3 Medical Instruments Stocks on Recovery Path After Dismal 2022

The medical instrument industry has been witnessing a significant transformation in the nature of business, with robotic and remote medical services in the limelight. However, the industry has suffered, having faced several challenges like rising raw material and labor cost as well as freight charges. These factors coupled with uncertainties related to the emergence of new COVID strains in some parts of the world are making it difficult to gauge the magnitude of economic revival.

A number of medical instrument companies, which confirmed a gradual rebound in their base businesses through the first half of 2022, once again witnessed staffing shortages and supply chain-related hazards in the second half of 2022.

However, companies that have adapted well to changing consumer preferences are witnessing a gradual recovery in their share price.

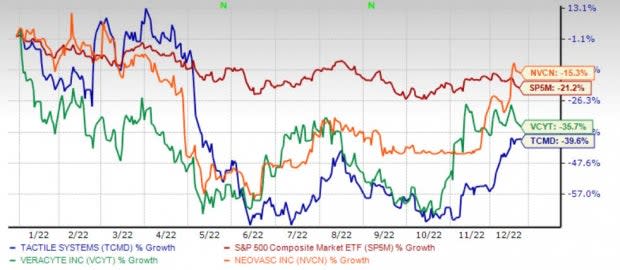

Image Source: Zacks Investment Research

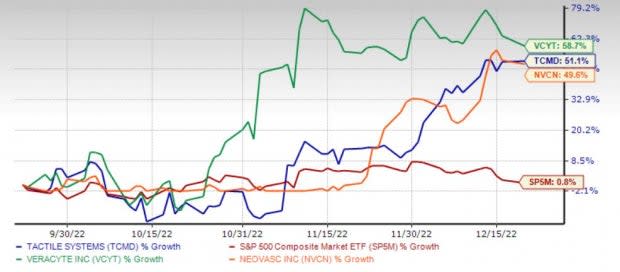

Here we discuss three medical instrument makers — Veracyte VCYT, Tactile Systems Technology TCMD and Neovasc NVCN — that have declined so far this year amid lingering challenges as shown above. However, these stocks have shown promise as their share price recovered nearly or more than 50% in the past 12 weeks despite a meagre upside in the S&P 500. The performance of these stocks has also outperformed their Zacks Medical – Instruments industry in the past 12 weeks. TCMD and NVCN carry a Zacks Rank #2 (Buy), indicating positive revisions in earnings per share (EPS) estimates lately. VCYT carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Veracyte

The company delivered an earnings and revenue surprise of 50% and 12.82%, respectively, for the quarter ended September 2022. Its loss per share narrowed 7.7% year over year in the third quarter of 2022 on the back of strong growth of more than 25% in revenues.

This molecular diagnostic company is expected to incur an annual loss of 61 cents per share in 2022, which implies an improvement of 41.4% from the year-ago quarter. The consensus EPS estimate for the full-year 2022 has improved 23.8% over the past 60 days. VCYT’s revenues in 2022 are expected to grow 32.9% year over year. The estimates for EPS and revenues for full-year 2023 imply an improvement of 15.1% and 12.1%, respectively, over 2022 numbers.

Veracyte’s earnings beat estimates in three of the past four quarters, with the average surprise being 23.50%.

While VCYT’s shares have declined 25.7% so far this year, they have gained 58.7% in the past 12 weeks. Veracyte offers genomic tests for cancers with increasing prevalence like lung cancer, prostate and bladder cancer, and breast cancer. These targeted indications are likely to drive revenues higher for the company going forward. It also provides genomic test for other indications like thyroid cancer and interstitial lung diseases. Based on these favorable services and rising earnings estimates, shares of this company are likely to be on an upward trend in the upcoming months.

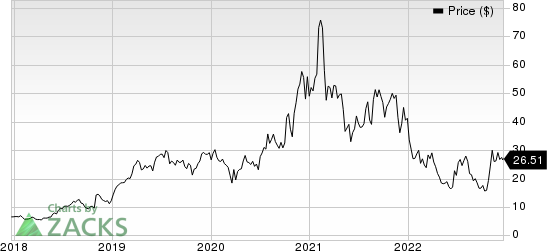

Veracyte, Inc. Price

Veracyte, Inc. price | Veracyte, Inc. Quote

Tactile Systems Technology

The company delivered an earnings and revenue surprise of 200% and 8.4%, respectively, for the quarter that ended September 2022. It reported earnings of 10 cents per share against a loss of 8 cents in the year-ago quarter on the back of strong growth of 25% in revenues in the same period.

Although this medical technology company is expected to incur a loss of 76 cents per share for full-year 2022, implying a deterioration of 26.7% from the year-ago period, earnings estimates for the fourth quarter and the first quarter of 2023 indicate an improvement of 150% and 42.8%, respectively. The consensus estimate for 2022 earnings has improved 12.6% over the past 60 days. TCMD’s revenues for full-year 2022 are expected to grow 17% year over year. The estimates for EPS and revenues for full-year 2023 suggest an improvement of 87.3% and 12%, respectively, over 2022 numbers.

While TCMD’s shares have declined 35.7% so far this year, the shares have gained 45.4% in the past 12 weeks. Tactile Systems Technology manufactures and distributes medical devices for the treatment of patients with underserved chronic diseases at home. The COVID-19 crisis over the past two-and-a-half years called for several services to be provided at home, including multiple healthcare services. The demand for at-home medical services is likely to increase going forward irrespective of COVID-19, especially driven by older patients and increasing focus on telehealth. The global home healthcare market is projected to reach $340.2 billion by 2027 at a CAGR of 8.5%, per a MarketsAndMarkets report. The growing market is likely to benefit Tactile Systems Technology going forward.

Tactile Systems Technology, Inc. Price

Tactile Systems Technology, Inc. price | Tactile Systems Technology, Inc. Quote

Neovasc

Although the company’s revenues and earnings were lower than expected and declined year over year in the third quarter, the metrics are expected to grow 33.7% and 148.6%, respectively, in 2023.

Neovasc has one commercial product — Neovasc Reducer — approved in Europe for the treatment of refractory angina. The company is evaluating the product in a pivotal clinical study to support regulatory approval in the United States.

The company’s revenues continue to grow on the back of demand for Neovasc Reducer in Europe, which is expected to grow 37.4% in 2022 from the year-ago period.

Neovasc Reducer enjoys Breakthrough Device designation, which will likely expedite the development and review of a device that demonstrates the compelling potential to provide more effective treatment or diagnosis. The study is expected to be completed in 2024. A potential U.S. approval to the product will likely drive revenues higher significantly. The company is also developing another product — Tiara for the transcatheter treatment of mitral valve disease. These developments augur well for the company.

While NVCN’s shares have declined 15.3% so far this year, the shares have gained 46.2% in the past 12 weeks.

Neovasc Inc. Price

Neovasc Inc. price | Neovasc Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Veracyte, Inc. (VCYT) : Free Stock Analysis Report

Neovasc Inc. (NVCN) : Free Stock Analysis Report

Tactile Systems Technology, Inc. (TCMD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance