Crédit Agricole S.A. (CRARY)

| Previous close | 7.24 |

| Open | 7.32 |

| Bid | 0.00 x 0 |

| Ask | 0.00 x 0 |

| Day's range | 7.29 - 7.39 |

| 52-week range | 5.60 - 7.68 |

| Volume | |

| Avg. volume | 166,154 |

| Market cap | 44.41B |

| Beta (5Y monthly) | 1.53 |

| PE ratio (TTM) | 7.13 |

| EPS (TTM) | 1.03 |

| Earnings date | N/A |

| Forward dividend & yield | 0.56 (7.66%) |

| Ex-dividend date | 25 May 2023 |

| 1y target est | N/A |

Bloomberg

BloombergJapan’s Top Currency Official Says G-7 Reaffirms Currency Commitments

(Bloomberg) -- The Group of Seven nations renewed commitments on foreign exchange policy that refer to the potentially harmful effects of excessive market movements, pledges that offer member states including Japan some latitude to defend their currencies in the face of dollar strength.Most Read from BloombergDubai Grinds to Standstill as Flooding Hits CityElon Wants His Money BackSingapore Loses ‘World’s Best Airport’ Crown to QatarRecord Rainfall in Dubai? Blame Climate Change, Not Cloud Seedi

Bloomberg

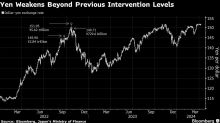

BloombergYen Drop Deepens After US Data, Raising Intervention Risk

(Bloomberg) -- The yen plunged through a level that Wall Street has warned could push Japanese authorities to step into the market to support the currency and then kept on going. Most Read from BloombergUS Sees Imminent Missile Strike on Israel by Iran, ProxiesUS Slams Strikes on Russia Oil Refineries as Risk to Oil MarketsChinese Cement Maker Halted After 99% Crash in 15 MinutesVietnam Tycoon Lan Sentenced to Death Over $12 Billion FraudUS Inflation Refuses to Bend, Fanning Fears It Will StickT

Business Wire

Business WireCrédit Agricole CIB Appoints Giliane Coeurderoy Senior Country Officer for Brazil

NEW YORK, April 01, 2024--Crédit Agricole CIB today announced the appointment of Giliane Coeurderoy as Senior Country Officer for Brazil.