Anglo American plc (AAUKF)

Other OTC - Other OTC Delayed price. Currency in USD

Add to watchlist

At close: 01:28PM EDT

Loading interactive chart…

- Bloomberg

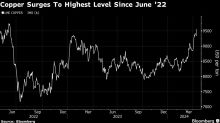

Copper’s Rally Continues as Ore Shortage Meets Resurgent Demand

(Bloomberg) -- Copper continued its upwards charge, hitting the highest since June 2022, as investors bet that curtailed ore supply will struggle to keep up with rising global demand.Most Read from BloombergTexas Warns of Possible Power Emergency Next WeekBiden to Return to White House as Israel Restricts Public LifeIsrael Bracing for Unprecedented Direct Iran Attack in DaysIsrael Versus Iran — What an Open War Between Them Could Look LikeRisk-Addicted Wall Street Funds Are Shaken as Bad News Pi

- Simply Wall St.

Investors in Anglo American (LON:AAL) have unfortunately lost 18% over the last three years

Anglo American plc ( LON:AAL ) shareholders should be happy to see the share price up 11% in the last month. But that...

- Simply Wall St.

Anglo American plc (LON:AAL) institutional owners may be pleased with recent gains after 31% loss over the past year

Key Insights Significantly high institutional ownership implies Anglo American's stock price is sensitive to their...