3 Canadian Dividend Stocks Offering Yields From 3.9% To 8.6%

In recent weeks, the Canadian market has experienced a shift, with rising yields and a general downward movement in most stock market indexes, although the pullback has remained relatively moderate. Following significant rallies in major indexes like the S&P 500 and the TSX, some level of consolidation or profit-taking was anticipated. In such a market environment, dividend stocks can be particularly appealing as they offer potential income stability and an opportunity to accumulate shares at more favorable prices during periods of volatility.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

IGM Financial (TSX:IGM) | 6.59% | ★★★★★★ |

Bank of Nova Scotia (TSX:BNS) | 6.56% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 6.85% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.38% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.90% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.01% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 4.05% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 3.99% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.58% | ★★★★★☆ |

Acadian Timber (TSX:ADN) | 6.71% | ★★★★★☆ |

Click here to see the full list of 35 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

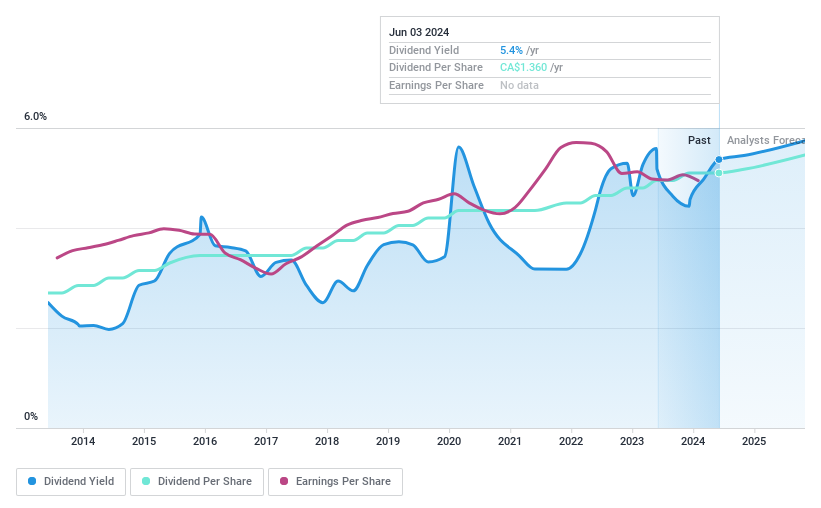

Canadian Western Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Canadian Western Bank offers personal and business banking products and services primarily in Western Canada, with a market capitalization of approximately CA$2.61 billion.

Operations: Canadian Western Bank generates CA$1.08 billion in revenue from its banking operations.

Dividend Yield: 5%

Canadian Western Bank (CWB) offers a stable dividend yield of 5.03%, underpinned by a low payout ratio of 40%, suggesting earnings sufficiently cover the payouts. Despite its dividends growing over the past decade, its yield remains modest compared to top Canadian dividend payers. Analysts anticipate a potential stock price increase of 26.4%. Recent affirmations include a steady quarterly dividend and inclusion in the S&P/TSX Preferred Share Index, reflecting positive market recognition and consistent shareholder returns as of April 2024.

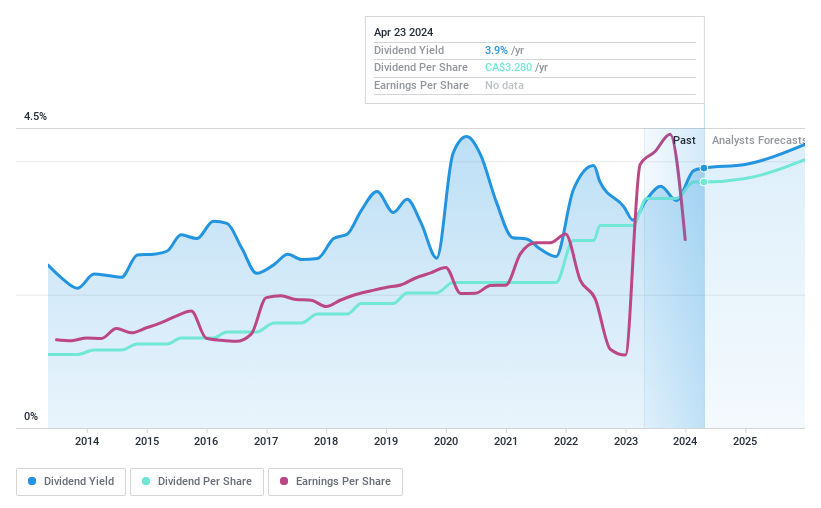

iA Financial

Simply Wall St Dividend Rating: ★★★★★☆

Overview: iA Financial Corporation Inc. operates in Canada and the United States, offering insurance and wealth management services, with a market capitalization of approximately CA$8.23 billion.

Operations: iA Financial Corporation Inc. generates revenue through its segments in Canadian insurance (CA$3.70 billion), U.S. operations (CA$1.46 billion), wealth management (CA$2.24 billion), and investments (CA$0.61 billion).

Dividend Yield: 3.9%

iA Financial's dividend yield sits at 3.9%, relatively low in the Canadian market, yet its dividends are supported by strong fundamentals, with a payout ratio of 41.3% and cash flow coverage at 30.2%. Over the past decade, dividends have shown growth and stability. The company's earnings have surged by 148.9% over the past year and are projected to grow annually by 14.22%. However, it trades at a significant discount of 67.4% below its estimated fair value as of April 2024, indicating potential undervaluation despite recent shareholder activism concerning ESG goals and governance practices.

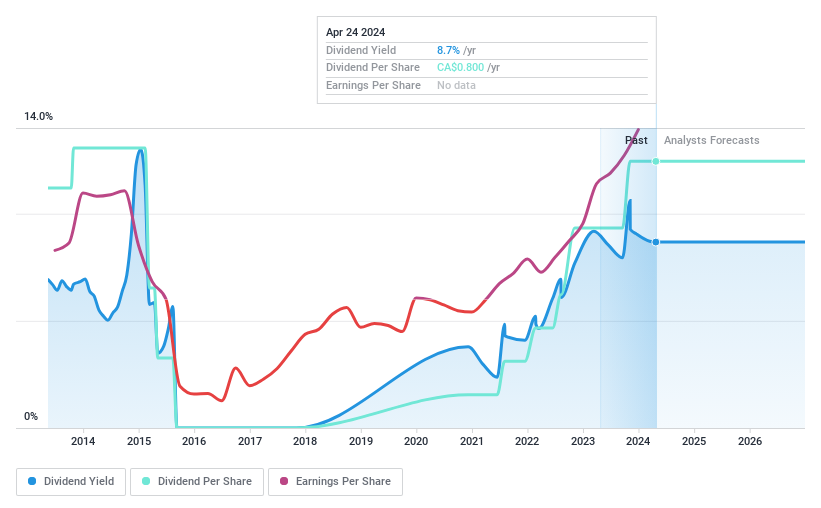

PHX Energy Services

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PHX Energy Services Corp. offers horizontal and directional drilling services, along with renting and selling drilling motors and equipment to oil and natural gas companies in Canada, the U.S., Albania, the Middle East, and globally, with a market cap of approximately CA$437.84 million.

Operations: PHX Energy Services Corp. generates CA$656.34 million from its horizontal oil and natural gas well drilling services.

Dividend Yield: 8.7%

PHX Energy Services offers a high dividend yield of 8.68%, ranking in the top 25% of Canadian dividend payers. Despite a significant earnings increase last year, dividends are poorly covered by cash flow with a payout ratio exceeding 100%. Analysts predict a price rise, yet concerns linger over the sustainability of dividends due to forecasted earnings declines and recent significant insider selling. The company recently affirmed its quarterly dividend at CAD$0.20 per share, maintaining investor interest despite financial inconsistencies.

Taking Advantage

Click this link to deep-dive into the 35 companies within our Top Dividend Stocks screener.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:CWBTSX:IAGTSX:PHX

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance