Macquarie Group Limited (MQG.AX)

| Previous close | 186.32 |

| Open | 183.90 |

| Bid | 183.11 x 39700 |

| Ask | 183.70 x 38900 |

| Day's range | 180.40 - 184.48 |

| 52-week range | 155.30 - 200.25 |

| Volume | |

| Avg. volume | 635,879 |

| Market cap | 70.612B |

| Beta (5Y monthly) | 1.12 |

| PE ratio (TTM) | 16.70 |

| EPS (TTM) | 10.98 |

| Earnings date | 03 May 2024 - 07 May 2024 |

| Forward dividend & yield | 7.05 (3.85%) |

| Ex-dividend date | 13 Nov 2023 |

| 1y target est | 189.11 |

Reuters

ReutersAustralia fines Macquarie Bank $6.4 million for not preventing unlawful third-party transactions

The bank allowed customers to give third parties, such as financial advisers and stockbrokers, different levels of transaction authority, including to withdraw fees, the Australian Securities and Investments Commission (ASIC) said in a statement. Macquarie Bank provided a bulk transacting tool to third parties to make multiple withdrawals across several customer accounts simultaneously.

Bloomberg

BloombergMacquarie Targets Over $1.5 Billion for Infrastructure Debt Fund

(Bloomberg) -- Macquarie Group Ltd. is discussing raising a new fund focused on infrastructure debt, according to people familiar with the matter.Most Read from BloombergBeyond the Ivies: Surprise Winners in the List of Colleges With the Highest ROITrump Media’s $5.3 Billion Selloff Deepens as 270% Rally FizzlesS&P 500 Breaks Below 5,100 as Big Tech Sells Off: Markets WrapIran’s Attack on Israel Sparks Race to Avert a Full-Blown WarApple Faces Worst iPhone Slump Since Covid as Rivals RiseThe Aus

Bloomberg

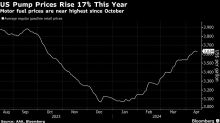

BloombergBiden Likely to Tap Oil Reserve for Summer Demand, Macquarie Says

(Bloomberg) -- The Biden administration will likely need to tap oil from the country’s emergency reserves to counter a spike in gasoline prices and amid inflation fears during the summer driving season. Most Read from BloombergBeyond the Ivies: Surprise Winners in the List of Colleges With the Highest ROITrump Media’s $5.3 Billion Selloff Deepens as 270% Rally FizzlesIran’s Attack on Israel Sparks Race to Avert a Full-Blown WarS&P 500 Breaks Below 5,100 as Big Tech Sells Off: Markets WrapApple F