4 reasons why Australian investors love Sharesight

With a growing number of Australian investors looking for opportunities in the stock market in 2020, many are looking at the performance numbers their broker provides and are left wondering how best to track the performance of their investments.

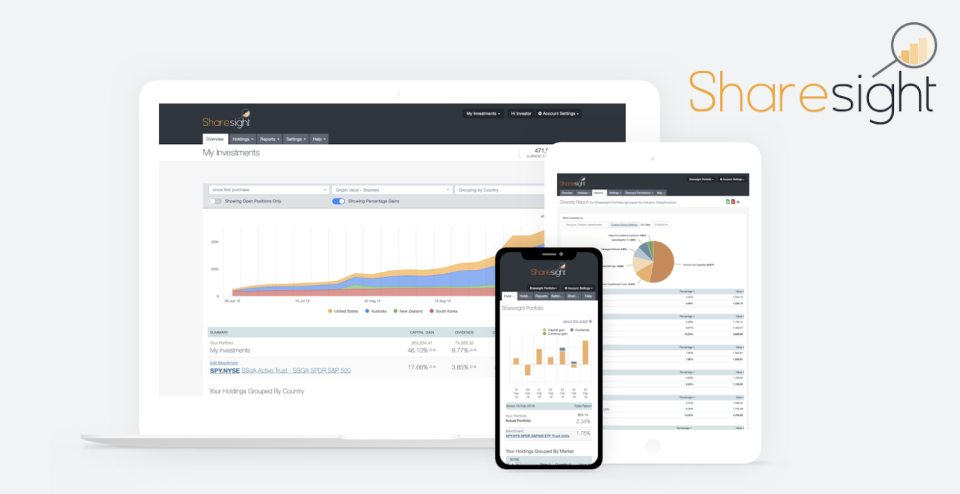

Fortunately there’s Sharesight, the all-in-one portfolio tracking tool built for the needs of Australian investors looking to track the performance of all of the stocks, ETFs, managed funds and everything else they invest in all in a single place.

Here’s 4 top reasons why Australian investors love Sharesight.

Track the performance of ALL your investments

If like most investors, you hold some shares on the ASX, perhaps some overseas tech stocks, an investment property and maybe even a small amount of bitcoin, tracking the performance of all of those investments in a single place is not easy.

Sharesight was built with the needs of multi-asset investors like you in mind, with support for investments in over 30 stock exchanges worldwide, in addition to managed funds, fixed interest, foreign exchange holdings and even private equity and property. Sharesight is the perfect solution to view the performance of ALL your investments.

Easily track dividend income

If you’re a dividend investor, keeping track of the dividend income you earn across all the investments in your portfolio is essential to understand both your cash flow, and to shape your investment decisions.

With Sharesight, dividends, including the value of franking credits are automatically tracked for each investment in your portfolio as soon as they are announced to the market. Plus with Sharesight’s Future Income Report you can quickly see all of the dividends (or distributions) that have been announced but not yet paid for all the stocks in your portfolio.

Support for over 150 Australian brokers

With support for more than 200 brokers worldwide, including over 150 in Australia, Sharesight makes it easy to import all your investment information to start tracking the performance of your portfolio within minutes.

Tax reports built for Australian investors

Not only is Sharesight the ideal way to view your investment performance, but Sharesight’s valuable tax reports (built according to ATO rules) save Australian investors time and money at tax time. Whether you file your taxes yourself, or via an accountant, Sharesight’s Australian-specific tax reports help thousands of investors save time and money every year when calculating their taxable income and capital gains tax liabilities.

Simply the best portfolio tracker for Australian investors

With thousands of Australian investors already using Sharesight to track their investment portfolios, what are you waiting for?

To get started for FREE, simply sign-up for a Sharesight account, import your holdings and watch as corporate actions such as dividends and stock splits are automatically tracked for the investments in your portfolio. Once your investments are added you’ll gain unparalleled insights into your portfolio performance and tax from ALL of your investments.

Yahoo Finance

Yahoo Finance