Should You Be Adding Card Factory (LON:CARD) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Card Factory (LON:CARD). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Card Factory

Card Factory's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, Card Factory has achieved impressive annual EPS growth of 53%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Card Factory shareholders can take confidence from the fact that EBIT margins are up from 11% to 15%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

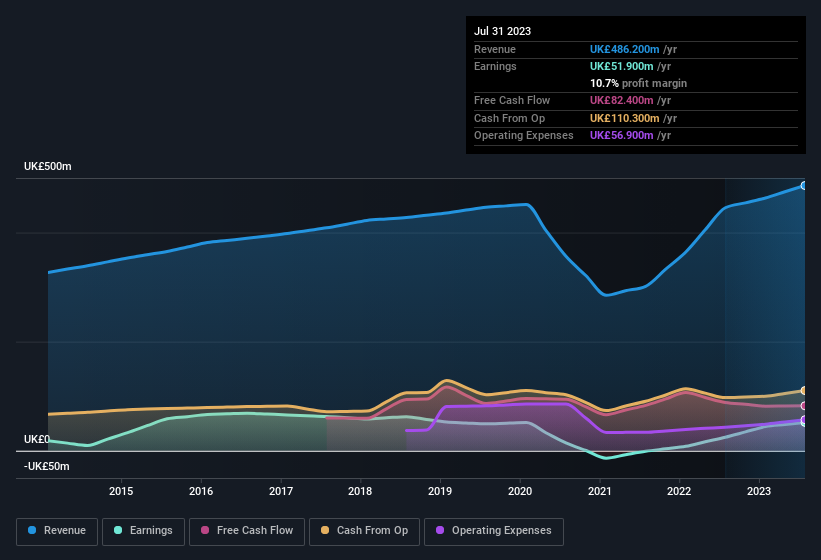

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Card Factory's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Card Factory Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the bigger deal is that the CEO & Executive Director, Darcy Willson-Rymer, paid UK£79k to buy shares at an average price of UK£0.91. Strong buying like that could be a sign of opportunity.

Should You Add Card Factory To Your Watchlist?

Card Factory's earnings have taken off in quite an impressive fashion. Most growth-seeking investors will find it hard to ignore that sort of explosive EPS growth. And indeed, it could be a sign that the business is at an inflection point. If this is the case, then keeping a watch over Card Factory could be in your best interest. You still need to take note of risks, for example - Card Factory has 1 warning sign we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Card Factory, you'll probably love this curated collection of companies in GB that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance