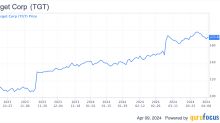

Target Corporation (TGT)

NYSE - NYSE Delayed price. Currency in USD

Add to watchlist

At close: 04:00PM EDT

After hours:

| Previous close | 163.32 |

| Open | 166.76 |

| Bid | 164.62 x 800 |

| Ask | 164.54 x 1100 |

| Day's range | 163.87 - 167.94 |

| 52-week range | 102.93 - 181.86 |

| Volume | |

| Avg. volume | 3,858,908 |

| Market cap | 75.934B |

| Beta (5Y monthly) | 1.15 |

| PE ratio (TTM) | 18.42 |

| EPS (TTM) | 8.93 |

| Earnings date | 22 May 2024 |

| Forward dividend & yield | 4.40 (2.69%) |

| Ex-dividend date | 14 May 2024 |

| 1y target est | 185.05 |

GuruFocus.com

GuruFocus.comCan Target's Recent Outperformance Continue?

The stock has significantly outperformed the broader market over the past few months, but future outperformance will be more difficult

Zacks

ZacksWhy Target (TGT) is a Top Growth Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Zacks

ZacksIs Target (TGT) Stock Undervalued Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.