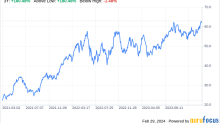

Imperial Oil Limited (IMO)

NYSE American - NYSE American Delayed price. Currency in USD

Add to watchlist

At close: 04:00PM EDT

After hours:

| Previous close | 69.61 |

| Open | 69.58 |

| Bid | 0.00 x 800 |

| Ask | 0.00 x 800 |

| Day's range | 68.83 - 70.52 |

| 52-week range | 44.46 - 74.58 |

| Volume | |

| Avg. volume | 404,111 |

| Market cap | 37.107B |

| Beta (5Y monthly) | 1.84 |

| PE ratio (TTM) | 11.24 |

| EPS (TTM) | N/A |

| Earnings date | N/A |

| Forward dividend & yield | 1.77 (2.56%) |

| Ex-dividend date | 01 Mar 2024 |

| 1y target est | N/A |

- Simply Wall St.

We Like These Underlying Return On Capital Trends At Imperial Oil (TSE:IMO)

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an...

- GuruFocus.com

Imperial Oil Ltd's Dividend Analysis

Imperial Oil Ltd (IMO) recently announced a dividend of $0.6 per share, payable on 2024-04-01, with the ex-dividend date set for 2024-03-01. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Imperial Oil Ltd's dividend performance and assess its sustainability.

- GuruFocus.com

Decoding Imperial Oil Ltd (IMO): A Strategic SWOT Insight

Uncovering the Financial and Strategic Position of Imperial Oil Ltd