position with $76.7 million in cash and a significant capacity under its revolving credit facility. Net cash provided by operating activities stood at $38.7 million for the quarter, up significantly from the previous year, highlighting efficient operations and strong cash generation capabilities.

Management Commentary

Dirk Allison, Chairman and CEO of Addus HomeCare, expressed satisfaction with the company's performance, citing effective execution and strong demand for home-based care services. Allison emphasized the strategic acquisitions and operational enhancements that have fortified Addus's market position and are expected to drive future growth.

Strategic Outlook and Forward-Looking Statements

Looking ahead, Addus is focused on leveraging its strong market presence and financial flexibility to explore accretive acquisition opportunities. The company aims to enhance its service offerings and expand its market reach, particularly in value-based contracting models, which are anticipated to support sustained long-term growth.

Conclusion

Despite missing EPS estimates, Addus HomeCare's first quarter results demonstrate a solid financial and operational foundation, driven by strategic initiatives and a strong demand for home-based care. The company's focus on expanding its service capabilities and market presence positions it well for future success. Investors and stakeholders may look forward to continued growth and operational enhancements that align with the company's long-term strategic goals.

Additional Information

Investors and interested parties may access more detailed financial data and future updates by attending Addus HomeCare's earnings call scheduled for May 7, 2024, or by visiting the Investor Relations section of the company's website at www.addus.com.

Explore the complete 8-K earnings release (here) from Addus HomeCare Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance