$210 million GONE: Tradies to be hit hard by Labor’s negative gearing policy

Tradies and small businesses look set to cop a $210 million hit from Labor’s controversial negative gearing policy, according to building and construction industry association Master Builders Australia (MBA).

If Labor wins the upcoming federal election, negative gearing – which covers repairs and maintenance costs – will be limited to new properties purchased after 1 January 2020.

It’s a policy designed to make housing more affordable for first-home buyers who have to compete against property investors who are snapping up their fifth or sixth investment property.

But according to MBA CEO Denita Wawn, the policy will also be felt by “thousands of small mum-and-dad building businesses and tradies in every city, town and region around Australia”.

The negative gearing changes will mean properties owners are less inclined to upkeep their properties, MBA argued.

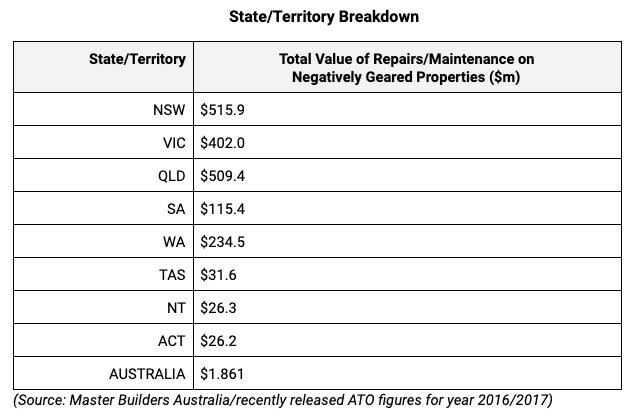

Building and construction workers performed a total of $1.86 billion in maintenance and renovation work in the 2016-17 financial year on negatively-geared homes, according to ATO figures.

Citing Cadence Economics figures, renovation activity will drop by $210 million in the five years following Labor’s policy changes, MBA chief economist Shane Garrett told Yahoo Finance.

But the figure is expected to be larger than this as fewer and fewer established homes are eligible for the tax concession, he pointed out.

“This work is the bread and butter of so many builders and tradies and Labor’s policy will hurt the viability of their business and will put their livelihoods at risk,” said Wawn.

“Repairs and maintenance and maintenance work is a lifeline for many home builders when times are tough as they have been in markets such as Perth and Adelaide for the past few years and we can expect the same in Sydney and Melbourne as those markets continue to fall.”

The repair work was not about “adding swimming pools or pergolas”, she added, but rather the regular maintenance and up-keep required to keep a property habitable.

“This is the day to day running repairs that keep a home up to standard for residents and renters,” she said.

MBA chief economist Shane Garrett explained to Yahoo Finance that repair work on negatively-geared properties was tax deductible under the current system.

But under Labor’s negative gearing policy, this would no longer be the case for dwellings bought after the first day of 2020, meaning investors and owners would have to fork out more for repair work.

“Labor’s promise to restrict negative gearing will make investing in these essential repairs significantly less attractive as it is implemented,” Wawn said.

Take an investor with $65,000 taxable income. As they would pay a marginal tax rate of 34.5 per cent, a $5,000 repair bill would set them back by $3,275 thanks to their 34.5 per cent tax rebate ($1,725).

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance