4 Trucking Stocks to Keep Tabs on Amid Industry Challenges

Prolonged truck driver shortages hurt the Zacks Transportation - Truck industry’s growth. Further, escalating operating expenses, led by high fuel costs, are denting the prospects of the truck transport providers.

However, despite this gloom, the industry participants have been gaining from factors like impressive freight demand (since economic activities have been gaining pace following the easing of COVID-led restrictions) and solid investor-friendly steps. Stocks like Old Dominion Freight Line ODFL, J.B. Hunt Transport Services, Inc. JBHT, Knight-Swift Transportation Holdings Inc. KNX and Landstar System, Inc. LSTR are well-positioned to capitalize on the healthy demand environment.

About the Industry

The Zacks Transportation - Truck industry consists of truck operators transporting freight to a diverse group of customers, mainly across North America. These companies provide full-truckload or less-than-truckload (LTL) services over the short, medium or long haul. The wide range of trucking services provided by these companies includes dry-van, dedicated, refrigerated, flatbed and expedited. Some of these companies have an extensive fleet of company-owned tractors and trucks, as well as independent contractor trucks. Beside trucking, most entities offer logistics and intermodal services, as well as value-added services like container drayage, truckload brokerage, supply-chain consulting and warehousing. A few players also offer asset-light services to third-party logistics companies in the transportation sector.

4 Trends Shaping the Future of the Trucking Industry

Impressive Freight Demand: Rosy freight market conditions despite high inflation bode well for the trucking industry. Increased freight demand is steadily driving trucking volumes, which, in turn, has been bolstering the trucking companies’ top lines for a while. The American Trucking Associations’ (ATA) advanced seasonally adjusted For-Hire Truck Tonnage Index gained 0.7% in January 2023 after increasing 1% in December. Truck tonnage volumes are anticipated to continue improving in the near term, as freight demand has been strong.

Prolonged Truck-Driver Shortage: Persistent driver crisis in the trucking industry is worsening the supply-chain challenges across the United States. Driver scarcity issues are limiting trucking capacity, making it difficult for trucking companies to meet increased freight demand. After estimating a crunch of 80,000 drivers in 2021, ATA’s chief economist Bob Costello expects the trucking industry to be short of more than 160,000 drivers by 2030.

High Fuel Costs & Supply-Chain Woes: Operating expenses are on the rise mainly due to increased fuel costs and hurting the bottom lines of the industry participants. Fuel expenses represent a key input cost for any transportation player. The recent production cut by the OPEC+ oil cartel, which includes OPEC members plus Russia, has led to a surge in oil prices. This may aggravate inflationary pressures and result in heightened economic uncertainty and market volatility. Supply-chain woes are also hurting the prospects of the stocks belonging to the trucking industry.

Dividend Hikes Signal Financial Strength: With the resumption of economic activities, many players, including some trucking companies, are reactivating their shareholder-friendly measures, like paying out dividends, which underline their solid financial footing and confidence in their businesses. In January 2023, JBHT upped its dividend by 5% to 42 cents per share. In February 2023, ODFL upped its dividend by 33% to 40 cents per share.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Trucking Industry, housed within the broader Zacks Transportation sector, currently carries a Zacks Industry Rank of 207. This rank places it in the Bottom 17% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, the average of the Zacks Rank of all member stocks, indicates dismal near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s earnings growth potential. The Zacks Consensus Estimate for 2023 earnings has declined 12.8% year over year for the industry.

Before we present a few stocks from the industry that you may want to consider, let’s look at the industry’s recent stock market performance and the valuation picture.

Industry's Price Performance

Over the past year, the Zacks Transportation - Truck industry has gained 13.7% against the S&P 500 composite’s fall of 7.6%. The broader sector has declined 7.4% over the same time frame.

One-Year Price Performance

Industry's Current Valuation

Based on the trailing 12-month EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation and amortization), a commonly used multiple for valuing trucking stocks, the industry is currently trading at 9.38X compared with the S&P 500’s 12.68X. It is also below the sector’s EV/EBITDA of 10.81X.

Over the past five years, the industry has traded as high as 18.06X and as low as 6.78X, the median being 10.13X, as the chart below shows.

Enterprise Value-to-EBITDA Ratio (TTM)

4 Trucking Stocks to Consider

Old Dominion: This is a leading LTL entity based in Thomasville, NC. With improved freight demand, the strong performance of the LTL segment is driving the company’s growth. In 2022, LTL shipments and LTL revenue per shipment increased 0.8% and 18.3%, year-over-year respectively. To cater to the buoyant demand scenario, in March, the company announced plans to open 8-10 service centers in 2022. The capacity enhancements include additional doors and staff, and technology upgrades (real-time track and traceability) to support growth and increased customer demand.

The Zacks Consensus Estimate for Old Dominion’s 2023 earnings has been revised 4% upward in the past 90 days. ODFL currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: ODFL

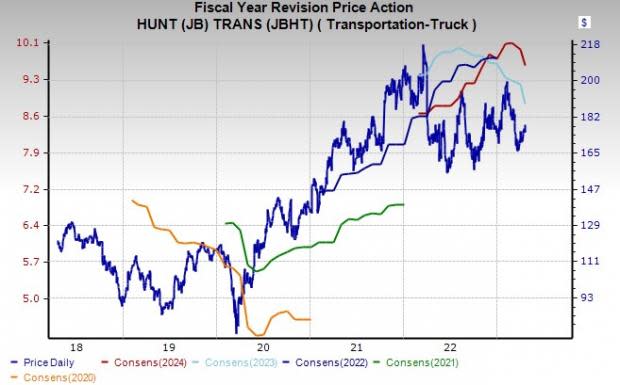

J.B. Hunt: The company provides a broad range of transportation services to a diverse group of customers in the United States, Canada and Mexico. JBHT is benefiting from the strong performances of the Dedicated Contract Services, Truckload and Final Mile Services units.

The Zacks Consensus Estimate for J.B. Hunt’s 2024 revenues is pegged at $15.5 billion, indicating a rise of 6.8% from the 2023 estimated level. JBHT currently carries a Zacks Rank of 3.

Price and Consensus: JBHT

Knight-Swift: Based in Phoenix, AZ, the company is the largest truckload carrier in North America. Increased revenues in the logistics segment are driving Knight-Swift’s top-line growth. Logistics revenues increased 12.7% in 2022.

The Zacks Consensus Estimate for the company’s 2024 earnings is pegged at $4.69 per share, indicating growth of 19.7% from the 2023 estimated level. KNX is currently a Zacks #3 Ranked stock.

Price and Consensus: KNX

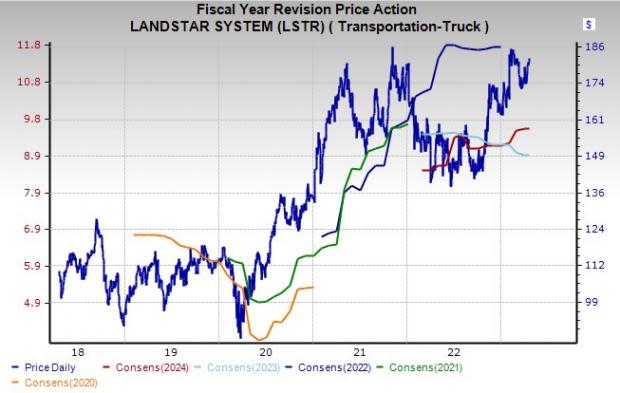

Landstar: Based in Jacksonville, FL, the company is an asset-light provider of integrated transportation management solutions. With the gradual recovery in the economy, freight market conditions improved. Strong demand in the van truckload business is driving Landstar’s segmental revenues. Revenues in the ocean and air-cargo carrier segment skyrocketed 70.9% year over year to $558.98 million in 2022. Other revenues increased 16.6% to $101.72 million.

The Zacks Consensus Estimate for Landstar’s 2024 earnings is pegged at $9.59 per share, which has risen 4.1% in the past 90 days. LSTR is currently a Zacks #3 Ranked stock.

Price and Consensus: LSTR

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Old Dominion Freight Line, Inc. (ODFL) : Free Stock Analysis Report

Knight-Swift Transportation Holdings Inc. (KNX) : Free Stock Analysis Report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance