The 5.9% return this week takes Paladin Energy's (ASX:PDN) shareholders three-year gains to 885%

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. Not every pick can be a winner, but when you pick the right stock, you can win big. Take, for example, the Paladin Energy Ltd (ASX:PDN) share price, which skyrocketed 864% over three years. Also pleasing for shareholders was the 27% gain in the last three months. It really delights us to see such great share price performance for investors.

Since the stock has added US$135m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Paladin Energy

Paladin Energy recorded just US$4,700,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, they may be hoping that Paladin Energy finds fossil fuels with an exploration program, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Paladin Energy has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

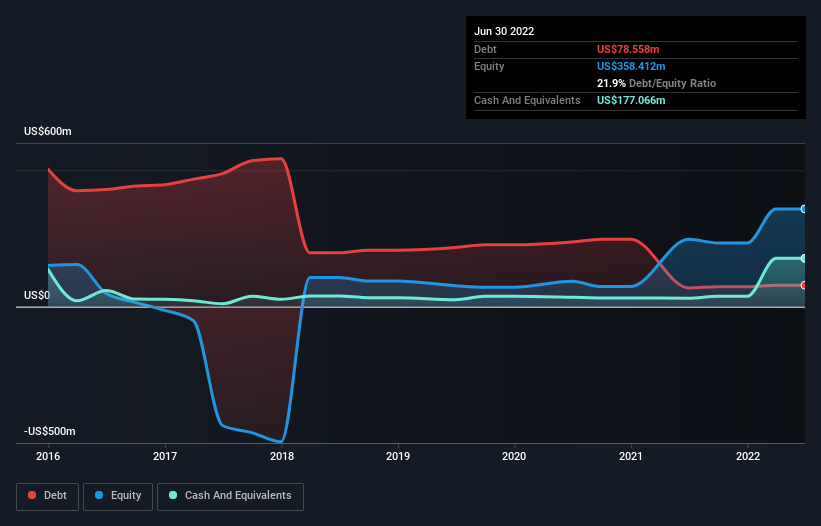

Paladin Energy has plenty of cash in the bank, with cash in excess of all liabilities sitting at US$54m, when it last reported (June 2022). That allows management to focus on growing the business, and not worry too much about raising capital. And with the share price up 30% per year, over 3 years , the market is focussed on that blue sky potential. You can see in the image below, how Paladin Energy's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. One thing you can do is check if company insiders are buying shares. If they are buying a significant amount of shares, that's certainly a good thing. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

What About The Total Shareholder Return (TSR)?

We've already covered Paladin Energy's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Paladin Energy hasn't been paying dividends, but its TSR of 885% exceeds its share price return of 864%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Paladin Energy shareholders are down 15% for the year, falling short of the market return. The market shed around 4.6%, no doubt weighing on the stock price. Fortunately the longer term story is brighter, with total returns averaging about 114% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. It's always interesting to track share price performance over the longer term. But to understand Paladin Energy better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Paladin Energy you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance