Should You Be Adding REA Group (ASX:REA) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like REA Group (ASX:REA). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for REA Group

How Fast Is REA Group Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Recognition must be given to the that REA Group has grown EPS by 44% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

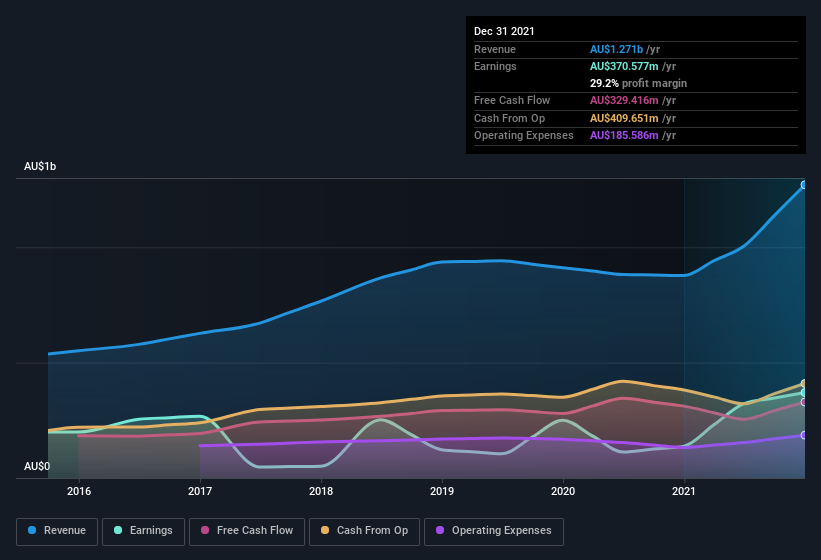

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. On the revenue front, REA Group has done well over the past year, growing revenue by 45% to AU$1.3b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of REA Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are REA Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Insiders both bought and sold REA Group shares in the last year, but the good news is they spent AU$55k more buying than they netted selling. At face value we can consider this a fairly encouraging sign for the company. We also note that it was the CEO & Executive Director, Owen Wilson, who made the biggest single acquisition, paying AU$657k for shares at about AU$68.30 each.

Along with the insider buying, another encouraging sign for REA Group is that insiders, as a group, have a considerable shareholding. To be specific, they have AU$59m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.4% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Owen Wilson, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to REA Group, with market caps over AU$12b, is around AU$5.9m.

The REA Group CEO received AU$4.3m in compensation for the year ending June 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add REA Group To Your Watchlist?

REA Group's earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest REA Group belongs near the top of your watchlist. You still need to take note of risks, for example - REA Group has 1 warning sign we think you should be aware of.

Keen growth investors love to see insider buying. Thankfully, REA Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance