3 Top Indian Dividend Stocks Offering Up To 7.9% Yield

The Indian market has experienced significant volatility recently, with a sharp 41% drop in the last 7 days, although it remains up by 41% over the past year. In this fluctuating environment, dividend stocks can be particularly appealing for their potential to provide investors with steady income streams and forecasted earnings growth of 16% annually.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Balmer Lawrie Investments (BSE:532485) | 3.85% | ★★★★★★ |

Bhansali Engineering Polymers (BSE:500052) | 4.19% | ★★★★★★ |

Castrol India (BSE:500870) | 3.90% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.93% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.20% | ★★★★★☆ |

D-Link (India) (NSEI:DLINKINDIA) | 3.12% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 7.99% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.72% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.53% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.56% | ★★★★★☆ |

Click here to see the full list of 23 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

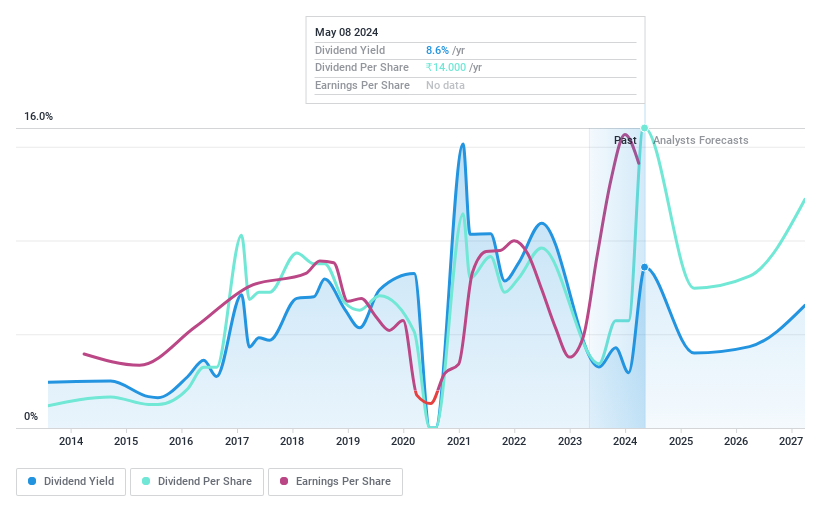

Indian Oil

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Indian Oil Corporation Limited operates in refining, pipeline transportation, and marketing of petroleum products across India, with a market capitalization of approximately ₹2.41 trillion.

Operations: Indian Oil Corporation Limited generates ₹83.35 billion from petroleum products and ₹2.62 billion from petrochemicals.

Dividend Yield: 8%

Indian Oil Corporation Limited (IOC) has recently committed to significant investments and strategic initiatives that could influence its dividend profile. The board approved a USD 78.31 million investment in a subsidiary for acquiring shares in Sun Mobility Pte. Ltd., alongside setting the record date for the 2023-24 final dividend, reflecting ongoing financial commitments. Additionally, IOC's collaboration with SJVN Limited to form a joint venture focusing on renewable projects highlights its strategic shift towards sustainable energy solutions. Despite these positive developments, it is crucial to note that IOC's dividends have shown volatility over the past decade, and earnings are projected to decline by an average of 29.6% annually over the next three years, potentially impacting future dividend sustainability despite current coverage by earnings and cash flows with payout ratios of 39.6% and 56.8%, respectively.

Take a closer look at Indian Oil's potential here in our dividend report.

Our valuation report here indicates Indian Oil may be undervalued.

