Should You Be Adding Korvest (ASX:KOV) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Korvest (ASX:KOV). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Korvest

How Fast Is Korvest Growing Its Earnings Per Share?

In the last three years Korvest's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Korvest's EPS shot from AU$0.42 to AU$0.89, over the last year. You don't see 113% year-on-year growth like that, very often. That could be a sign that the business has reached a true inflection point.

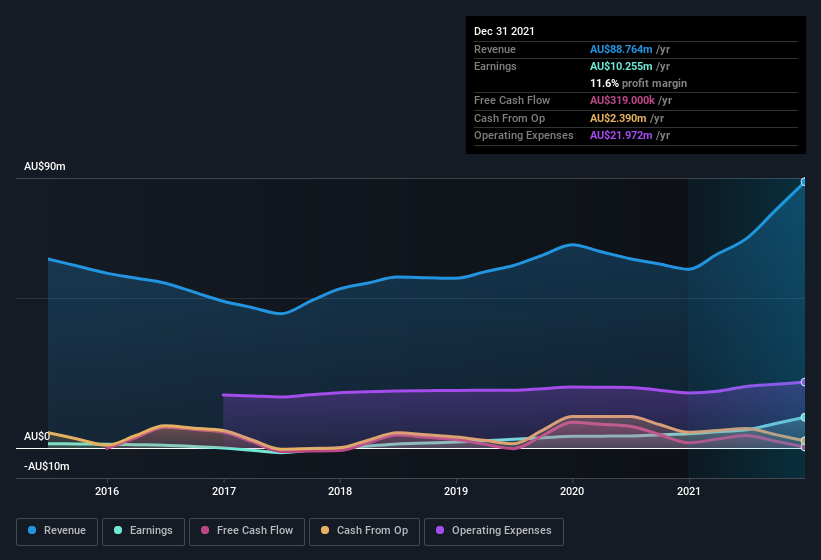

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Korvest is growing revenues, and EBIT margins improved by 8.8 percentage points to 16%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Korvest is no giant, with a market capitalization of AU$85m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Korvest Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One positive for Korvest, is that company insiders paid AU$52k for shares in the last year. While this isn't much, we also note an absence of sales. It is also worth noting that it was Independent Non-Executive Chairman Andrew Stobart who made the biggest single purchase, worth AU$32k, paying AU$6.44 per share.

Should You Add Korvest To Your Watchlist?

Korvest's earnings have taken off like any random crypto-currency did, back in 2017. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If that's the case, you may regret neglecting to put Korvest on your watchlist. It is worth noting though that we have found 3 warning signs for Korvest (1 is potentially serious!) that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Korvest, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance