Zscaler (ZM) to Report Q4 Earnings: What's in the Cards?

Zscaler ZS is set to report fourth-quarter fiscal 2019 results on Sep 10.

Notably, the company’s earnings beat the Zacks Consensus Estimate in the trailing four quarters, the average positive surprise being 400%.

In third-quarter fiscal 2019, the company reported adjusted earnings of 5 cents per share beating the Zacks Consensus Estimate by 4 cents. Revenues of $79.1 million surged 61% year over year and comfortably surpassed the consensus mark of $75 million.

For the fourth quarter, the company expects total revenues between $81 million and $83 million. Non-GAAP earnings are expected between a penny and 2 cents.

The Zacks Consensus Estimate for earnings stayed flat at a cent over the past 30 days. The consensus mark for revenues is pegged at $82.2 million.

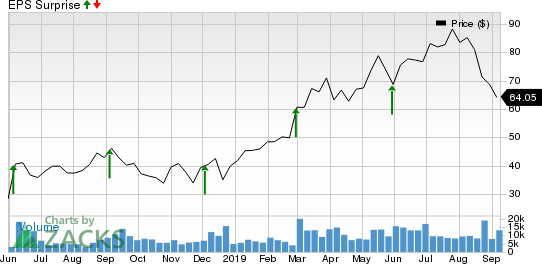

Zscaler, Inc. Price and EPS Surprise

Zscaler, Inc. price-eps-surprise | Zscaler, Inc. Quote

Let’s see how things are shaping up for this announcement.

Factors to Watch

Zscaler’s expanding portfolio strengthens its competitive position and boosts its user base. Growing adoption of the company’s cloud platform security solutions by enterprises is noteworthy.

Additionally, the company’s ability to provide cloud-based security solutions irrespective of the users’ “device or location” is a key catalyst. This is expected to have helped the company win customers in the to-be-reported quarter.

Zscaler cloud’s capability to effectively handle web traffic and block any unnecessary interference on Microsoft's MSFT Office 365 is another major growth driver. The company is also helping enterprises mitigate a number of encrypted SSL-based threats.

Further, the partnership with NTT Communications expands Zscalers’ global footprint.

The above-mentioned factors are expected to drive fourth-quarter revenue results.

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) along with a positive Earnings ESP has a good chance of beating estimates. Meanwhile, the Sell-rated stocks (Zacks Rank #4 or 5) are best avoided.

Zscaler has a Zacks Rank #3 and an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell, before they’re reported, with our Earnings ESP Filter.

Stocks With Favorable Combination

Here are a couple of stocks you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat.

Micron Technology MU has an Earnings ESP of +7.76% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Oracle ORCL has an Earnings ESP of +0.10% and a Zacks Rank #3.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance