3 High Insider Ownership ASX Stocks With Minimum 19% Earnings Growth

Amid a backdrop of mixed performances in global markets, with Wall Street showing varied results and the ASX200 poised for a subdued start, investors continue to navigate through an environment marked by significant corporate activities and commodity price movements. In such a market scenario, stocks with high insider ownership can be particularly noteworthy as they often signal strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Alpha HPA (ASX:A4N) | 28.3% | 95.9% |

Liontown Resources (ASX:LTR) | 16.4% | 64.3% |

SiteMinder (ASX:SDR) | 11.4% | 69.4% |

Plenti Group (ASX:PLT) | 12.6% | 68.5% |

Let's review some notable picks from our screened stocks.

Alpha HPA

Simply Wall St Growth Rating: ★★★★★★

Overview: Alpha HPA Limited is a specialty metals and technology company with a market capitalization of approximately A$887.11 million.

Operations: The company generates revenue primarily from its HPA First Project, which brought in A$0.03 million.

Insider Ownership: 28.3%

Earnings Growth Forecast: 95.9% p.a.

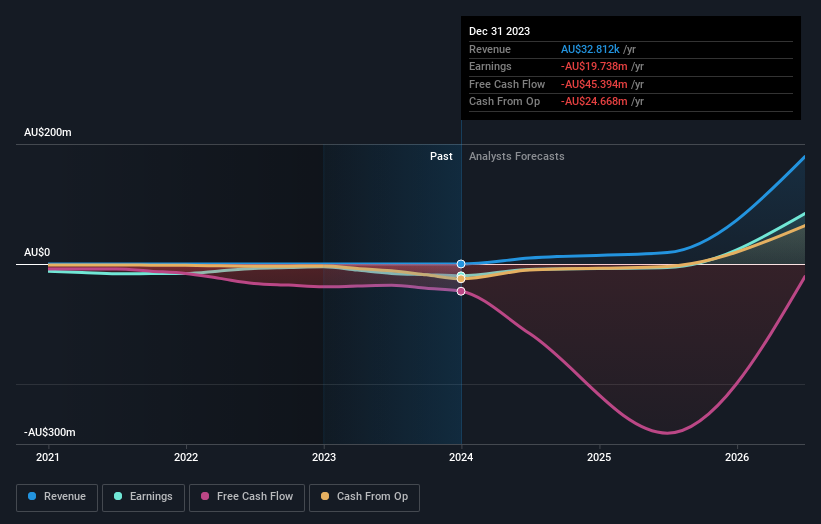

Alpha HPA, an Australian growth company with significant insider ownership, is trading at a substantial discount relative to its fair value. Despite generating only A$33K in revenue and experiencing a net loss increase to A$8.54 million from A$4.48 million year-over-year, it forecasts robust annual revenue growth at 93% and earnings growth of approximately 95.93%. Expected to turn profitable within three years, Alpha HPA's projected Return on Equity is very high at 40.1%. However, the firm has faced shareholder dilution over the past year and currently possesses less than one year of cash runway.

Take a closer look at Alpha HPA's potential here in our earnings growth report.

Our expertly prepared valuation report Alpha HPA implies its share price may be too high.

Flight Centre Travel Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, and Asia, with a market capitalization of A$4.36 billion.

Operations: The company generates revenue primarily through its leisure and corporate travel segments, with the leisure segment bringing in A$1.28 billion and the corporate segment contributing A$1.06 billion.

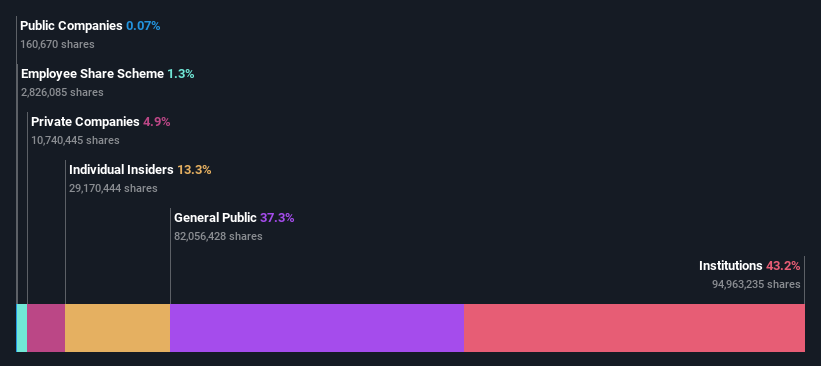

Insider Ownership: 13.3%

Earnings Growth Forecast: 19.2% p.a.

Flight Centre Travel Group, a growth-oriented firm with substantial insider ownership in Australia, has shown promising financial recovery. Recently added to the S&P/ASX 100 Index, the company reported a significant turnaround with half-year sales reaching A$1.29 billion and net income of A$86.6 million, contrasting sharply with a loss just the previous year. Despite trading below its estimated fair value and slower revenue growth forecasts compared to high-growth benchmarks, Flight Centre's earnings are expected to outpace the market average significantly.

Vulcan Steel

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vulcan Steel Limited operates in New Zealand and Australia, focusing on the sale and distribution of steel and metal products, with a market capitalization of approximately A$883.07 million.

Operations: The company generates revenue primarily through its metals segment, which brings in NZ$638.86 million, and its wholesale miscellaneous activities, accounting for NZ$532.02 million.

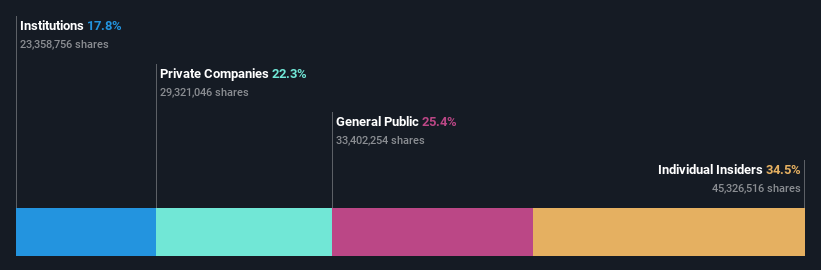

Insider Ownership: 34.5%

Earnings Growth Forecast: 26.9% p.a.

Vulcan Steel, despite a recent executive shake-up with the resignation of director Russell Chenu, remains poised for robust growth. The company is trading slightly below analyst price targets and shows promising earnings growth projected at 26.9% per year, outpacing the Australian market average. However, its revenue growth lags behind at 2.3% annually. Insider activities reflect more buying than selling recently, though not in large volumes, suggesting moderate confidence from within despite a high level of debt and underwhelming profit margins compared to last year.

Summing It All Up

Click this link to deep-dive into the 89 companies within our Fast Growing ASX Companies With High Insider Ownership screener.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:A4N ASX:FLT and ASX:VSL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance