2 Consumer Loan Stocks With Solid Dividend Yield to Watch

The Zacks Consumer Loans industry has been bearing the brunt of muted consumer sentiments, mainly attributable to record-high inflation and geopolitical matters. These have raised the fear of economic slowdown and even recession over the next few months. Hence, the demand for consumer loans is likely to fall and hamper the industry players’ top-line growth. Weakening asset quality as economic growth continues to slow down is another major near-term headwind.

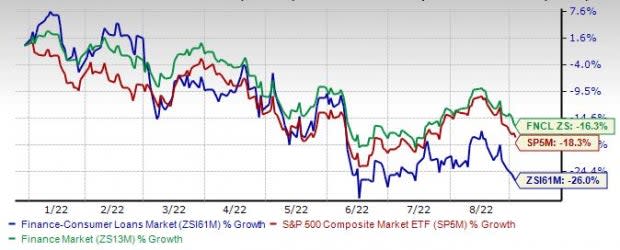

Also, the consumer loan industry has widely underperformed the S&P 500 Index and Zacks Finance sector so far this year. The stocks in this industry have collectively lost 26% while the Zacks S&P 500 composite and Zacks Finance sector have declined 18.3% and 16.3%, respectively.

Image Source: Zacks Investment Research

Do these challenges imply investors should avoid the stocks from this industry? Well, the answer to this is a resounding no. We believe that solid dividend-paying consumer loan stocks – Ally Financial Inc. ALLY and Navient Corporation NAVI – should remain on investors’ radar despite near-term concerns. Apart from robust dividend yield, these two companies have solid fundamentals to help them navigate current headwinds.

To choose these consumer loan providers, we ran the Zacks Stocks Screener to identify stocks with a dividend yield in excess of 3% and a dividend payout ratio of less than 30%. Also, both stocks currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Let’s discuss the above-mentioned consumer loan stocks in detail:

Detroit, MI-based Ally Financial is a diversified financial services company providing a broad array of financial products and services, primarily to automotive dealers and their customers. It operates as a financial holding company and a bank holding company. Ally Bank is an indirect, wholly-owned banking subsidiary of Ally Financial.

Strong origination volumes, retail loan growth, rising rates and an increase in deposit balances are expected to keep supporting Ally Financial’s revenues. Further, as part of its plan to diversify revenues, the company has forayed into the mortgage business, and its efforts in wealth management and online brokerage related to credit card offerings are commendable. Acquisitions of Fair Square Financial (a credit card provider), TradeKing and Health Credit Services (a point-of-sale payment provider) will likely help improve ALLY’s product offerings.

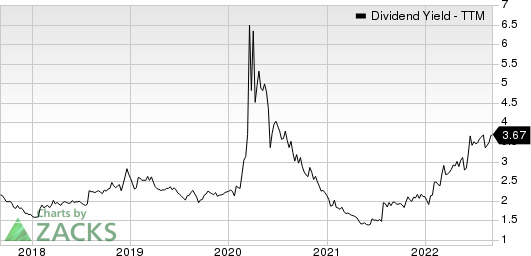

The stock has a dividend yield of 3.67% and a five-year annualized dividend growth of 19%. Further, ALLY's payout ratio is 15% of earnings at present. Check Ally Financial’s dividend history here.

Ally Financial Inc. Dividend Yield (TTM)

Ally Financial Inc. dividend-yield-ttm | Ally Financial Inc. Quote

Navient, headquartered in Wilmington, DE, is a leading provider of education loan management and business processing solutions for education, healthcare and government clients at the federal, state and local levels. As of Jun 30, 2022, the company had total assets of $78.05 billion, FFELP loans of $49.21 billion and private education loans of $19.66 billion.

Navient’s business risk reduction and simplification efforts bode well. Following the receipt of all necessary approvals in October 2021, the company transferred all of its the Department of Education loan servicing contracts to Maximus. With this move, NAVI eliminated an operationally-risky business and amplified its focus on domains outside government student loan servicing. Decent economic growth and the historically low unemployment rate should further drive growth in the Private Education Refinance Loan portfolio and enhance the company’s business prospects.

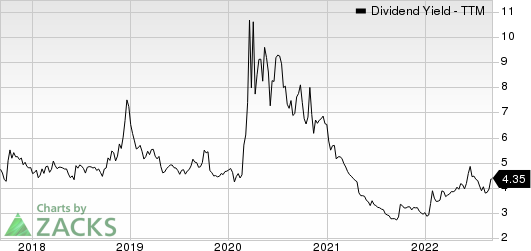

The company has a dividend yield of 4.35%. Currently, NAVI's payout ratio is 28% of earnings. Check Navient’s dividend history here.

Navient Corporation Dividend Yield (TTM)

Navient Corporation dividend-yield-ttm | Navient Corporation Quote

Conclusion

Furnishing one’s portfolio with dividend stocks shows prudence, as these provide a source of a steady income and a cushion against market risks. Despite the benefits of dividend stocks, it is true that not every company can maintain its dividend-paying steak. So, investors must be judicious while picking dividend stocks for steady returns.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

Navient Corporation (NAVI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance