Why DLocal Stock Crashed This Week

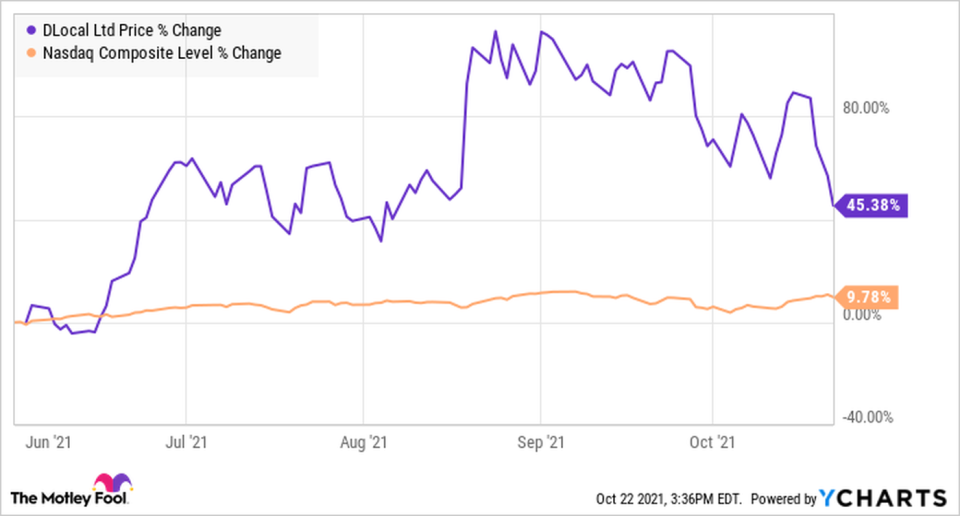

Shares of DLocal Limited (NASDAQ: DLO) dropped 22.4% in value week to date as of 2:54 p.m. EDT on Friday, according to data provided by S&P Global Market Intelligence. A few days later, it announced pricing for a secondary offering of common shares, which the market seemed to take as a sign that the stock's valuation is getting frothy. While the offering of 17 million shares could infuse DLocal with nearly $1 billion in cash that it could use to reinvest in growth, the stock sells for a high price-to-sales ratio of 102 even after this week's slide in the share price.

Yahoo Finance

Yahoo Finance