Federal Home Loan Mortgage Corporation (FMCC)

| Previous close | 1.4565 |

| Open | 1.4500 |

| Bid | 0.0000 x 0 |

| Ask | 0.0000 x 0 |

| Day's range | 1.3260 - 1.4600 |

| 52-week range | 0.4000 - 1.7500 |

| Volume | |

| Avg. volume | 2,394,080 |

| Market cap | 884.082M |

| Beta (5Y monthly) | 1.48 |

| PE ratio (TTM) | N/A |

| EPS (TTM) | N/A |

| Earnings date | N/A |

| Forward dividend & yield | N/A (N/A) |

| Ex-dividend date | 12 June 2008 |

| 1y target est | N/A |

- GlobeNewswire

Freddie Mac Multifamily Enhances Policies to Strengthen Due Diligence, Deter Fraud and Reduce Risks

MCLEAN, Va., April 15, 2024 (GLOBE NEWSWIRE) -- Freddie Mac (OTCQB: FMCC) Multifamily today announced a series of policy and process enhancements that further strengthen underwriting due diligence, bolster fraud detection and deterrence, and mitigate other risks. Effective April 18, the changes include enhanced property inspection requirements and additional due diligence, among other measures. "Freddie Mac remains focused on risk management and works to enhance our processes to better detect an

- GlobeNewswire

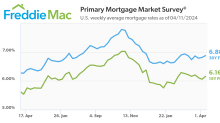

Mortgage Rates Move Toward Seven Percent as Markets Digest Incoming Data

Primary Mortgage Market Survey® U.S. weekly average mortgage rates as of 04/11/2024 MCLEAN, Va., April 11, 2024 (GLOBE NEWSWIRE) -- Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.88 percent. “Mortgage rates have been drifting higher for most of the year due to sustained inflation and the reevaluation of the Federal Reserve’s monetary policy path,” said Sam Khater, Freddie Mac’s Chief Ec

- GlobeNewswire

Freddie Mac Sells $104 Million in Non-Performing Loans

Awards SPO Pool to One WinnerMCLEAN, Va., April 09, 2024 (GLOBE NEWSWIRE) -- Freddie Mac (OTCQB: FMCC) today announced it sold via auction 679 deeply delinquent non-performing residential first lien loans (NPLs) from its mortgage-related investments portfolio. The loans, with a balance of approximately $104 million, are currently serviced by Specialized Loan Servicing LLC and NewRez LLC, d/b/a Shellpoint Mortgage Servicing. The transaction is expected to settle in June 2024. The sale is part of