More than 63,000 people have signed a Change.org petition to ‘save the mortgage broking industry’

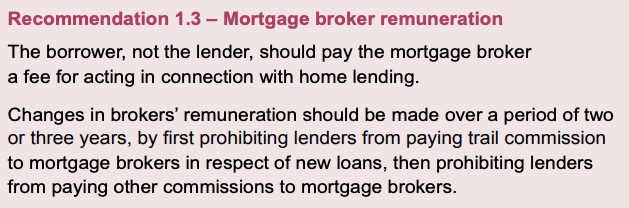

Of the 76 recommendations made in the banking Royal Commission’s final report, it’s recommendation 1.3 that has shaken the status quo of the mortgage broking industry.

“Why should a broker, whose work is complete when the loan is arranged, continue to benefit from the loan for years to come?” Royal Commissioner Kenneth Hayne wrote in the report.

But the recommendation to eventually ban the payment of commissions to mortgage brokers by the lender has been met with vehement protest and opposition from mortgage brokers the country over, who have cried out at the damage it will do to their business, their income, to competition in the industry and to their customer base.

The backlash has now been channelled through an online petition on Change.org, which has now amassed more than 63,000 signatories and calls on the government to ignore Hayne’s recommendation in order to “save the mortgage broking industry”.

“We completely reject the assertion by Commissioner Hayne and Matt Comyn, CBA CEO, that trailing commission is ‘money for nothing’,” the petition said.

“We support keeping mortgage broking free to consumers, and we support the ‘paid-the-same’ commission model employed by most brokerages that has ensured impartial decision making for almost 30 years.”

The petition, which was created by mortgage broking firm Hypothèque founder Rob McFadden, argued that the current remuneration model actually served customers better, not worse.

“Mortgage brokers are available 24/7 to answer clients questions, undertake loan variations, provide support and education, review their loans and make sure they aren’t getting ripped off by the banks by negotiating better rates on their behalf, as well as many other services.

“This is what they receive trailing commission for, and we stress actually provides for better customer outcomes,” the petition said.

Without mortgage brokers, banks will use ‘rate creep’ to “gouge” more interest from clients and offer better deals to new clients while existing clients essentially pay more.

The abolishment of the current remuneration structure will see “billions of dollars” go back to the big banks, and home buyers who are “already making the most expensive purchase of their life” will be left to absorb the costs, according to the petition.

Misconduct has been found in the upper echelons of the major banks, “yet mortgage brokers and their customers are the key group likely to suffer significant penalties in the wake of the report”.

“Mortgage brokers are mostly small business owners who potentially could lose their businesses and their staff could lose their jobs,” the petition said.

“The Big 4 banks, meanwhile, have had some of their best days on the share market since the report was made publicly available.”

‘We need brokers’

People who signed the Change.org petition left public comments on the petition in defence of mortgage brokers and criticised the recommendation.

Another signatory to the petition, Janzey Pratt, expressed indignance at the fact that mortgage brokers and their customers, rather than banks, were on the receiving end of the major inquiry’s attention.

Others spoke about the benefits of having an intermediary in dealing with the big banks.

Treasurer Josh Frydenberg has confirmed that trail commission will be abolished, first for new loans, from 1 July 2020. Here’s what the recommendation means for borrowers.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: Mortgage brokers dealt massive blow: What it means for borrowers

Now read: Royal Commission into banks hands down major findings

Now read: Royal Commission recommends criminal referral

Now read: Banking Royal Commission: What do the findings mean for you?

Yahoo Finance

Yahoo Finance