The 10 best super funds of 2019

For many Australians, getting their finances in order is one of their big plans for the new year.

And as many of Australia’s superannuation funds eke out their eighth consecutive year of growth, making sure your provider is performing for you is one easy step to take.

Related story: 8 things we learnt about superannuation in 2019

Related story: The forgotten women: How superannuation is failing Australia’s mums

Related story: How much should I have in my superannuation by now?

According to analysis firm SuperRatings, Australia’s funds should make an annual return of around 15 per cent for 2019 - a high not seen since 2013.

“We may not have seen the ramp up in shares before Christmas that some were hoping for, but it’s still safe to say that 2019 has been a highly successful year for super funds and their members,” said SuperRatings executive director Kirby Rappell.

“It’s been a nervous year for investors, so it’s great to see that super can deliver some much-needed stability and solid returns during this period. There might not be a lot of positive economic news at the moment, but at least super is one story we can all draw some hope from.”

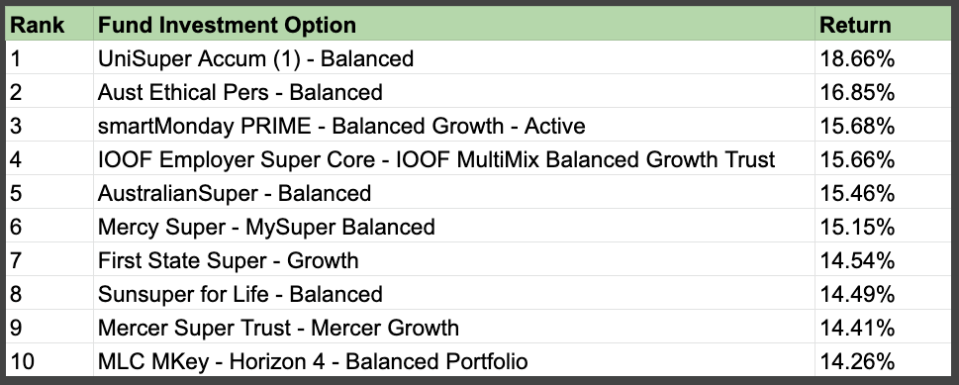

In the year to 30 November 2019, among balanced investment options, UniSuper made the highest return, recording a return of 18.66 per cent.

That was followed by Australian Ethical (16.85 per cent) and smartMonday PRIME (15.68 per cent).

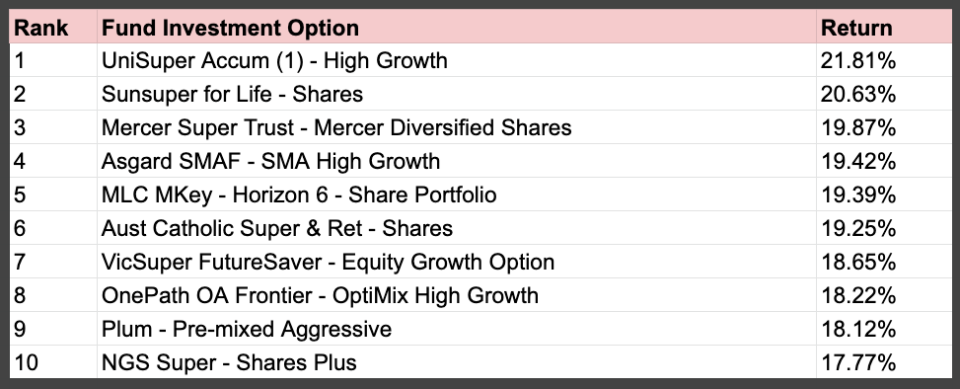

Among the high growth investment options, UniSuper also took out the top spot, with its option returning 32.82 per cent.

However, SuperRatings also had a warning: choosing a fund based off returns alone can be a dangerous move.

“Focusing purely on returns as a measure of a fund’s success ignores a range of factors, not least of which is the level of risk involved in generating that return,” the firm said.

So, it’s always worth considering your risk tolerance and financial goals.

“Looking at past performance can be useful when picking the right fund, but it shouldn’t be the sole criteria. For one thing, past performance is no guarantee of future performance, but there are many factors members should take into account when assessing a super fund, including insurance, governance, member services, and of course fees.”

Yahoo Finance

Yahoo Finance