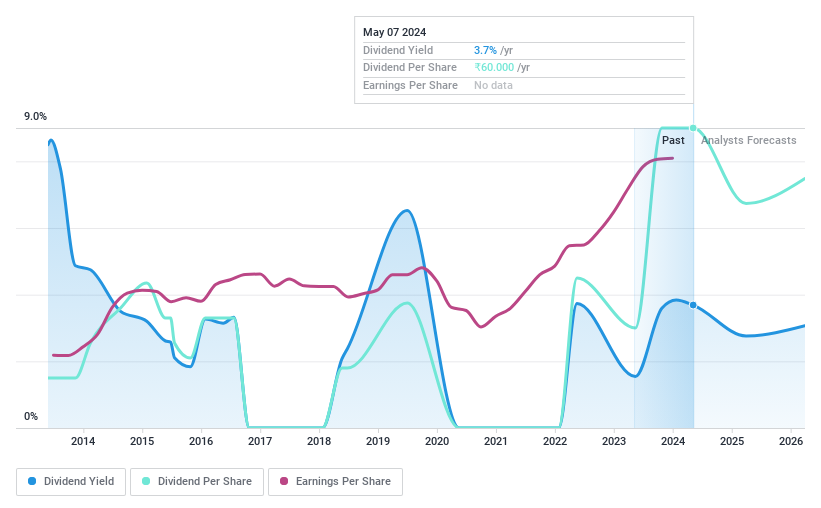

MPS

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPS Limited specializes in content creation, production, and distribution services for various sectors including publishers and corporate institutions across India, Europe, the US, and globally, with a market cap of approximately ₹30.15 billion.

Operations: MPS Limited generates its revenue by offering content-related platforms and services to a diverse clientele that includes publishers, learning companies, corporate institutions, libraries, and content aggregators across multiple regions.

Dividend Yield: 3.4%

MPS Limited has recommended a final dividend of INR 45 for FY 2023-24, reflecting a commitment to shareholder returns despite past volatility in dividend payments. With earnings growth of 14.4% annually over the last five years and projected growth of 20.32% per year, financial performance appears robust. However, concerns remain about the sustainability of dividends as they are not well covered by cash flows with a high cash payout ratio of 91.7%. The P/E ratio at 25.4x remains below the market average, suggesting some value potential amidst these challenges.

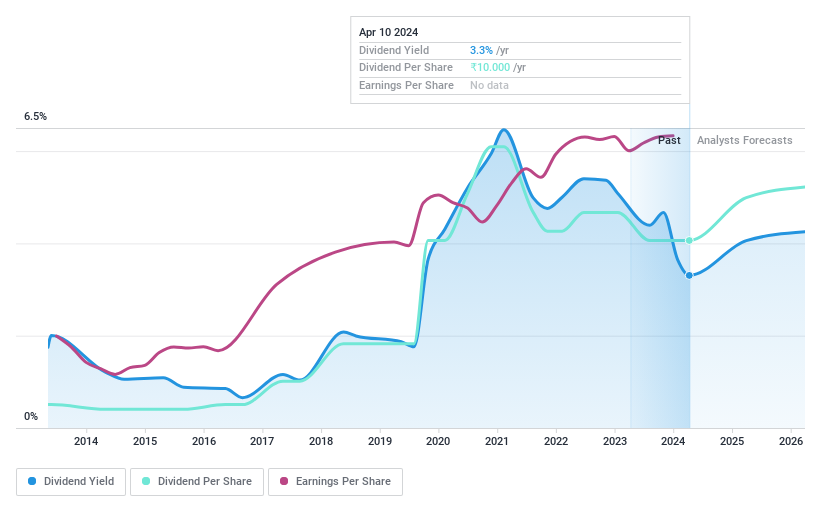

Petronet LNG

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Petronet LNG Limited operates in India, focusing on the import, storage, regasification, and supply of liquefied natural gas (LNG), with a market capitalization of approximately ₹475.13 billion.

Operations: Petronet LNG Limited generates ₹52.73 billion from its natural gas business.

Dividend Yield: 3.2%

Petronet LNG has demonstrated a mixed performance in its dividend strategy, with a history of volatile payouts despite a recent increase over the past decade. The company's dividends are well-supported by earnings and cash flows, with low payout ratios of 12.8% and 37.2%, respectively. Additionally, Petronet's P/E ratio stands at 13x, favorable compared to the broader Indian market average of 30.1x. Recent financial results show an uptick in net income for FY 2023-24, suggesting potential stability ahead despite past fluctuations in dividend consistency.

Next Steps

Reveal the 23 hidden gems among our Top Dividend Stocks screener with a single click here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:IOC NSEI:MPSLTD and NSEI:PETRONET.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance