12 money lessons from the Great Depression that are relevant in the COVID era

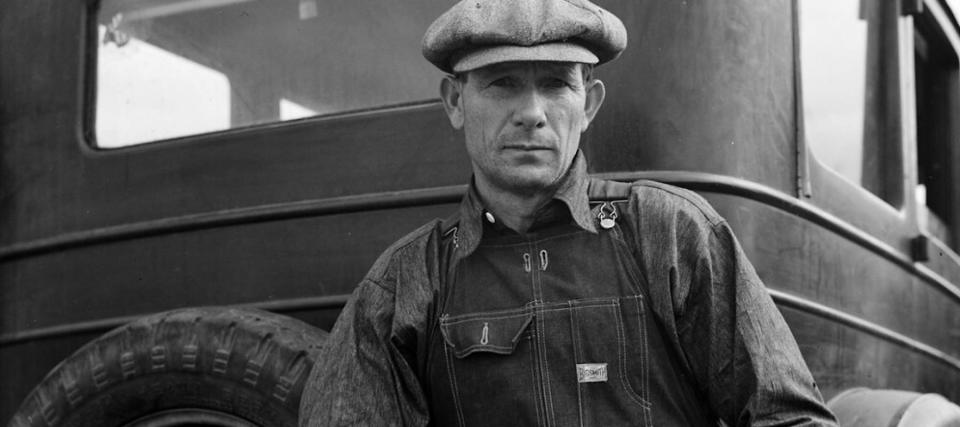

Tens of millions of people have filed for unemployment since the coronavirus reached American shores, leading financial experts to draw comparisons between the “Great Lockdown” and the worst economic disaster in modern history: the Great Depression.

Beginning with a stock market crash in October 1929, the Great Depression dragged on for almost a decade, upending the lives of Americans from virtually every walk of life.

Close to a quarter of the U.S. population was jobless, and even essential workers like doctors saw their income drop by up to 40%. Some people scraped by on just pennies a day.

Though the Great Depression occurred nearly a century ago, many of the hard lessons learned in the Dirty '30s can be applied to the current financial crisis. Click to see some of the most relevant tips today.

1. Save for emergencies

Coming on the heels of the Roaring '20s, a period of widespread prosperity following World War I, the Great Depression sent a shockwave through the country that most Americans were completely unprepared for.

People who didn’t have enough savings stashed away ended up broke, unemployed and saddled with debt.

One of the most important lessons to take away from the Depression is that anything can happen, and it’s always a good idea to plan ahead.

As the unemployment rate keeps rising, you may be worried that you’ve missed your chance. But it’s not too late to set up an emergency fund. The sooner you start putting money into a high-yield savings account, the more you’ll have available when you need it most.

2. Do it yourself

During the Great Depression, DIY became the guiding principle. If you wanted something but couldn’t afford to buy it, the next best option was to make it yourself.

People made everything from clothes to cleaning supplies at home. They even whipped up toys like corn husk dolls to keep the kids busy.

If you’re looking to save a bit of money during the pandemic — or just avoid going to the store — you can find a ton of free tutorials online that will show you how to make all sorts of useful household products. Don’t try to make your own disinfectant, though.

3. Take steps to avoid debt

One of the reasons poverty was so widespread during the Great Depression was that, during the Roaring '20s, many Americans took out installment loans and lines of credit with retailers.

So when the stock market crashed and the layoffs began, these borrowers found themselves faced with a mountain of debt and no way to pay it off.

These days debt is still a major problem. People have been eager to defer their credit card payments during the pandemic, but unless their interest is on hold, too, they’re only digging themselves in deeper.

To avoid repeating the mistakes of the Great Depression, try your best to clear your debt as soon as possible. You may want the help of a debt consolidation loan to save on interest, lower your monthly payments and get out of debt faster.

4. Eat at home

For the majority of Americans in the 1930s, dining out was — pardon the pun — off the table. Practically every meal was cooked from scratch at home, and the recipes of the day were creative to say the least.

Classic Depression-era dishes included vinegar pie, dandelion salad and something called Hoover Stew, which incorporated macaroni, hot dogs and anything else lying around that seemed somewhat edible.

While you might not be quite that desperate, making your meals at home and actually using up the food you’ve got in your pantry remains a sensible way to save money — especially since you can earn cash back on your groceries by snapping a photo of your receipt.

5. Don’t be afraid to relocate

If the economic fallout of the Great Depression wasn’t bad enough, farming in the Southern Plains states during the 1930s was ground to a halt by a series of droughts and dust storms.

As a result, the area known as the Dust Bowl saw the largest migration in U.S. history, with more than 2 million residents pulling up stakes and moving to wherever they could find work.

With unemployment today nearing 15%, many Americans have begun to broaden their job search and consider relocating.

Thankfully, finding employment in a new place no longer involves hopping a freight train and riding the rails from town to town. The best online job boards use artificial intelligence to track down relevant posts from all over the country. Then you can apply for multiple positions with just a few clicks.

6. Protect your family with life insurance

Being a parent can be stressful at the best of times, but the Great Depression was a new low. Not only was it hard to provide adequate food and shelter, but if something happened to you, your children could be left out in the cold without a dollar to their name.

One of the saving graces for families during the Depression was life insurance, which provided liquidity during a time when even the banks couldn’t. Cash value policies helped many families stay afloat and avoid financial ruin.

To this day, buying a life insurance policy is critical to ensure that your family will be protected after you’re gone. And thanks to convenient online services, finding a policy that fits your family’s needs is easier than booking a hotel.

7. Live within your means

Many Americans saw the economic growth of the Roaring '20s as an excuse to live outside of their means.

People purchased big-ticket items they couldn’t really afford on installment — meaning they’d make a small down payment upfront, then make monthly payments with interest moving forward. It was like getting a mortgage for everything.

Needless to say, that did not end up being a smart move.

In order to keep your head above water during the pandemic, you’ll need to avoid making the same mistake. Keep a budget of your monthly expenses and try your best to only make necessary purchases — with money you have — for the time being.

If you're shopping online, be sure to use this free browser add-on — it saves you money every time you shop and compares stores to make sure you're getting the best price available..

8. Refinance your mortgage

When the Great Depression hit, homeowners suddenly found themselves unable to make their mortgage payments.

To prevent foreclosures, President Franklin D. Roosevelt signed the Homeowners Refinancing Act of 1933, allowing Americans to alter the terms of their loans so they could keep their homes.

Refinancing is still a valuable tool to trim down the cost of your mortgage. It could help you save thousands of dollars a year on your monthly payments.

Currently, mortgage rates are the lowest they’ve ever been, so regardless of how the pandemic has affected your finances, you should consider refinancing.

It’s easy to compare rates online, and even if your current mortgage is only a year old, you may be able to save a bundle.

9. Odd jobs are better than no job

As the Great Depression wore on, people took work anywhere they could get it. That includes individual tasks, like chopping wood or shovelling snow, paid upon completion.

These days, one-off jobs are typically known as side gigs, and they’re no longer limited to manual labor. Slick online marketplaces is a great example — will allow you to advertise all sorts of services, from copy editing to art to voiceover work.

You can also make some quick cash by signing up for a rewards program that asks you to complete simple tasks like watching videos and filling out surveys. It may not earn you as much as a full-time job, but just like back in the 1930s, every little bit helps.

10. Spare change adds up

One of the best known songs of the Depression era was “Brother, Can You Spare a Dime?” — and for good reason. Back then, a dime or two could mean the difference between eating or going hungry on any given day.

And while a dime doesn’t carry the same clout that it did in the Dirty '30s, it can still make a difference if you save up enough of them.

Most of us have coins and bills collecting dust in drawers and coat pockets, and if you’re stuck at home during the pandemic, you might as well see how much you can find.

But if you really want to see the power of spare change in action, try using a micro-investing app. They’ll round your day-to-day purchases up to the nearest dollar and invest the difference. You’ll be surprised by how quickly those dimes turn into dollars.

11. If you want to retire, start saving now

For most people during the Great Depression, there was no such thing as retirement. More than 63% of men ages 65 to 74 were still in the labor force in 1930.

When the market crashed, people found themselves without savings to fall back on. The only way to afford the bare essentials like food and shelter was to work until they were physically unable to do so.

If you’d like to avoid working well into your 70s, it’s a good idea to start saving for your retirement as soon as possible. Social Security doesn’t go that far, even today.

Not sure how to start? Try talking to a certified financial planner, who will help you map out a plan based on your current situation, whatever it may be.

12. Help your community

Times were tough for everyone during the Depression, and the fact that most people were going through similar hardships helped create a stronger sense of community.

Americans rallied together and supported their neighbors — whether it was a bit of food, some spare clothes or a dry place to sleep. Those who had more gave to those who had less whenever possible.

And while social distancing measures during the pandemic demand a different approach to helping out your community, there are still plenty of ways you can lend a hand to those in need.

Make an effort to support local businesses and donate to local charities and food banks if you have the means to do so.

Yahoo Finance

Yahoo Finance