Why Eldorado Gold Became the Least Impressive Gold Stock

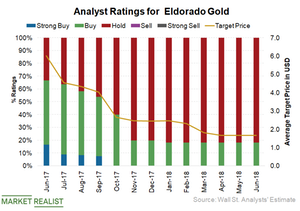

Eldorado Gold (EGO) is one of the few gold stocks that have seen rapidly deteriorating sentiments from analysts in the last year. Currently, only 15% of the 13 Wall Street analysts covering it rate it as a “buy.” This stands in sharp contrast to the ~78% “buy” ratings it had almost a year ago. Eldorado Gold stock suffered a great deal in 2017 due to its standoff with the Greek government and some technical issues at its mines in Turkey.

Yahoo Finance

Yahoo Finance