3 Solid Australian Dividend Stocks With Minimum Yields Of 2.9%

In the past week, the Australian stock market has held steady, reflecting a period of relative calm amidst global economic fluctuations. Over the last year, it has seen modest growth with a 4.3% increase and earnings projected to grow by 10% annually. Against this backdrop, solid dividend stocks with minimum yields of 2.9% stand out for their potential to offer investors both stability and consistent income streams in these current market conditions.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Computershare (ASX:CPU) | 2.99% | ★★★★★☆ |

Korvest (ASX:KOV) | 6.73% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.39% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 5.11% | ★★★★★☆ |

CTI Logistics (ASX:CLX) | 6.99% | ★★★★★☆ |

Ansell (ASX:ANN) | 2.77% | ★★★★☆☆ |

Atlas Arteria (ASX:ALX) | 7.41% | ★★★★☆☆ |

Joyce (ASX:JYC) | 7.37% | ★★★★☆☆ |

BHP Group (ASX:BHP) | 5.47% | ★★★★☆☆ |

Wesfarmers (ASX:WES) | 2.98% | ★★★★☆☆ |

Click here to see the full list of 29 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

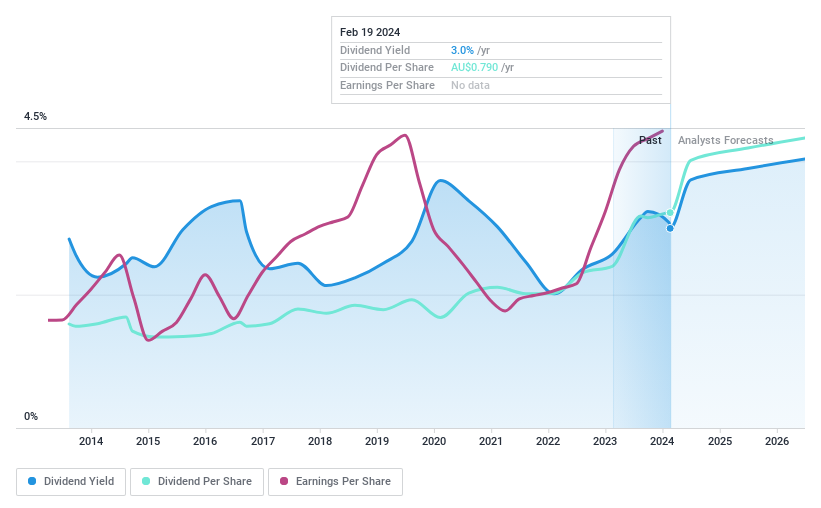

Computershare (ASX:CPU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Computershare Limited is a financial services company specializing in issuer services, employee share plans, voucher services, business communications, utilities management, technology solutions, and mortgage and property rental services with a market capitalization of approximately A$15.69 billion.

Operations: Computershare Limited generates its revenue primarily from issuer services at $1.19 billion, followed by mortgage and property rental services at $566.33 million, employee share plans and voucher services at $406.20 million, and communication services & utilities at $330.42 million.

Dividend Yield: 3%

Computershare (ASX:CPU) presents a mixed picture for dividend-focused investors. The company has demonstrated a commitment to dividends, with payments increasing over the past decade and showing stability. Its current payout ratios indicate that dividends are well-supported by both earnings and cash flows, suggesting sustainability. However, CPU's dividend yield is modest relative to Australia's top dividend payers, and while debt levels have improved over time, its net debt to equity ratio remains high. Additionally, the company has seen profit growth acceleration in the past year which outpaces its five-year average, yet future revenue forecasts hint at potential headwinds with an expected decline. Despite these challenges, Computershare maintains reliable interest coverage and has reduced its debt-to-equity ratio recently—factors that may reassure income-seeking shareholders about the company's fiscal health and dividend prospects.

Discovering a possibly undervalued opportunity can be exciting, but ensuring it fits well within your investment goals is essential. Do so seamlessly using the analytical power of Simply Wall St's portfolio tool.

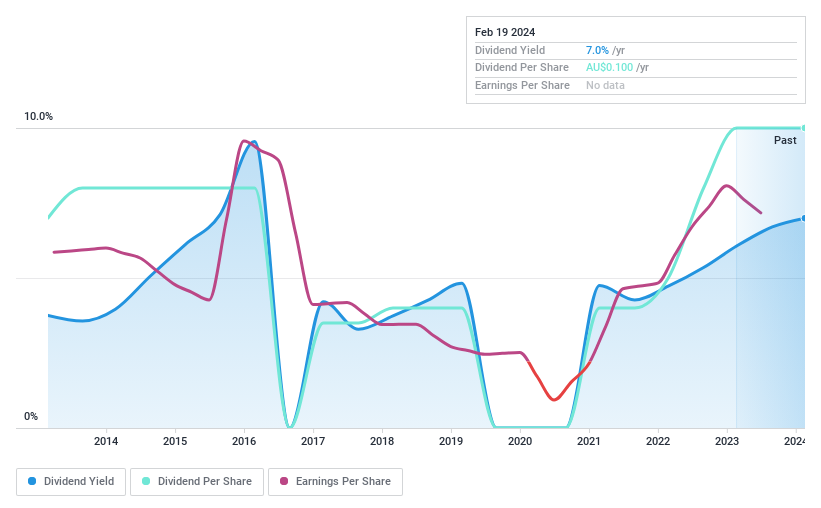

CTI Logistics (ASX:CLX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CTI Logistics Limited is an Australian company specializing in transport and logistics services with a market capitalization of approximately A$110.5 million.

Operations: CTI Logistics Limited generates its revenue primarily from two segments: Transport, which contributes A$212 million, and Logistics, accounting for A$110.9 million.

Dividend Yield: 7.0%

CTI Logistics (ASX:CLX) offers a nuanced opportunity for dividend investors, with a track record of increasing payouts over the last decade, reflecting a commitment to shareholder returns. The company's debt profile has improved markedly, with a significant reduction in the debt to equity ratio and net debt levels deemed satisfactory. Earnings have risen notably over five years, although recent growth has not kept pace with this longer-term trend. Dividends appear sustainable given their coverage by both earnings and cash flow, yet historical volatility in payments may give pause to those seeking absolute stability. Despite boasting one of the higher yields in its market segment, CLX's dividend reliability could be questioned due to past inconsistencies.

Delve into the full analysis dividend report here for a deeper understanding of CTI Logistics.

Our valuation report here indicates CTI Logistics may be undervalued.

Recognizing undervalued stocks is just the first step. To effectively track your investment's performance and make informed decisions, consider utilizing Simply Wall St's portfolio tool.

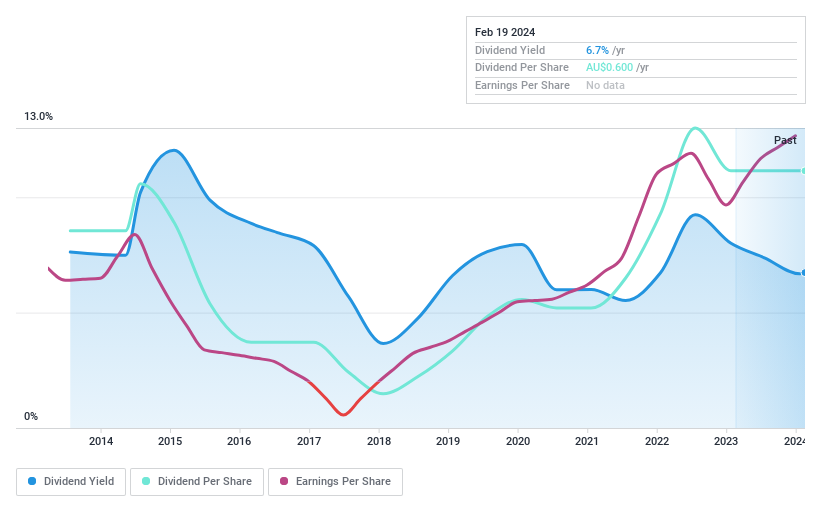

Korvest (ASX:KOV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Korvest Ltd is an Australian company specializing in hot dip galvanizing and sheet metal fabrication, with a market capitalization of approximately A$104 million.

Operations: Korvest Ltd generates its revenues primarily from two segments: production, which contributes A$10.169 million, and industrial products, accounting for A$96.074 million.

Dividend Yield: 6.7%

Korvest (ASX:KOV) presents a compelling profile for dividend investors, underscored by a debt-free balance sheet and robust earnings growth of 31.3% annually over the past five years. The company's net profit margins have improved, with the latest figures at 11.6%, enhancing its financial health. Dividends have shown an upward trajectory over a decade, backed by prudent payout ratios—56.3% from earnings and 51.2% from cash flows—suggesting sustainability in shareholder returns. However, potential investors should note KOV's historical dividend volatility which may temper expectations for consistent income streams despite its attractive yield within the top quartile of Australian dividend payers at 6.73%.

Get an in-depth perspective on Korvest's performance by reading our dividend report here.

Once you've identified a possibly undervalued stock like this one, it's vital to follow its journey closely. That process is easy with the robust features of Simply Wall St's portfolio management solution.

Final Remarks

Discover the potential of high-yield dividends by exploring options with the intuitive Simply Wall St screener. Click through to start exploring the rest of the 29 Top Dividend Stocks now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance