4 Stocks to Watch on Dividend Hikes Amid Economic Turmoil

Investor sentiment in the United States is indeed clouded by various negative economic indicators. A series of banking failures, concerns raised by U.S. treasury secretary Janet Yellen over a possible default in meeting the government’s obligation as early as by Jun 1 if the debt ceiling is not raised and higher-than-expected inflation according to the Federal Reserve are the key reasons. The Dow, the S&P 500 and the Nasdaq have gained 1.16%, 7.77% and 17.58%, respectively, so far this year.

Wall Street was shocked by the sudden failure of Silicon Valley Bank, Signature Bank and the takeover of Credit Suisse by a European rival UBS and First Republic Bank by JPMorgan Chase. The collapse of First Republic Bank is the second-biggest baking failure in the history of U.S. banking. This raised questions within the investor community about whether the Federal Reserve has overstepped its aggressive rate hike stances to fight inflation.

U.S. treasury secretary, in her letter to the Congress, raised a concern that the world’s biggest economy could run out of cash and may not be able to meet its obligations, unless the debt ceiling is raised. This means the government will fail to pay its dues, cut back spending and, most importantly, face severe financial market volatility.

Major economic readings like retail sales and manufacturing PMI have shown stress in recent months. The only exception is the labor market, which has remained resilient and added over 1 million jobs in the past three months. The Fed apprehends higher interest rates to slow down business activity and cut down demand for labor.

The Fed increased the overnight interest rates yet again by a quarter of a percentage point on May 3 to meet its ambitious inflation target of 2% over the long term. Domestic inflation for the month of March came in at 5% year over year and is currently in a downward trajectory. The question remains whether the Fed will be able to strike the right balance between a higher interest rate and inflation to make a soft landing for the economy.

Inflation remains a worry for most of the countries around the world mostly due to geopolitical tensions which continues to create energy crisis and supply-chain challenges. Thus, investors looking for regular income and capital preservation can invest in mature businesses, which pay out regular dividends. Amid adverse economic conditions, these stocks remain profitable due to their proven business models.

Companies that tend to reward investors with a high dividend payout outperform non-dividend-paying stocks during market volatility. Investors can expect a regular flow of income in volatile market conditions.

On that note, let us look at companies like CNO Financial Group CNO, The Timken Company TKR, Murphy USA MUSA and Pool Corp. POOL which have lately hiked their dividend payouts.

CNO Financial Group is a group of insurance companies operating throughout the United States. This Zacks Rank #3 (Hold) company develops, administers and markets supplemental health insurance, annuity, individual life insurance and other insurance products. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

On May 5, CNO declared that its shareholders would receive a dividend of 15 cents a share on Jun 23, 2023. CNO has a dividend yield of 2.62%.

Over the past five years, CNO has increased its dividend six times, and its payout ratio presently sits at 23% of earnings. CNO Financial Group’s dividend history here.

CNO Financial Group, Inc. Dividend Yield (TTM)

CNO Financial Group, Inc. dividend-yield-ttm | CNO Financial Group, Inc. Quote

The Timken Company is based in North Canton, OH. This Zacks Rank #2 (Buy) company is a global manufacturer of bearings, friction management products, and mechanical power transmission components.

On May 5, TKR announced that its shareholders would receive a dividend of 33 cents a share on May 30, 2023. TKR has a dividend yield of 1.65%.

Over the past five years, TKR has increased its dividend five times. Its payout ratio now sits at 19% of earnings. Check The Timken Company’s dividend history here.

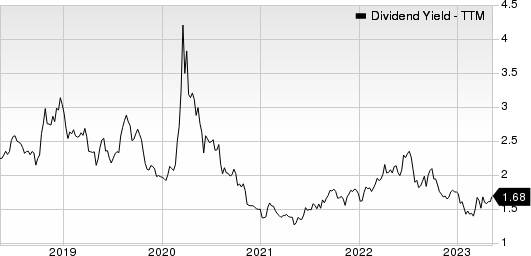

Timken Company (The) Dividend Yield (TTM)

Timken Company (The) dividend-yield-ttm | Timken Company (The) Quote

Murphy USA is based in El Dorado, AR. This Zacks Rank #2 company is a leading independent retailer of motor fuel and convenience merchandise in the United States.

On May 4, MUSA declared that its shareholders would receive a dividend of 38 cents a share on Jun 1, 2023. MUSA has a dividend yield of 0.52%.

In the past five-year period, MUSA has increased its dividend six times. Its payout ratio at present sits at 6% of earnings. Check Murphy USA’s dividend history.

Murphy USA Inc. Dividend Yield (TTM)

Murphy USA Inc. dividend-yield-ttm | Murphy USA Inc. Quote

Pool Corp. is a distributor of swimming pool supplies, equipment, and related leisure products. This Zacks Rank #3 company is also a leading regional wholesale distributor of irrigation and landscape products.

On May 4, POOL declared that its shareholders would receive a dividend of $1.10 a share on May 31, 2023. POOL has a dividend yield of 1.14%.

In the past five years, Zacks Rank #3 POOL has increased its dividend six times. Its payout ratio at present sits at 24% of earnings. Check Pool Corp’s dividend history.

Pool Corporation Dividend Yield (TTM)

Pool Corporation dividend-yield-ttm | Pool Corporation Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNO Financial Group, Inc. (CNO) : Free Stock Analysis Report

Pool Corporation (POOL) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Timken Company (The) (TKR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance