RBOB Gasoline May 25 (RBK25.NYM)

- Yahoo Finance Video

2024 election: What Biden, Trump could mean for commodities

Presidential policies can have a ripple effect throughout the economy and broader markets. With the 2024 presidential election coming up — and the first debate happening on Thursday, June 27 — uncertainty around several sectors arises as candidates President Joe Biden and Former President Donald Trump have very different views on how to run the country. One of those markets that could shift drastically on policy alone is commodities, with crude oil (BZ=F, CL=F) and gas prices (RB=F) already facing pressure from geopolitical volatility. Blue Line Futures Chief Market Strategist Phil Streible joins Market Domination to provide insights into what investors should keep in mind with the commodity market during an election year and how each candidate may impact the market: "Energies are one of the top focuses that we're going to be watching. Under Trump, we were energy independent. We did also have a hard stance on Iran. It makes a play for lower energy prices if Trump was to come into office where we are much more dependent on OPEC, South American oil, it's very difficult for oil and gas exploration companies to get those permits to expand wells." Streible continues: "With the green energy Initiative front and center under the Biden administration, it's just really tough with the regulations in order to boost that output. So you're going to see more elevated energy prices with Biden around." For more expert insight and the latest market action, click here to watch this full episode of Market Domination. This post was written by Nicholas Jacobino

- Bloomberg

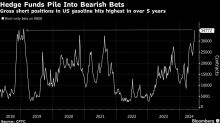

Hedge Funds Turn Most Bearish on US Gasoline in Five Years

(Bloomberg) -- Hedge funds and money managers boosted bearish bets against US gasoline to the highest in more than five years as worries about oversupply grow. Most Read from BloombergNvidia’s 13% Stock Rout Has Traders Scouring Charts for SupportBuzzFeed Struggles to Sell Owner of Hit YouTube Show ‘Hot Ones’Jain Global Raises $5.3 Billion, Secures Cash From Abu DhabiHow Long Can High Rates Last? Bond Markets Say Maybe ForeverWikileaks’ Julian Assange to Plead Guilty, Ending Yearslong US BattleS

- Yahoo Finance Video

COVID 'revenge travel' is still affecting gas demand: Analyst

While oil prices (BZ=F, CL=F) have risen during the last week, gas prices (RB=F) have remained relatively steady despite the summer travel season picking up. Patrick De Haan, GasBuddy head of petroleum analysis, joins Market Domination to give insight into oil and gas prices and Biden's potential leverage over gas prices. "According to our GasBuddy demand data, we've seen real demand at the pump essentially be under 9 million barrels a day. And compared to back in 2019 and 2018, that's very soft. Traditionally, we'd see numbers somewhere more in the mid to upper 9 million barrel-a-day range. So I think demand is still soft and I think to your point, Covid is still playing a role. We saw a lot of revenge travel in 2022. That's when international travel really wasn't possible. Last year we saw gasoline prices lower. I think we still saw revenge travel domestically last year. I think this year we're still seeing some of that revenge travel," De Haan tells Yahoo Finance. For more expert insight and the latest market action, click here to watch this full episode of Market Domination. This post was written by Nicholas Jacobino