4 Consulting Services Stocks Worth Adding to Your Portfolio

The Consulting Services industry has outpaced the S&P 500 Index so far this year.

The industry, which is placed in the top 14% of more than the 250 Zacks industries, has rallied 25.5% in the said time frame, comfortably surpassing the index’s rise of 15.2%.

Economic strength has kept manufacturing and non-manufacturing activities in good shape, thus keeping the demand environment for consulting services strong. The Purchasing Managers' Index (PMI) measured by Institute of Supply Management (ISM) touched 52.1% in May, indicating better economic activity in the manufacturing sector. This marks the 33rd month of consecutive manufacturing growth. Also, May was the 112th month of consecutive growth in non-manufacturing activities with ISM-measured Non-Manufacturing Index (NMI) touching 56.9%.

Global players are increasingly expanding in areas beyond the United States and Europe to other industrialized regions and growing economies. They have increased moves to take advantage of trends such as AI, analytics, cybersecurity and digital trends.

Acquisitions and technology investments are rampant. For instance, Accenture ACN acquired Karmarama to fasten implementation of end-to-end customer experiences through customer-focused data analytics and user experience design. Capgemini has combined its consulting brand with digital and creative businesses. IBM, Deloitte, BCG and PricewaterhouseCoopers have also incorporated digital design.

4 Consulting Firms to Invest In

The industry comprises companies that offer economic, financial, business, information technology and management consulting,

With the help of the Zacks Stock Screener, we have zeroed in on four promising stocks from the consulting services industry, which have a favorable Zacks Rank #1 (Strong Buy) or 2 (Buy). These stocks also have a solid expected earnings growth rate for 2019 and have witnessed upward earnings estimate revisions in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

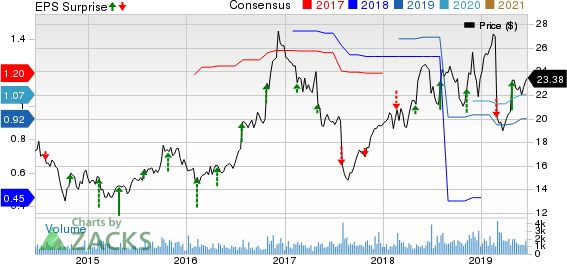

Navigant Consulting, Inc. NCI is a provider of professional services to corporate executives and senior management, corporate counsel, law firms, corporate boards, special committees and governmental agencies. It also sports a Zacks Rank #1 and has a market capitalization of $917.2 million. The company’s expected earnings growth rate for 2019 is more than 95.7%. The Zacks Consensus Estimate for 2019 has improved 3.4% in the past 60 days.

Navigant Consulting, Inc. Price, Consensus and EPS Surprise

Navigant Consulting, Inc. price-consensus-eps-surprise-chart | Navigant Consulting, Inc. Quote

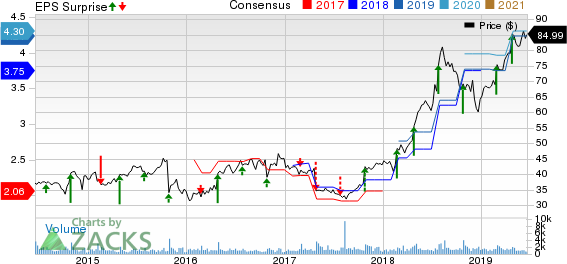

FTI Consulting, Inc. FCN is a provider of business advisory services. It also sports a Zacks Rank #1 and has a market capitalization of $3.2 billion. The company’s expected earnings growth rate for 2019 is 6%. The Zacks Consensus Estimate for 2019 has improved 13.1% in the past 60 days.

FTI Consulting, Inc. Price, Consensus and EPS Surprise

FTI Consulting, Inc. price-consensus-eps-surprise-chart | FTI Consulting, Inc. Quote

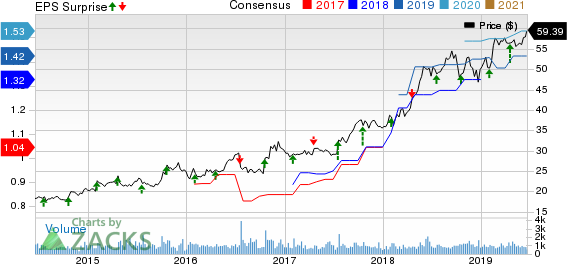

Exponent, Inc. EXPO operates as a science and engineering consulting company globally. Currently, it sports a Zacks Rank #2 and has a market capitalization of $3 billion. The company’s expected earnings growth rate for 2019 is 13.6%. The Zacks Consensus Estimate for 2019 has improved 2.2% in the past 60 days.

Exponent, Inc. Price, Consensus and EPS Surprise

Exponent, Inc. price-consensus-eps-surprise-chart | Exponent, Inc. Quote

Huron Consulting Group Inc. HURN is a professional services company, which provides advisory, technology and analytic solutions. It carries a Zacks Rank #2 and has a market capitalization of $1.2 billion. The company’s expected earnings growth rate for 2019 is 14.4%. The Zacks Consensus Estimate for 2019 has improved 0.4% in the past 60 days.

Huron Consulting Group Inc. Price, Consensus and EPS Surprise

Huron Consulting Group Inc. price-consensus-eps-surprise-chart | Huron Consulting Group Inc. Quote

Will you retire a millionaire?

One out of every six people retires a multimillionaire. Get smart tips you can do today to become one of them in a new Special Report, “7 Things You Can Do Now to Retire a Multimillionaire.”

Click to get it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Navigant Consulting, Inc. (NCI) : Free Stock Analysis Report

Exponent, Inc. (EXPO) : Free Stock Analysis Report

Huron Consulting Group Inc. (HURN) : Free Stock Analysis Report

Accenture PLC (ACN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance