2 Top Rated Stocks to Watch for EPS Growth as Earnings Approach

Several intriguing stocks are reporting their quarterly results on Monday, April 22. Most appealing is that a few of these companies are experiencing solid EPS growth that can lead to stellar performance in the portfolio.

Keeping this scenario in mind, here are two such stocks to consider as they look poised to move higher if they can reach or exceed earnings expectations.

AZZ AZZ: Starting in the industrial products sector, AZZ sports a Zacks Rank #1 (Strong Buy) as a global provider of metal coating services, welding solutions, and specialty electrical equipment.

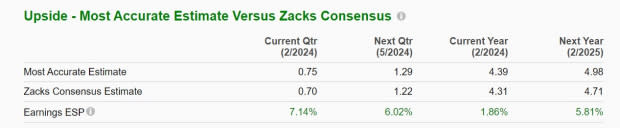

AZZ also offers highly engineered services for infrastructure purposes and is expecting substantial earnings growth. Reporting its fiscal fourth quarter results on Monday, Q4 EPS is projected at $0.70 compared to $0.30 a share in the comparative quarter. Plus, the Zacks Expected Surprise Prediction (ESP) indicates AZZ could top earnings expectations with the Most Accurate Estimate having Q4 EPS slated at $0.75 a share and 7% above the Zacks Consensus.

Image Source: Zacks Investment Research

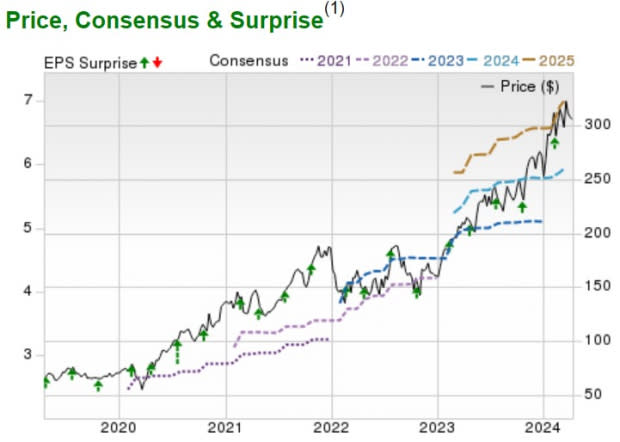

Notably, AZZ has been one of the market’s top performers this year with its stock soaring +29% YTD. Correlating with the strong price performance, annual earnings are projected to climb 24% in fiscal 2024 and are expected to rise another 9% in FY25 to $4.71 per share.

Image Source: Zacks Investment Research

Cadence Design Systems CDNS: Sporting a Zacks Rank #2 (Buy), Cadence Design Systems is a stock to watch in the technology sector. Being a leading electronic system designing company, Cadence Design provides computational software and hardware along with intellectual property (IP) and services to multiple vertical sectors.

Steady expansion is certainly a reason to consider Cadence Design’s stock despite first quarter earnings expected to dip to $1.13 a share versus EPS of $1.29 in the comparative quarter. However, the Zacks ESP indicates Cadence Design should reach its Q1 bottom line expectations, and annual earnings are still projected to jump 15% this year and are slated to climb another 18% in FY25 to $7.00 per share.

It’s also noteworthy that Cadence Design has surpassed earnings expectations for a remarkable 24 consecutive quarters with CDNS sitting on +4% gains in 2024 and up +33% over the last year.

Image Source: Zacks Investment Research

Bottom Line

The steady EPS growth of AZZ and Cadence Design Systems has been hard to overlook making them two of the top stocks to watch next week. To that point, quarterly results will help indicate if their strong price performances over the last year can continue amid recent market volatility.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AZZ Inc. (AZZ) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance