Nomura Holdings, Inc. (NMR)

| Previous close | 5.86 |

| Open | 5.89 |

| Bid | 5.86 x 2900 |

| Ask | 5.86 x 4000 |

| Day's range | 5.85 - 5.92 |

| 52-week range | 3.38 - 6.62 |

| Volume | |

| Avg. volume | 3,303,138 |

| Market cap | 17.381B |

| Beta (5Y monthly) | 0.70 |

| PE ratio (TTM) | 24.38 |

| EPS (TTM) | N/A |

| Earnings date | N/A |

| Forward dividend & yield | N/A (N/A) |

| Ex-dividend date | 29 Sept 2021 |

| 1y target est | N/A |

- Bloomberg

UBS, Nomura Battle to Win Rates Sales to Europe’s Ultra Rich

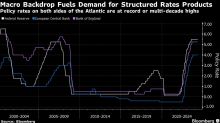

(Bloomberg) -- UBS Group AG and Nomura Holdings Inc. are making a push to sell sophisticated fixed-income products to the ultra wealthy in Europe, competing against firms such as BNP Paribas SA.Most Read from BloombergDubai Grinds to Standstill as Cloud Seeding Worsens FloodingChina Tells Iran Cooperation Will Last After Attack on IsraelWhat If Fed Rate Hikes Are Actually Sparking US Economic Boom?Tesla Asks Investors to Approve Musk’s $56 Billion Pay AgainPowell Signals Rate-Cut Delay After Run

- Reuters

Nomura aims to boost US credit portfolio to $50 billion in 5-10 years, executive says

Nomura Holdings aims to expand its U.S. credit portfolio to $50 billion within 10 years and may seek small acquisitions to beef up its private credit business, the top Japanese investment bank's U.S. asset management chief said. The goal is line with Nomura's strategy to increase investments in private markets and diversify sources of revenue to cushion the impact from wild fluctuations in the performance of its global trading business. "We want to definitely grow this (U.S. credit) business collectively, quite substantially over the next five to 10 years to $50 billion or more" in assets under management, Robert Stark, who heads the U.S. asset management business, told Reuters in an interview.

- Reuters

Nomura aims to boost US credit portfolio to $50 bln in 5-10 years, executive says

Nomura Holdings aims to expand its U.S. credit portfolio to $50 billion within 10 years and may seek small acquisitions to beef up its private credit business, the top Japanese investment bank's U.S. asset management chief said. The goal is line with Nomura's strategy to increase investments in private markets and diversify sources of revenue to cushion the impact from wild fluctuations in the performance of its global trading business. "We want to definitely grow this (U.S. credit) business collectively, quite substantially over the next five to 10 years to $50 billion or more" in assets under management, Robert Stark, who heads the U.S. asset management business, told Reuters in an interview.