AbbVie Inc (ABBV) Q1 2024 Earnings: Adjusted EPS Tops Estimates Despite Revenue Challenges

Adjusted Diluted EPS: $2.31, down 6.1% year-over-year, exceeding estimates of $2.23.

GAAP Diluted EPS: $0.77, a significant increase of 492.3% from the previous year.

Net Revenues: $12.310 billion, up 0.7% on a reported basis and 1.6% on an operational basis, surpassing estimates of $11.922 billion.

Immunology Portfolio Revenues: $5.371 billion, a decrease of 3.9% on a reported basis, primarily due to Humira biosimilar competition.

Oncology Portfolio Revenues: $1.543 billion, an increase of 9.0% on a reported basis, driven by strong performance of Venclexta.

Neuroscience Portfolio Revenues: $1.965 billion, up 15.9% on a reported basis, led by significant growth in Vraylar and Qulipta sales.

2024 Full-Year Guidance: Adjusted diluted EPS forecast raised from $10.97 - $11.17 to $11.13 - $11.33, reflecting strong first-quarter performance and ongoing operational execution.

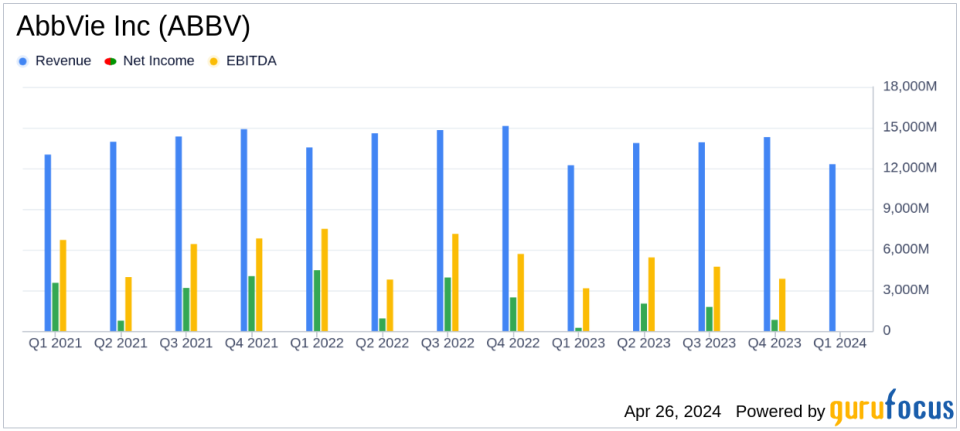

On April 26, 2024, AbbVie Inc (NYSE:ABBV) released its 8-K filing, detailing the financial outcomes for the first quarter ended March 31, 2024. The pharmaceutical giant reported a diluted EPS of $0.77 on a GAAP basis, marking a significant increase of 492.3% year-over-year. The adjusted diluted EPS was $2.31, surpassing the analyst estimate of $2.23, despite a decrease of 6.1% from the previous year. This quarter's results included an unfavorable impact of $0.08 per share related to acquired IPR&D and milestones expense.

AbbVie, known for its robust portfolio in immunology, oncology, neuroscience, and aesthetics, faced mixed financial dynamics this quarter. The company's net revenues reached $12.310 billion, a slight increase of 0.7% on a reported basis and 1.6% on an operational basis, aligning closely with the estimated revenue of $11,922.59 million. This growth was primarily driven by strong performances in the neuroscience and oncology segments, despite significant challenges in the immunology sector due to biosimilar competition impacting Humira sales.

Segment Performance and Strategic Developments

The immunology portfolio, usually a stronghold for AbbVie, saw a decline, with net revenues from this segment decreasing by 3.9% on a reported basis to $5.371 billion. This was primarily due to a steep decline in global Humira net revenues, which plummeted by 35.9% on a reported basis to $2.270 billion. Conversely, the oncology portfolio exhibited growth, with revenues increasing by 9.0% on a reported basis to $1.543 billion, bolstered by a 14.2% increase in global Venclexta net revenues.

Neuroscience and aesthetics also showed contrasting trends. Neuroscience revenues surged by 15.9% to $1.965 billion, driven by strong sales of Botox Therapeutic and Vraylar. However, the aesthetics portfolio experienced a downturn, with a 4.0% decrease in revenues to $1.249 billion, influenced by lower sales of Botox Cosmetic and Juvederm.

Operational Excellence and Financial Health

AbbVie's operational execution remains robust, with an adjusted gross margin ratio of 82.9% reflecting high profitability in core areas. The company's R&D investments continue to be substantial, aligning with its strategic focus on expanding and enhancing its product pipeline. The adjusted operating margin stood at an impressive 42.2%, although the GAAP operating margin was lower at 22.7% due to specific adjustments.

The company also successfully completed the acquisition of ImmunoGen, which adds the flagship cancer therapy, Elahere, to its oncology portfolio. This move is expected to bolster AbbVie's position in the oncology market, providing new avenues for growth and innovation.

Looking Ahead: Raised Guidance and Strategic Outlook

Encouraged by the quarter's performance, AbbVie has raised its full-year adjusted diluted EPS guidance from $10.97 - $11.17 to $11.13 - $11.33. This adjustment accounts for the ongoing impact of acquired IPR&D and milestones expense, reflecting management's confidence in the company's operational strength and market strategy.

In conclusion, AbbVie's first quarter of 2024 demonstrates a complex yet promising landscape. While challenges in the immunology sector are significant, the growth in other areas and strategic acquisitions provide a balanced outlook. Investors and stakeholders will likely watch closely how AbbVie navigates market dynamics, particularly with the upcoming leadership transition as Robert A. Michael takes over as CEO in July 2024.

For more detailed insights and ongoing updates, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from AbbVie Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance